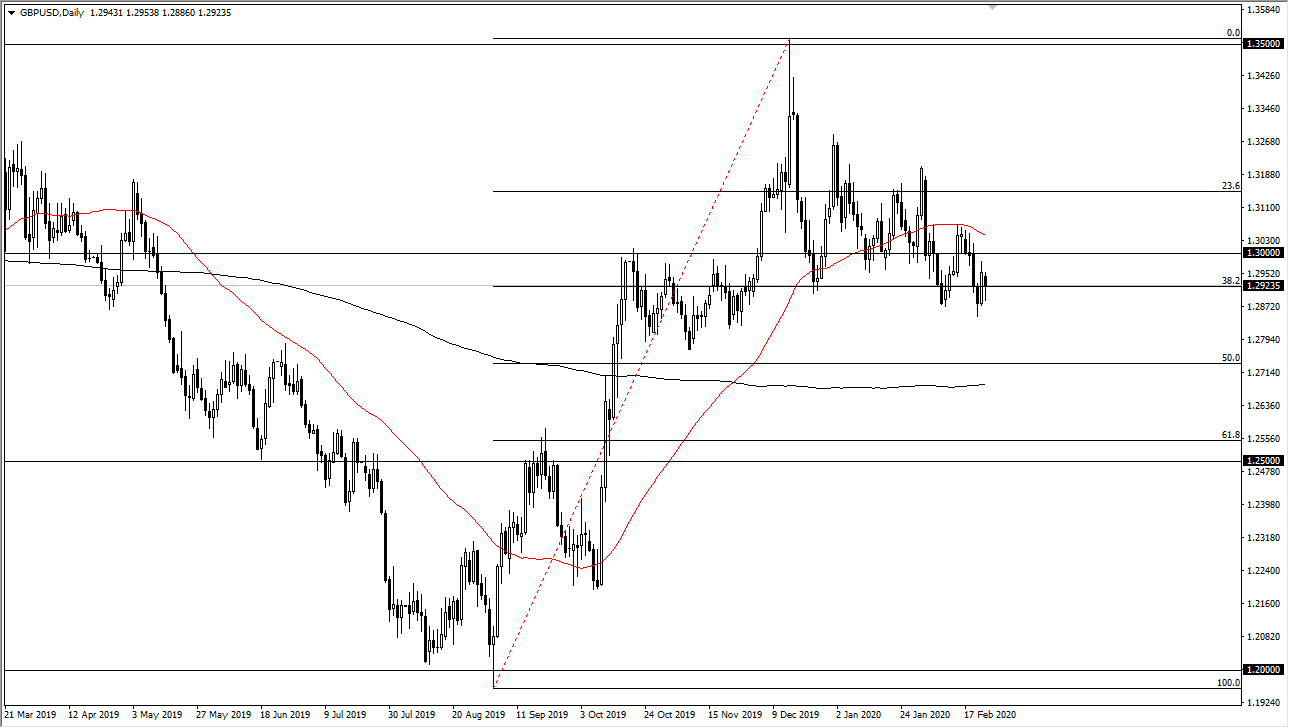

The British pound initially fell during the trading session on Monday as the week started off rather soft. That being said though, the British pound has recovered quite a bit of the losses, thereby forming a bit of a hammer. That is a very bullish sign, and therefore suggests that the buyers are coming back now that the British pound has been made a bit “cheaper” than it was. All things being equal, if the market was to break down below the 1.2850 level, then we have a move to the 200 day EMA underneath, something that could get things moving rather quickly. However, if we can break higher and clear the 50 day EMA, then the market could go much higher, perhaps reaching towards the 1.32 handle.

If we can clear that area, then I believe that the British pound goes looking towards the 1.35 handle, which is the most recent high, and would of course be quite a feat to do. I don’t think that it would be easy, and I think it’s more of a grind higher than anything else. The downside might be a little bit quicker, but at the end of the day I do anticipate that the previously mentioned 200 day EMA should be crucial. Breaking down below there could send this market much lower, perhaps down to the 1.25 handle.

The 1.25 level coincides nicely with the 61.8% Fibonacci retracement level, which of course is a nice confluence, but if we do break down below the 200 day EMA, it will probably freak a lot of traders out. If that happens, then I believe that the market probably accelerates, and we get a major “risk off” type of situation. To the upside, even if we do rally and break all the way to the 1.35 handle, I think it is going to be much slower than falling apart. The British pound is historically cheap, so there could be value hunters willing to step in and pick it up. However, one of the biggest problems is pair will have been the fact that the other side of the equation is the US dollar, which of course is rather strong. Keep in mind that the US economy is outperforming the rest of the world when it comes to larger economies, so of course the currency itself continues to attract a lot of attention.