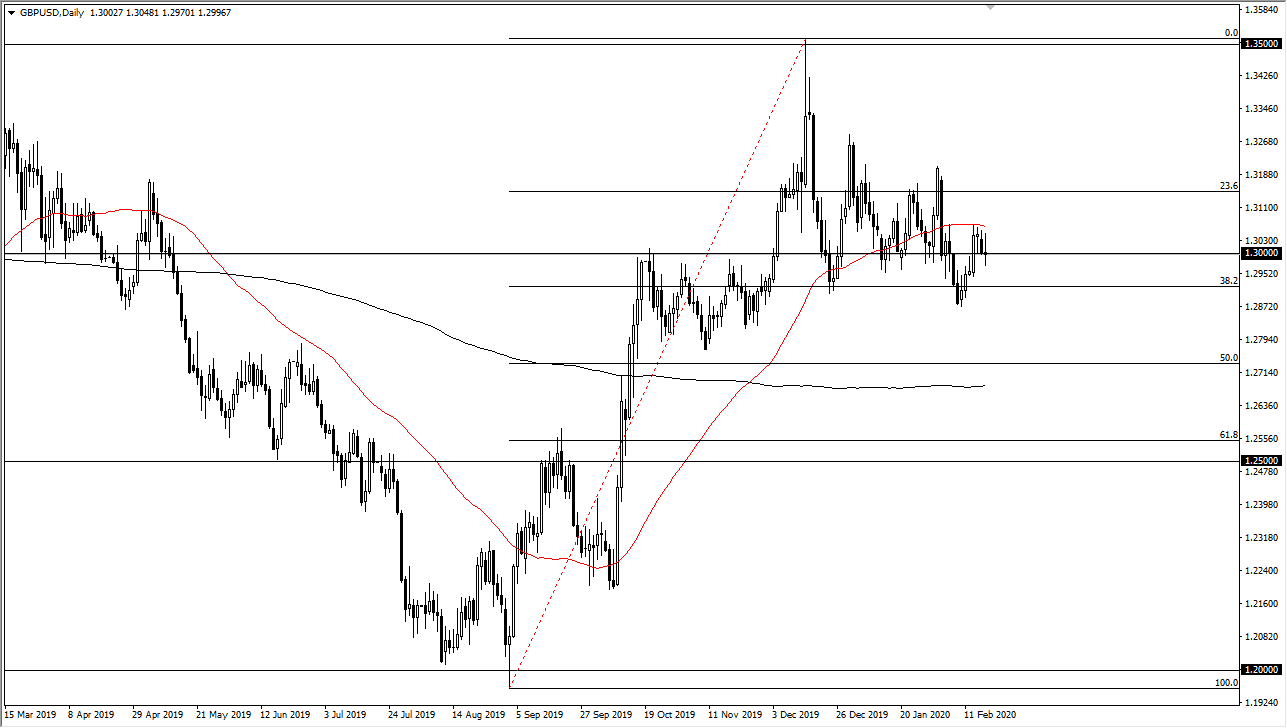

The British pound went back and forth during the trading session on Thursday, as the market try to reach towards the 50 day EMA during the day, but then broke down to reach towards 1.30 level. Underneath, there seems to be plenty of support just above the 1.2950 level, so at this point it’s likely that the market is showing signs of confusion right now, as would make the most sense. After all, the United Kingdom is currently trying to enter a negotiation with the European Union in order to work out some type of trade deal. That puts a lot of concerns around the British pound and of course that would make quite a bit of volatility.

The British decided to press forward with a budget, so that lifts some concerns, but this is a market that is trading against the US dollar which of course will be more preferable to the British pound in the short term. Longer-term, the British pound looks very likely to be thought of as cheap, but at this point I’m not willing to jump in and until we break above the 50 day EMA on a daily close. If that happens, the 1.32 level would offer resistance. Breaking above that level opens up the door to the 1.35 handle.

Pullbacks at this point should see plenty of support near the 1.29 level, and of course at the 1.28 level as well. This is a market that continues to find plenty of buyers underneath, and I think that the market will eventually turn around but in the short term it’s very difficult to do that. If you are a longer-term trader though, you could get a bit of a position built based upon the short-term pullbacks and little bits and pieces. Building up a larger core position could be very profitable given enough time, but you would need to see the British be free and clear of the negotiations with the Europeans. It is because of this that although I am bullish, the reality is that the market probably needs a certain amount of calming down in order to go higher. That being said, I’m not willing to short this market, at least not quite yet as there is a lot of support underneath. It’s probably easier to trade the British pound against other currencies at this point.