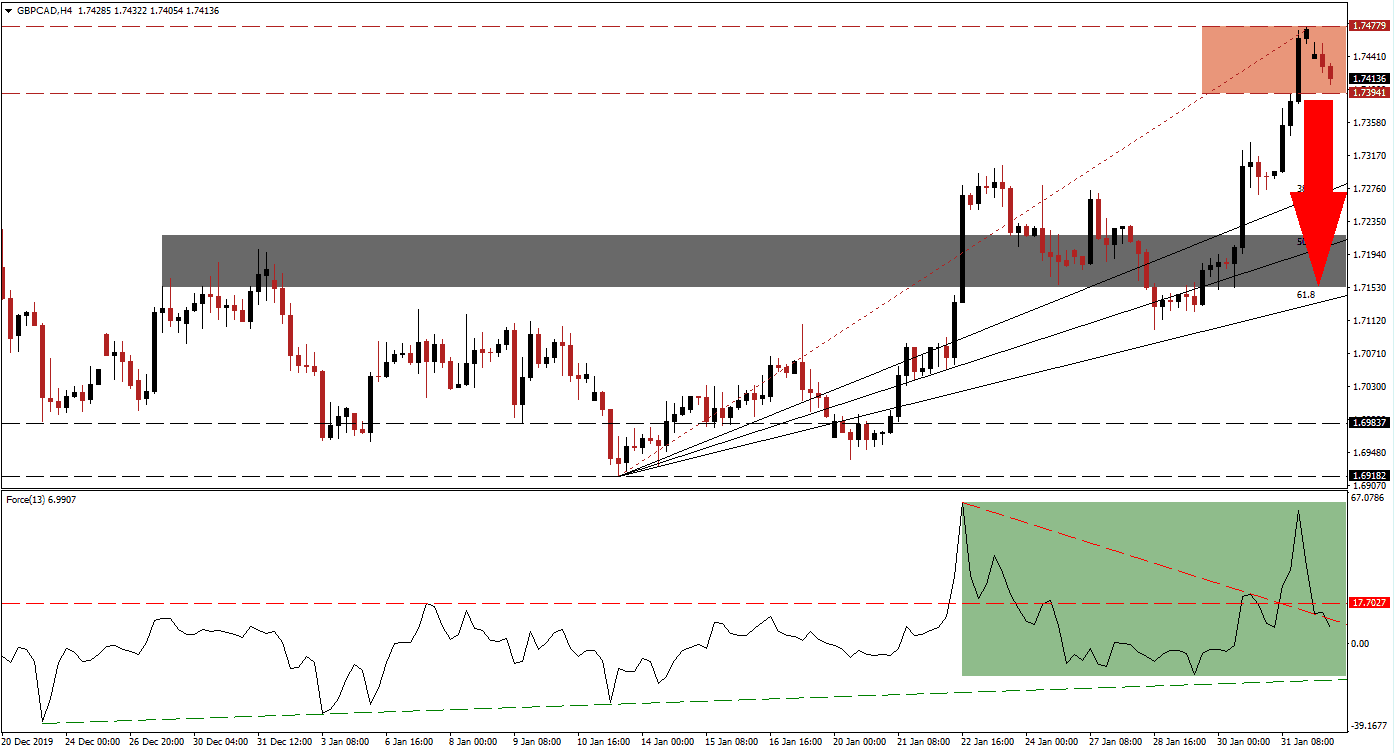

Brexit was implemented, and while the UK will abide EU rules as well as regulations during the transition period, it is now free to pursue trade deals, the first step in reclaiming its economic sovereignty. This currency pair accelerated into its long-term resistance zone following the conversion of its short-term resistance zone into support. A profit-taking sell-off is now pending after the massive advance in the GBP/CAD. This will ensure the longevity of the rally, allowing Forex traders a new buying opportunity.

The Force Index, a next-generation technical indicator, followed the higher high in price action with a spike of its own but recorded a marginally lower high. As a result of the build-up in bullish momentum, the Force Index completed a breakout above its descending resistance level, which was quickly reversed. This technical indicator is now on track to extend its reversal into negative territory until it will reach its ascending support level, as marked by the green rectangle, allowing bears to take control of the GBP/CAD. You can learn more about the Force Index here.

With the loss in bullish momentum inside of the resistance zone located between 1.73941 and 1.7779, as marked by the red rectangle, a breakdown is expected to initiate the pending profit-taking sell-off. This will take the GBP/CAD into its ascending 38.2 Fibonacci Retracement Fan Support Level, closing the gap. Today’s UK manufacturing PMI is predicted to show the sector remained in a recession, which may provide the short-term fundamental catalyst for a corrective phase.

Forex traders are advised to monitor the intra-day high of 1.73332, the peak of a previous pause from where the GBP/CAD spiked into its higher high. A breakdown below this level is favored to result in the addition of new net short orders. This should suffice to pressure price action into its short-term support zone located between 1.71537 and 1.72180, as marked by the grey rectangle, enforced by its 61.8 Fibonacci Retracement Fan Support Level. You can learn more about a support zone here.

GBP/CAD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.74100

Take Profit @ 1.71600

Stop Loss @ 1.74900

Downside Potential: 250 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 3.13

In the event of a breakout in the Force Index above its descending resistance level, the GBP/CAD is anticipated to keep its rally intact without an interruption. The long-term fundamental outlook remains increasingly bullish for this currency pair, with short-term pauses representing outstanding buying opportunities. A breakout should take price action into its next resistance zone between 1.76990 and 1.77928, the peak of the post-election rally last December.

GBP/CAD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.75100

Take Profit @ 1.77500

Stop Loss @ 1.74250

Upside Potential: 240 pips

Downside Risk: 85 pips

Risk/Reward Ratio: 2.82