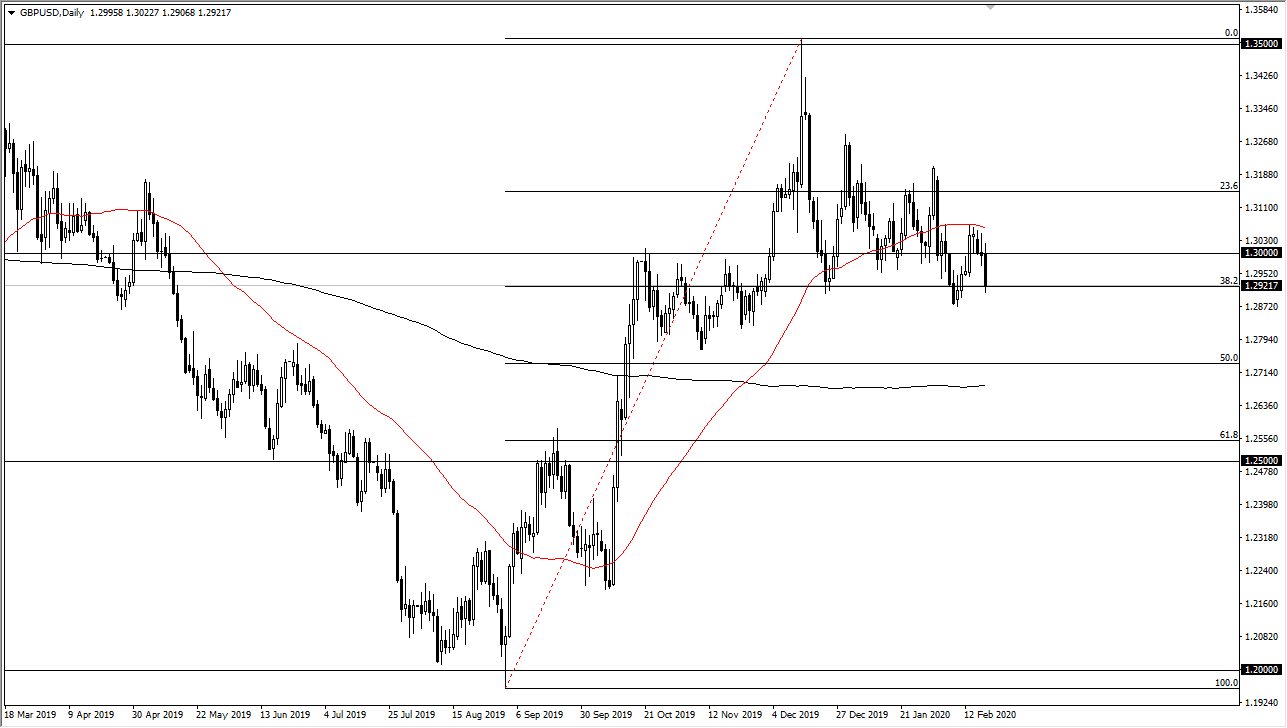

The British pound has initially tried to rally during the trading session on Thursday, but then broke down below the 1.30 level to show signs of negativity again. Quite frankly, the British pound is reflecting US dollar strength in this pair more than anything else. The market has been very choppy as of late, and I think it will continue to be due to the uncertainty when it comes to the United Kingdom negotiating with the European Union. Ultimately, this is a market that has the world’s strongest currency and economy and it, the United States and therefore it will be treated a little bit differently than other pairs involving the British pound.

To the upside, I see the 50 day EMA as major resistance. We need to clear that in order to be comfortable unless of course we form some type of longer-term candlestick that suggests the buyers are coming back into play, perhaps on the weekly chart. The 200 day EMA underneath will offer support as well, as it is near the 1.27 level. I do believe that eventually we get a bit of a bounce but as long as the US dollar is so strong against everything else, I think that a bounce in this market should get you looking for trades in the British pound against other currencies.

For example, you may be looking to buy the British pound, but why do it against the greenback when the US is so strong? In other words, I believe that buying the British pound against something like the Australian dollar makes quite a bit more sense, or perhaps even the Japanese yen now that the Japanese economy looks destined to fall into recession. Looking at this chart, there is a lot of support underneath, so I do anticipate that eventually the British pound does bounce, but obviously we have a lot of work to do in order to make it a buyable of that, at least against the US dollar.

As the dollar continues to be one of the favorite currencies in the world, this will continue to make this pair are little bit difficult to rally. If we do break above the 50 day EMA, it’s likely that the market could go to the 1.32 handle, possibly even the 1.35 level. Again though, you can probably look at the British pound as more or less a secondary indicator than anything else.