Following UK Prime Minister Johnson’s landslide electoral victory, clarity for businesses allowed February to post the strongest increase in activity in ten months. The UK economy is closer to a boom than a bust, a reality not priced into the British Pound. Covid-19 has a global impact, and the UK is unlikely to escape damages but is well-prepared to grow through those issues. The GBP/CHF corrected from its resistance zone in an orderly fashion, reflecting safe-haven demand for the Swiss Franc amid uncertainty over trade talks between the EU and the UK, as well as the degree of virus-related economic damages.

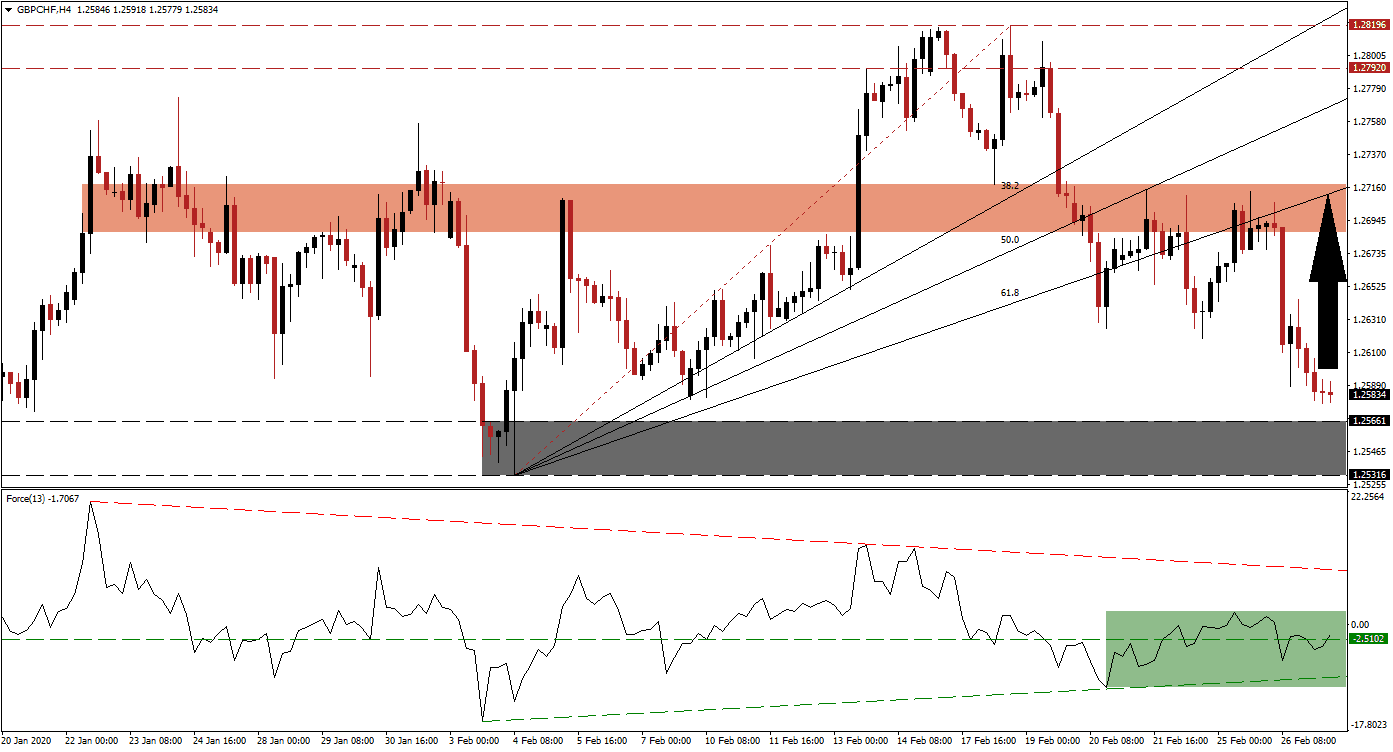

The Force Index, a next-generation technical indicator, shows the presence of a positive divergence. Bullish momentum is building, suggesting the correction in the GBP/CHF is in its end-phase. The Force Index is in the process of confirming the conversion of its horizontal resistance level into support, as marked by the green rectangle. Its ascending support level is applying additional upside pressure. Bulls are expected to take control of price action once this technical indicator pushes into positive conditions, closing in on its descending resistance level.

Providing a floor for the GBP/CHF is its support zone located between 1.25316 and 1.25661, as marked by the grey rectangle, from where the previous advance emerged. It also houses the starting-point of its Fibonacci Retracement Fan sequence. Switzerland reported a bigger than expected budget surplus for 2019, adding a temporary boost to the downside. Recession fears in the Alpine nation, together with a Swiss National Bank policy supporting a weaker currency, enforce a bullish bias in this currency pair.

Given the rise in bullish momentum, a short-covering rally is anticipated to materialize. Forex traders are advised to monitor the intra-day low of 1.26189, the low of a previous pause in the corrective phase, which spiked price action into its short-term resistance zone. This zone is located between 1.26870 and 1.27177, as marked by the red rectangle. The ascending 61.8 Fibonacci Retracement Fan Resistance Level is on the verge of exiting it, suggesting a breakout may extend the GBP/CHF farther to the upside. The next resistance zone awaits this currency pair between 1.27920 and 1.28196. You can learn more about a breakout here.

GBP/CHF Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.25850

Take Profit @ 1.27150

Stop Loss @ 1.25550

Upside Potential: 130 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 4.33

Should the Force Index correct below its ascending support level, the GBP/CHF may be pressured to a breakdown extension. With the increasingly bullish fundamental scenario for the UK economy, the Bank of England’s next monetary adjustment is likely to be an interest rate increase. Forex traders are recommended to view any breakdown from current levels as an outstanding buying opportunity. The next support zone is located between 1.23524 and 1.24023.

GBP/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.25150

Take Profit @ 1.24000

Stop Loss @ 1.25550

Downside Potential: 115 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.88