Japanese companies face intense disruptions related to Covid-19, impacting a wide range of sectors, from tourism to technology. The Japanese Yen is the primary safe-haven currency for Forex traders, but the mounting issues facing the economy show signs of weaknesses against select currencies. UK Prime Minister Johnson is reshuffling his inner circle, which led to the surprise resignation of the Chancellor of the Exchequer Javid. New appointments are strengthening the government ahead of tough EU trade talks. The GBP/JPY accelerated to the upside, awaiting a fresh breakout pending.

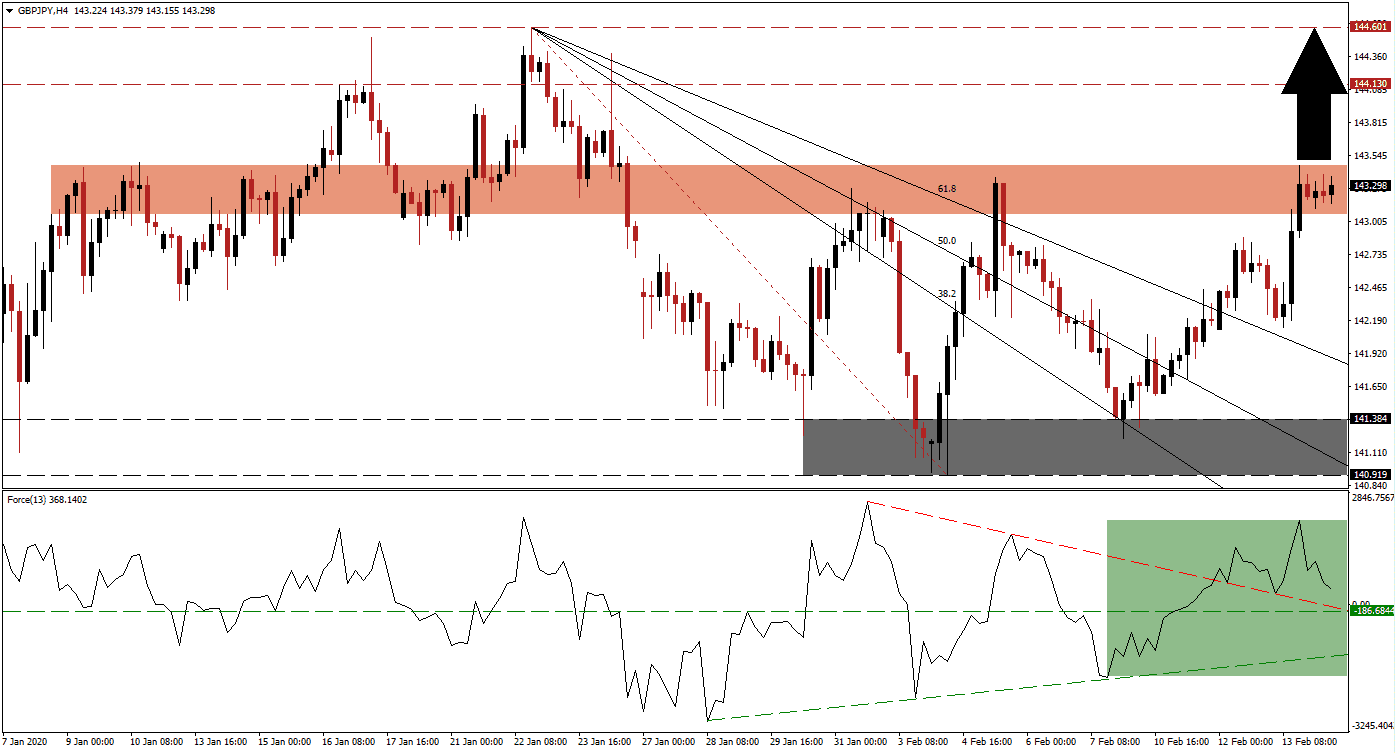

The Force Index, a next-generation technical indicator, retreated from its most recent peak but remains well in positive territory with bulls in charge of price action. A series of higher lows established a strong ascending support level, which is expected to limit short-term reversals. Adding to bullish developments in the GBP/JPY is the breakout in the Force Index above its descending resistance level, as marked by the green rectangle. This technical indicator is anticipated to maintain its position above its horizontal support level. You can learn more about the Force Index here.

Following the initial breakout in this currency pair above its support zone, the GBP/JPY advanced into its short-term resistance zone, recording a higher high. A quick reversal took it back into its support zone located between 140.919 and 141.384, as marked by the grey rectangle, where a higher low was formed. The current breakout sequence took price action through its entire Fibonacci Retracement Fan sequence. More upside pressures emerged following the conversion of its descending 61.8 Fibonacci Retracement Fan Resistance Level into support.

With Covid-19 impacting the Japanese economy to a degree that counters the safe-haven appeal of its currency, a fresh breakout is expected to extend the rally. The GBP/JPY has paused its massive advance inside of its short-term resistance zone located between 143.062 and 143.469, as marked by the red rectangle. This currency pair is positioned to spike into its long-term resistance zone, which awaits price action between 144.130 and 144.601. More upside is possible but requires a new fundamental catalyst. You can learn more about a resistance zone here.

GBP/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 143.300

Take Profit @ 144.600

Stop Loss @ 142.900

Upside Potential: 130 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 3.25

A breakdown in the Force Index below its ascending support level is anticipated to lead the GBP/JPY into one of its own. As the UK economy is gaining steam despite the global economic challenges, the downside potential appears limited to its intra-day low of 142.050. This marks the low of a candlestick following a price gap to the downside, offering Forex traders an excellent buying opportunity.

GBP/JPY Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 142.600

Take Profit @ 142.850

Stop Loss @ 142.050

Downside Potential: 55 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.20