UK economic data has consistently surprised to the upside since Prime Minister Boris Johnson secured an overwhelming majority in the House of Commons and delivering Brexit. The long-term outlook for the British Pound is increasingly bullish, with the Bank of England’s next monetary adjustment likely to be an interest rate increase. A rise in volatility should be accounted for, following the massive advance over the past twelve months. The GBP/SGD shows signs of exhaustion, ripe for a minor correction before resuming its advance. This morning’s industrial production data out of Singapore surged, defying expectations for an annualized contraction. A breakdown in price action below its resistance zone is pending.

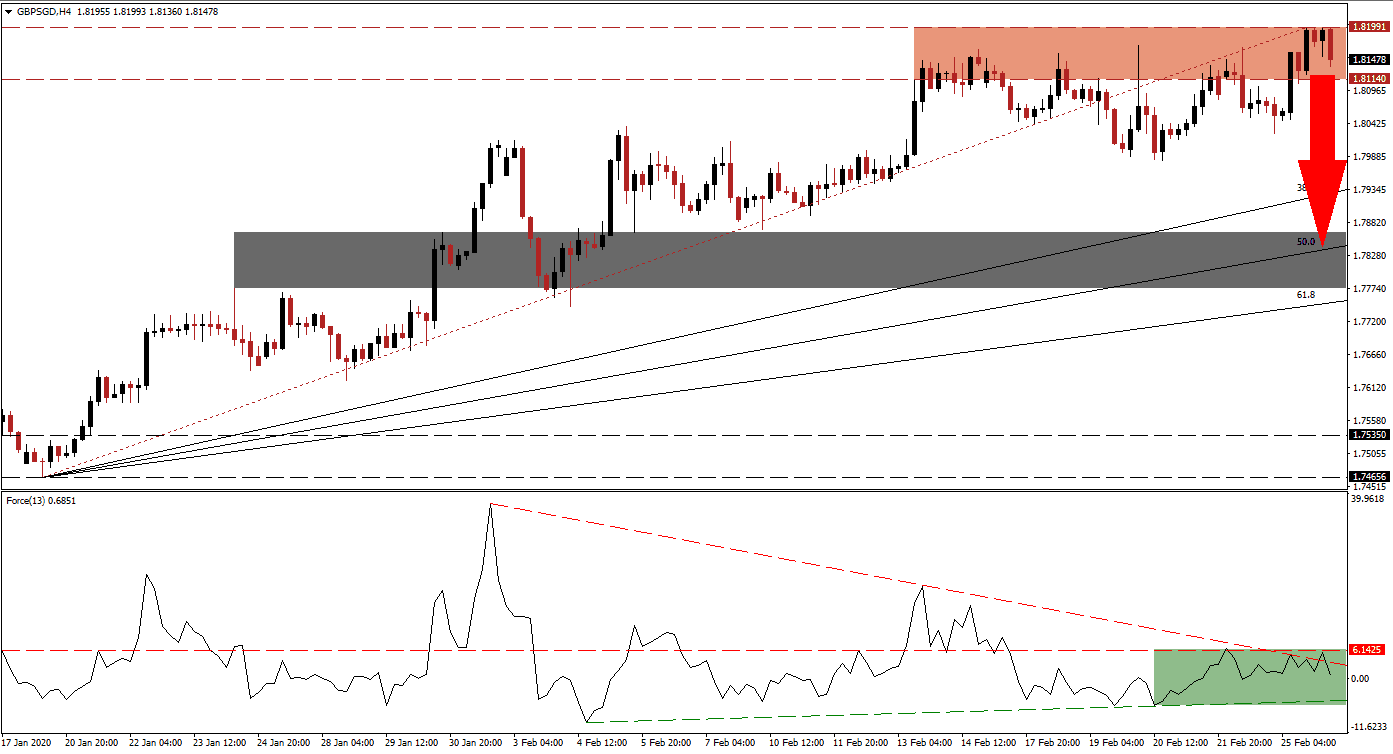

The Force Index, a next-generation technical indicator, points towards the formation of a shallow negative divergence. After the GBP/SGD initially reached its resistance zone, a sideways trend with a bullish bias allowed drift to a higher high. The Force Index reversed below its horizontal resistance level, where it was reversed by its ascending support level. It was rejected by its descending resistance level, as marked by the green rectangle, resulting in a lower high. This technical indicator is now positioned to move into negative territory, granting bears control of this currency pair.

A breakdown in the GBP/SGD below its resistance zone located between 1.81140 and 1.81991, as marked by the red rectangle, is anticipated to trigger a profit-taking sell-off. One key level to monitor is the intra-day low of 1.80271, the low of the previous rejection in this currency pair by its Fibonacci Retracement Fan trendline. A push below this level is favored to close the gap between price action and its ascending 38.2 Fibonacci Retracement Fan Support Level. You can learn more about a profit-taking sell-off here.

Singapore is taking measures to counter the economic impact of Covid-19, likely to be named a global pandemic in the coming days. The GBP/SGD is expected to descend into its short-term support zone located between 1.77736 and 1.78648, as marked by the grey rectangle. Downside pressure could ease at its 50.0 Fibonacci Retracement Fan Support Level, from where a reversal is possible. The 61.8 Fibonacci Retracement Fan Support Level is enforcing the bottom range of this zone.

GBP/SGD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.81500

Take Profit @ 1.78500

Stop Loss @ 1.82400

Downside Potential: 300 pips

Upside Risk: 90 pips

Risk/Reward Ratio: 3.33

In case of a reversal in the Force Index above its descending resistance level, the GBP/SGD is anticipated to attempt a breakout and extend its advance. While the long-term outlook remains bullish, a short-term correction will ensure the longevity of the trend. Failure to initiate one now prepares this currency pair for a more massive correction in the future. The next resistance zone awaits price action between 1.84475 and 1.85370.

GBP/SGD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.82800

Take Profit @ 1.84800

Stop Loss @ 1.82100

Upside Potential: 200 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 2.86