Economic data out of the UK has been stronger than markets anticipated, adding to upside momentum in the British Pound. Prime Minister Johnson has reshuffled his cabinet to align the core team ahead of trade negotiations with the EU. Since he won a landslide election in December and delivering Brexit two weeks ago, his government will lead challenging trade talks. The absence of a trade deal remains an option, especially if the UK economy continues to outperform the bloc. An extension of the breakout sequence in the GBP/CAD is favored.

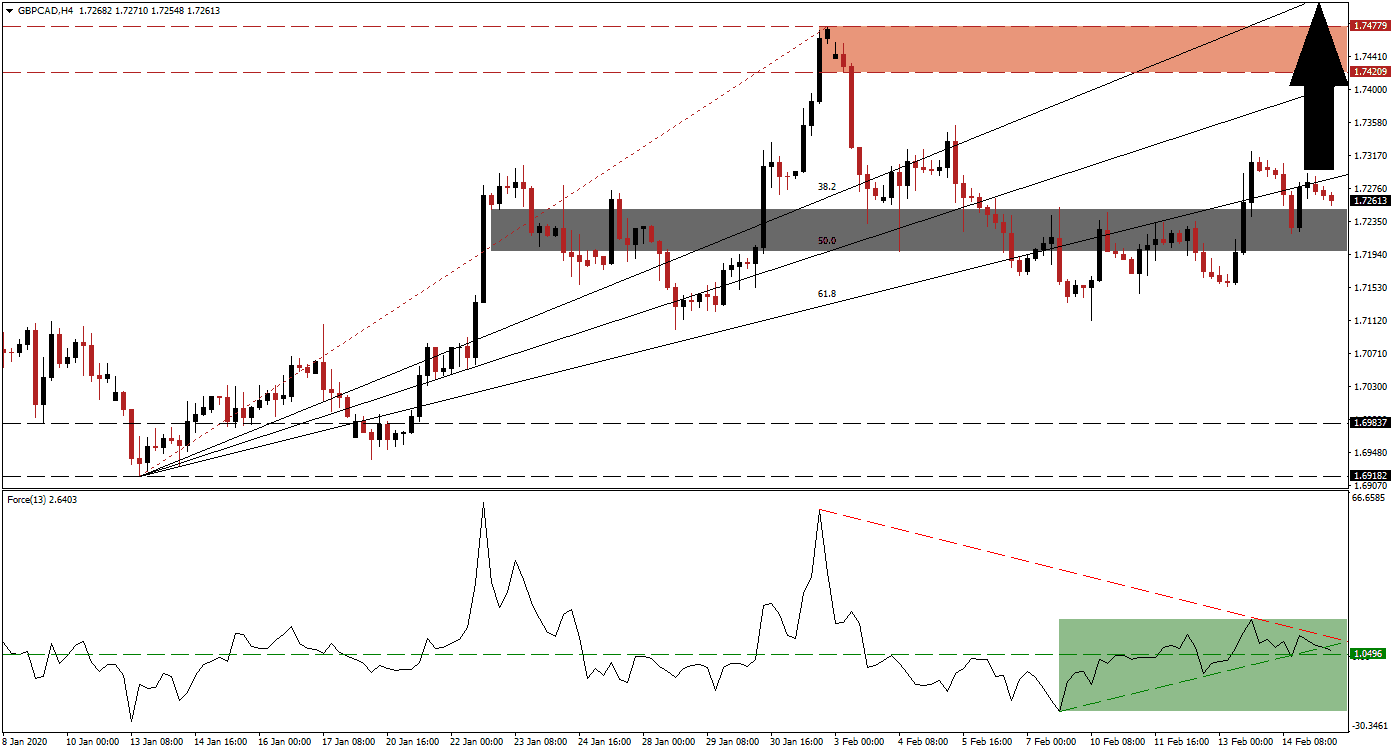

The Force Index, a next-generation technical indicator, points towards a gradual recovery in bullish momentum, which will guide price action higher in a measured fashion. After this currency pair corrected from its new 2020 high, the Force Index recorded a higher low, from where its ascending support level emerged. The conversion of its horizontal resistance level into support, as marked by the green rectangle, added more upside pressure. This technical indicator maintains its position in positive territory, with bulls in charge of the GBP/CAD. You can learn more about the Force Index here.

Following the breakout in this currency pair above its short-term resistance zone, which converted it into support, a minor reversal materialized. This zone is located between 1.71976 and 1.72499, as marked by the grey rectangle. A retest of the conversion is normal price action behavior, often preceding a more massive advance. Forex traders are advised to monitor the intra-day high of 1.73226, the peak of the current breakout. More net buy orders in the GBP/CAD are likely to follow a breakout.

One pending bullish development to keep in mind is the favored breakout in price action above its ascending 61.8 Fibonacci Retracement Fan Resistance Level. This will convert it into support, from where the Fibonacci Retracement Fan sequence may guide the GBP/CAD to the upside. The next resistance zone is located between 1.74209 and 1.74779, as marked by the red rectangle. With the 38.2 Fibonacci Retracement Fan Resistance Level above this zone, and the 50.0 Fibonacci Retracement Fan Resistance Level approaching the bottom range, a fresh breakout is expected.

GBP/CAD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.72600

Take Profit @ 1.75600

Stop Loss @ 1.71600

Upside Potential: 300 pips

Downside Risk: 100 pips

Risk/Reward Ratio: 3.00

Should the descending resistance level pressure the Force Index into a breakdown, the GBP/CAD is anticipated to follow suit. Given the slowdown in the Canadian economy, coupled with the increasing strength of the UK one, the downside potential appears limited. Forex traders are recommended to view a potential contraction in this currency into its long-term support zone as a great buying opportunity. This zone awaits price action between 1.69182 and 1.69837.

GBP/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.69900

Take Profit @ 1.69200

Stop Loss @ 1.71200

Downside Potential: 70 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.33