David Frost, the UK’s Chief Brexit Negotiator, confirmed that the country is not seeking to align its post-transition rules and regulations with the EU. He noted its defies the entire purpose of leaving the trading bloc and stated that it is possible to be a political partner and economic competitor. This remains in-line with the promises of Brexit during the 2016 referendum, and while the British Pound initially slipped, the outlook remains increasingly bullish. Clarity about where the UK is heading allows businesses to plan accordingly, with economic data surprising to the upside. The GBP/USD converted its short-term resistance zone into support, from where more upside is expected.

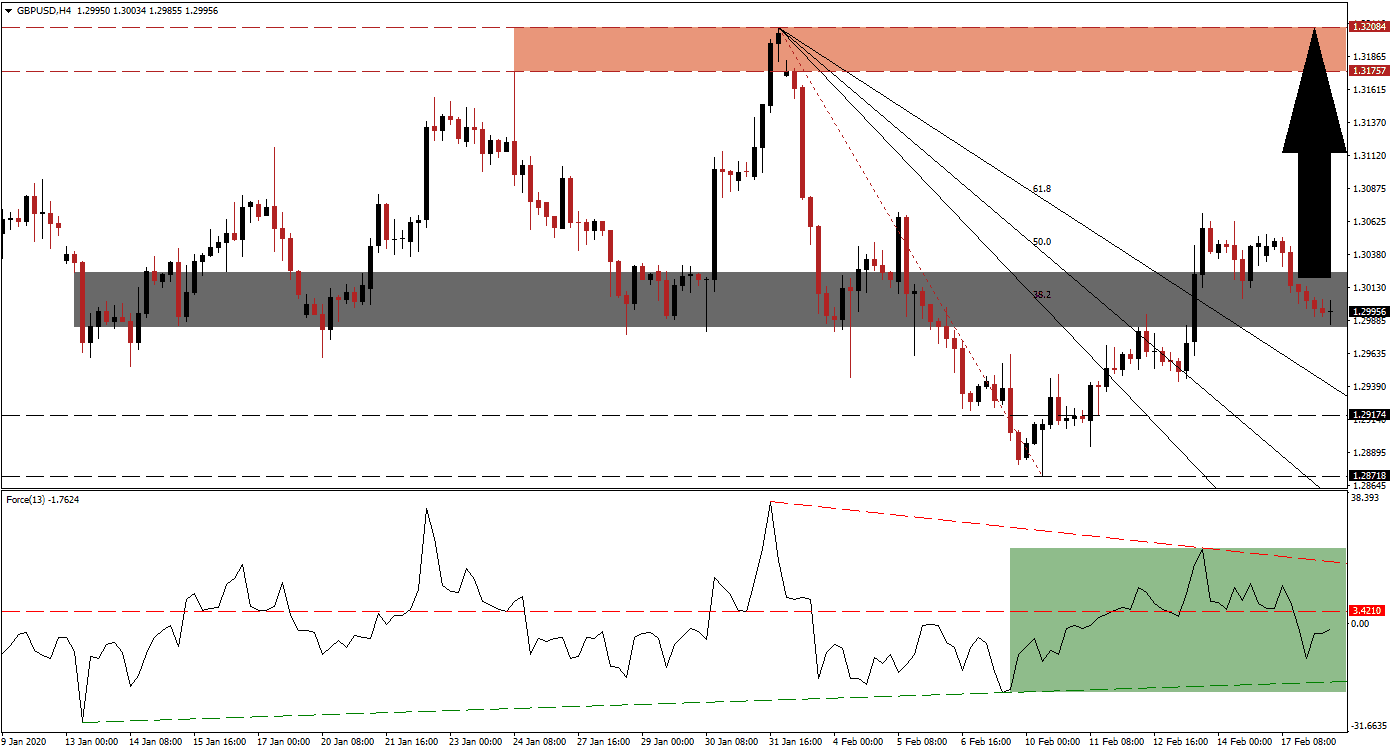

The Force Index, a next-generation technical indicator, retreated from its post-breakout peak and moved below its horizontal support level, converting it back into resistance. Additional downside pressure is provided by its descending resistance level, but this is countered by its ascending support level. The Force Index started to change direction off of a higher low, as marked by the green rectangle. This technical indicator is favored to advance into positive territory from where bulls will regain control of the GBP/USD. You can learn more about the Force Index here.

Following the conversion of its short-term resistance zone into support, bullish pressures are expanding, suggesting more upside is pending. This zone is located between 1.29830 and 1.30245, as marked by the grey rectangle. A pause in the breakout sequence of the GBP/USD is not only normal price action behavior but also necessary to ensure the longevity of the uptrend. The brightening outlook and clarity for the UK economy, together with emerging structural weakness in the US economy, increase by political uncertainty, position this currency pair for an extension of its advance.

Adding to bullish developments is the breakout in the GBP/USD above its entire Fibonacci Retracement Fan sequence. A move in price action above the intra-day high of 1.30688, the peak of its current push higher, is anticipated to result in the next wave of net buy orders. It will provide the required momentum to propel price action into its resistance zone located between 1.31757 and 1.32084, as marked by the red rectangle. More upside is likely to follow, given the developing fundamentals. You can learn more about the Fibonacci Retracement Fan here.

GBP/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.29950

Take Profit @ 1.31750

Stop Loss @ 1.29500

Upside Potential: 180 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 4.00

In the event of a breakdown in the Force Index below its ascending support level, the GBP/USD is expected to face a spike in downside pressure. Any move lower from current levels should be considered an excellent buying opportunity, and Forex traders are highly recommended to take advantage of it. The downside potential appears limited to its support zone located between 1.28718 and 1.29174 from where the breakout sequence emerged.

GBP/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.29250

Take Profit @ 1.28750

Stop Loss @ 1.29500

Downside Potential: 50 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.00