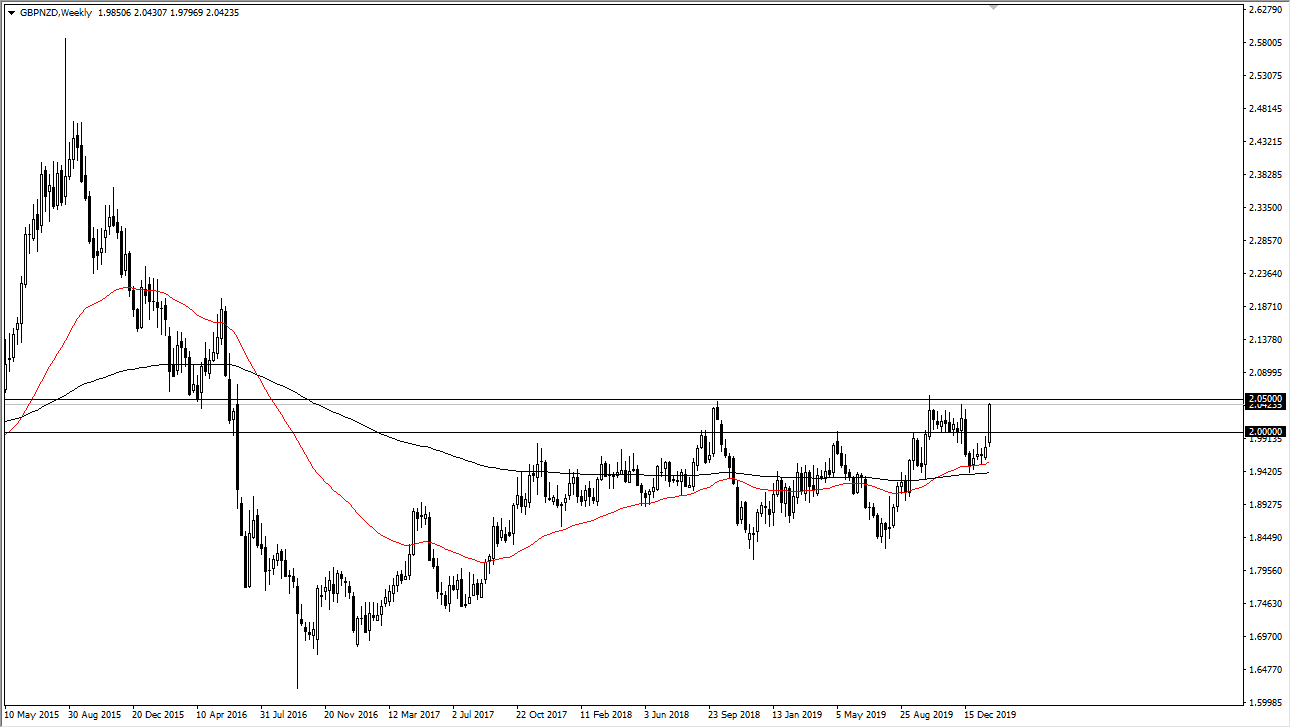

The British pound has exploded to the upside during the last week of the month, as January ended up being very bullish. The British pound is now threatening the 2.05 level against the New Zealand dollar, and if it can break above there it’s likely that the British pound will continue to go much higher. Ultimately, I think that short-term pullbacks will be bought, especially with an eye on the 2.00 level as massive support. At this point, the 50 week EMA looks to be supportive, so pullback should have plenty of reasons to turn around. Beyond that, the New Zealand dollar is highly sensitive to China so don’t be surprised at all to see the New Zealand dollar continue to suffer in general.

On the other side of this equation we have the Brexit being sorted out, and now that the United Kingdom has escaped the European Union without imploding, that in and of itself is reason enough to suspect that this market will continue to go higher given enough time. All things being equal though, we probably will get some type of short-term pullback that we can take advantage of. The 2.10 level will be the next target, followed by the 2.15 handle. This could be a rather explosive move, because this is an area that is so obvious to traders around the world. Ultimately, this is a market that I believe will have that explosive move, and the fact that we are closing at the top of the range for the week heading into the month of February suggests that we are in fact going to continue to see buying pressure, and while the British pound has been so strong against other currencies, the fact that the New Zealand dollar has been hammered makes this a bit of a “perfect set up.”

The market will continue to be very noisy, and of course move to the latest headlines coming out of Wuhan and the rest of China. Keep in mind that the New Zealand dollar is going to be highly sensitive to all things Asia and of the headlines over the weekend get worse, that is going to cause even more pressure to this market. To the downside, it’s not until we break down below the 1.94 level that I’m considering this a market that can be sold. That seems to be very unlikely, barring some type of catastrophic headline coming out of the Brexit situation.