After the Reserve Bank of New Zealand maintained its interest rate at 1.00%, noting that the economic damage from the coronavirus remains does not justify an adjustment to monetary policy, the New Zealand Dollar rallied. Consumer spending remained weak in January, and while the central bank kept interest rates unchanged, the finance minister told MPs that the economic cost could reach $250 million, concentrated in the first quarter. An inter-agency coronavirus task force has been created to derive an action plan. The GBP/NZD dropped into its short-term support zone following this morning’s developments.

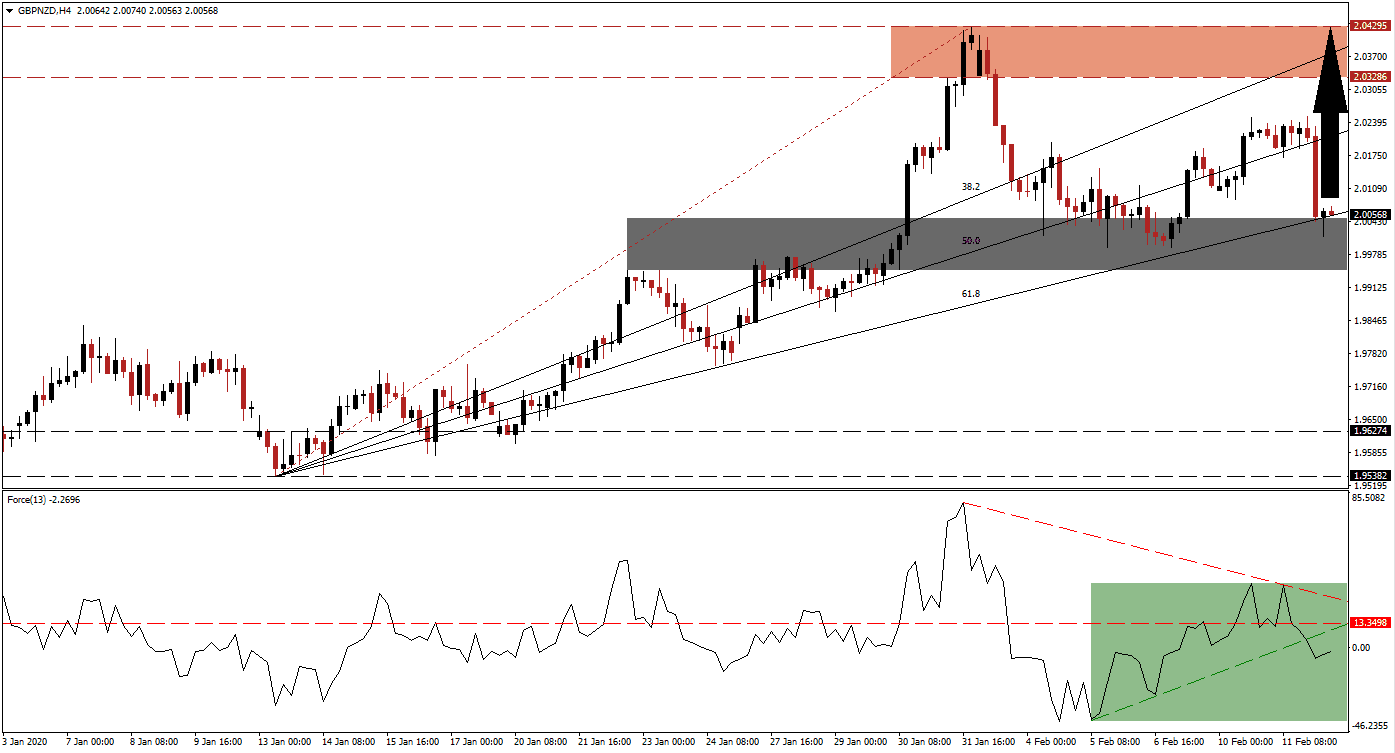

The Force Index, a next-generation technical indicator, converted its horizontal support level into resistance. A descending resistance level formed due to the lower high, as marked by the green rectangle. It pressured the Force Index below its ascending support level and into negative territory, but signs of a recovery have emerged. This technical indicator is favored to reverse above the 0 center-line, allowing bulls to retake control of price action in the GBP/NZD. You can learn more about the Force Index here.

After this currency pair dropped below its ascending 50.0 Fibonacci Retracement Fan Support Level, turning it into resistance, bearish pressures eased as the GBP/NZD reached its short-term support zone. The 61.8 Fibonacci Retracement Fan Support Level just crossed above this zone, located between 1.99470 and 2.00503, as marked by the grey rectangle. A short-covering rally is expected to materialize, allowing price action to resume its uptrend. The 2.00000 psychological support level should be monitored closely, as it may inspire the pending advance.

Unless fundamental conditions change drastically, the GBP/NZD is positioned to accelerate into its resistance zone located between 2.03286 and 2.04295, as marked by the red rectangle. The 38.2 Fibonacci Retracement Fan Support Level has entered this zone and is likely to guide price action to the upside. Forex traders are advised to pay attention to the intra-day high of 2.02489, the peak before the price drop. A breakout may provide enough upside pressure to initiate a more massive advance.

GBP/NZD Technical Trading Set-Up - Price Action Recovery Scenario

Long Entry @ 2.00500

Take Profit @ 2.04250

Stop Loss @ 1.99250

Upside Potential: 375 pips

Downside Risk: 125 pips

Risk/Reward Ratio: 3.00

Should the Force Index slide deeper into negative territory, pressured by its descending resistance level, the GBP/NZD is anticipated to attempt a breakdown. While the next support zone is located between 1.95382 and 1.96274, the intra-day low of 1.97588 may end any push to the downside. It marks the last instance price action accelerated off of its 61.8 Fibonacci Retracement Fan Support Level. Given the fundamental outlook for this currency pair, Forex traders are advised to consider this a great buying opportunity.

GBP/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.98600

Take Profit @ 1.97600

Stop Loss @ 1.99100

Downside Potential: 100 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 2.00