The British pound, although oversold from what I can tell, is more than likely going to continue suffering at the hands of the greenback, not necessarily because of major concerns with the Pound itself, but more than likely as a reflection of the strength coming out of the United States.

GBP/USD

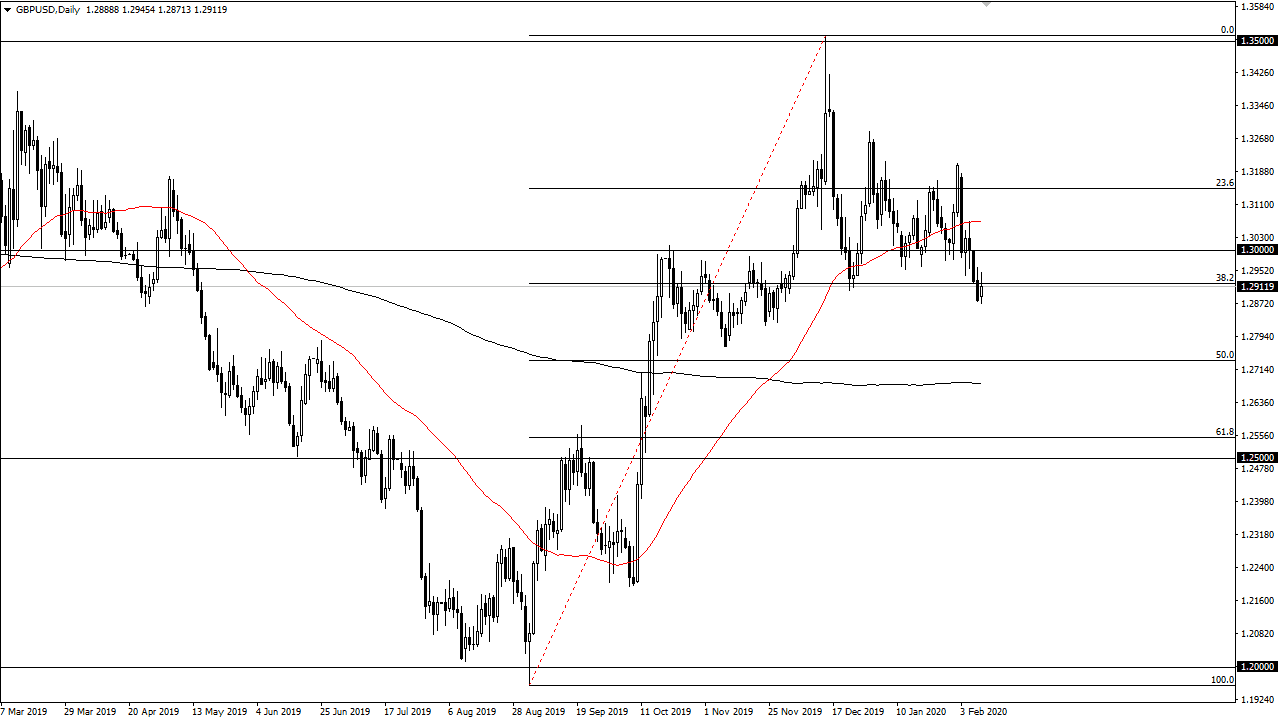

The British pound has initially tried to rally during the trading session on Monday but gave back quite a bit of the gains in order to form a less than impressive candlestick. It still looks as if it is supported near the 1.29 level, at least temporarily. That being said, I do believe that rallies will continue to be sold on a short-term time basis, as the US dollar has outperformed other currencies as well.

Even if the British pound does in fact rally rapidly, it is still going to struggle a bit due to the fact that there has been so much noise just above. Furthermore, the US continues to outperform the rest of the world, so it makes quite a bit of sense that we would see the greenback strengthen in general or at least “fall less” against the British pound.

While I do believe in the British pound over other currencies such as the Euro or the Australian dollar, the reality is that it is still going to be somewhat sluggish. It’s essentially “less bad” than the rest of those other currencies as so many of them are sensitive to Asia and all things coronavirus related. That being said, there is a lot of noise out there, and of course the United Kingdom continues to go through the entire Brexit situation as far as negotiating a trade deal with the European Union is concerned. With that, expect a lot of choppy volatility but I see quite a bit of support underneath as well. I believe at this point the market will be supported all the way down to at least the 200 day EMA, which is closer to the 1.27 level. In other words, I’m not necessarily looking to sell this market, but I’m a bit skittish about buying it unless we get some type of pullback or recapture the 1.30 level on a daily close. All things being equal, it’s probably best to let the market sort itself out before putting a lot of money together into a position. However, if we recapture that 1.30 level, that would be extraordinarily bullish.