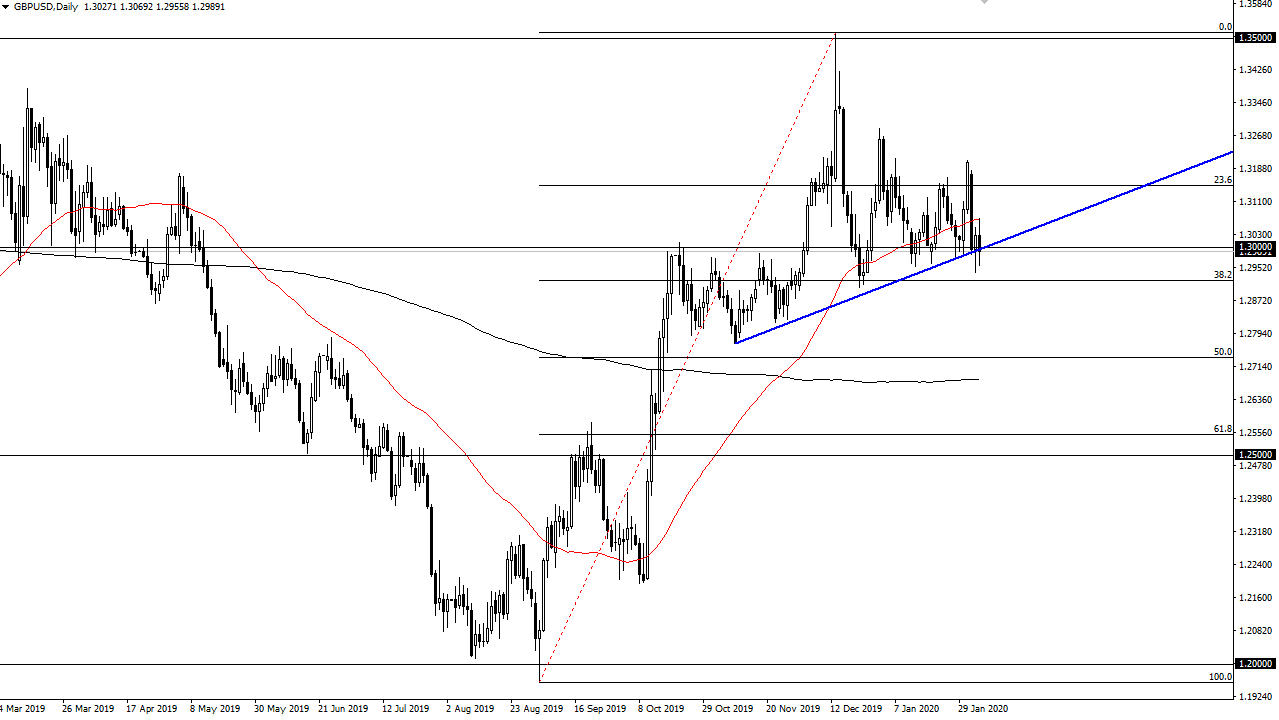

The British pound has had a rough trading session during the day on Wednesday as more games are being played with Twitter. There was an announcement that the European Union was going to rewrite the MiFID rules to handicap the City of London, but the reality of the situation is that there are 11 months ago, and most of the selling was probably due to machines and simple panic traders. All things being equal, the market still hangs on to the 1.30 region as support and of course the uptrend line that I have marked on the chart. Going into the back half of the week, it’s very likely that we will start to focus more on Non-Farm Payrolls coming out the United States.

Looking at this chart, it has been very choppy, and pressure filled, but it is worth noting that below the 1.30 level there seem to be plenty of buyers taking advantage of “cheap British pounds.” Ultimately, that’s a sign that perhaps the British pound had been oversold longer term, which I think at this point most people recognize. I also recognize that the 50 day EMA above should cause some issues, but if we can break above there it’s likely that the market goes looking towards the 1.32 handle after that. Unfortunately, during the day that Tweet came out and caused chaos in the market, something that we have seen time and time again over the last three years.

This does give us some information though, that the machines are trading the British pound still. Because of this, you will have to be resilient and keep your position size small enough to handle these nasty and sudden moves. Longer-term traders are buying the British pound because it is cheap, and quite frankly I believe that eventually we will go looking towards 1.35 handle, and then possibly even higher than that by the end of the year. Keep in mind that the negotiations between London and the EU continue, so the occasional headline will continue to throw this market around, but in the end the British do have the upper hand, despite what some people would tell you in the European Union. Boris Johnson has a major wildcard in his back pocket: and that’s the United States. Now that the United Kingdom has left the European Union, the European Union is actually a smaller market that the United States, and a free-trade agreement between Washington and London should be a relatively easy thing to accomplish.