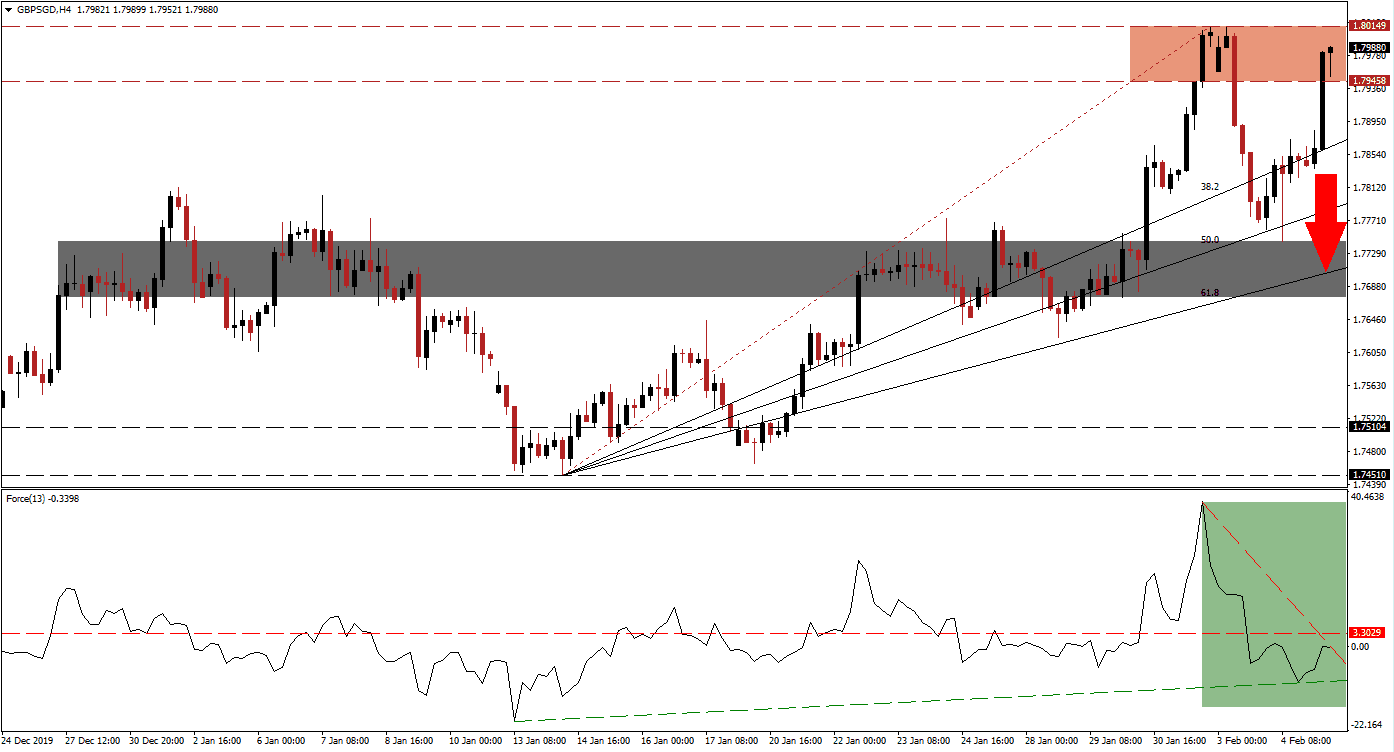

After this currency pair spiked off of its ascending 38.2 Fibonacci Retracement Fan Support Level into its resistance zone, momentum failed to confirm the advance. This has made the GBP/SGD vulnerable to a corrective phase. The Singapore Dollar sold off after commentary from the Monetary Authority of Singapore, suggesting there is room to ease monetary policy due to the economic threats of the coronavirus. Devaluation of the Singapore Dollar by the MAS is often conducted via direct market interventions, not interest rate cuts.

The Force Index, a next-generation technical indicator, offered the first signal that the advance is unsustainable. As the GBP/SGD recovered from its initial breakdown below its resistance zone, the Force Index remained in negative conditions, as marked by the green rectangle. Therefore, bears are in charge of price action, and while this technical indicator bounced off of its ascending support level, it is expected to remain below its horizontal resistance level. You can learn more about the Force Index here.

Following the first rejection of this currency pair by its resistance zone located between 1.79458 and 1.80149, as marked by the red rectangle, a second breakdown attempt is favored to initiate a profit-taking sell-off. This is anticipated to lead to a more substantial corrective phase. Concerns over post-Brexit trade negotiations between the EU and the UK are likely to counter market interference by the MAS. A rise in volatility should accompany the GBP/SGD, as pressures for either a breakout or breakdown are on the rise.

As the Fibonacci Retracement Fan sequence is approaching the resistance zone, the absence of bullish momentum is expected to force a breakdown in this currency pair. This will clear a corrective phase in the GBP/SGD into its short-term support zone located between 1.76735 and 1.77441, as marked by the grey rectangle. With the long-term fundamental outlook for this currency pair bullish, a breakdown extension remains unlikely unless existing conditions change materially. You can learn more about a support zone here.

GBP/SGD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.80000

Take Profit @ 1.77250

Stop Loss @ 1.80700

Downside Potential: 275 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.93

Should the Force Index push through its descending resistance level and convert its horizontal resistance level into support, the GBP/SGD is anticipated to extend its advance. While the long-term fundamental scenario remains bullish, the short-term technical picture suggests temporary weakness. Price action will face its next resistance zone between 1.82158 and 1.82834, the peak of the post-election rally in this currency pair.

GBP/SGD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.81150

Take Profit @ 1.82800

Stop Loss @ 1.80350

Upside Potential: 165 pips

Downside Risk: 80 pips

Risk/Reward Ratio: 2.06