Australian data this morning showed the services sector contracted further in January, adding to selling pressure in its currency. The coronavirus continues to dominate short-term fundamentals, with the Reserve Bank of Australian noted that the negative economic impact is greater than that of the 2002/2003 SARS epidemic. As the situation develops, more clarity of the economic disruption will become evident. The Australian Dollar is the primary Chinese Yuan proxy currency, directly impacted by developments. More downside is favored, anticipated to pressure the GBP/AUD into a breakout.

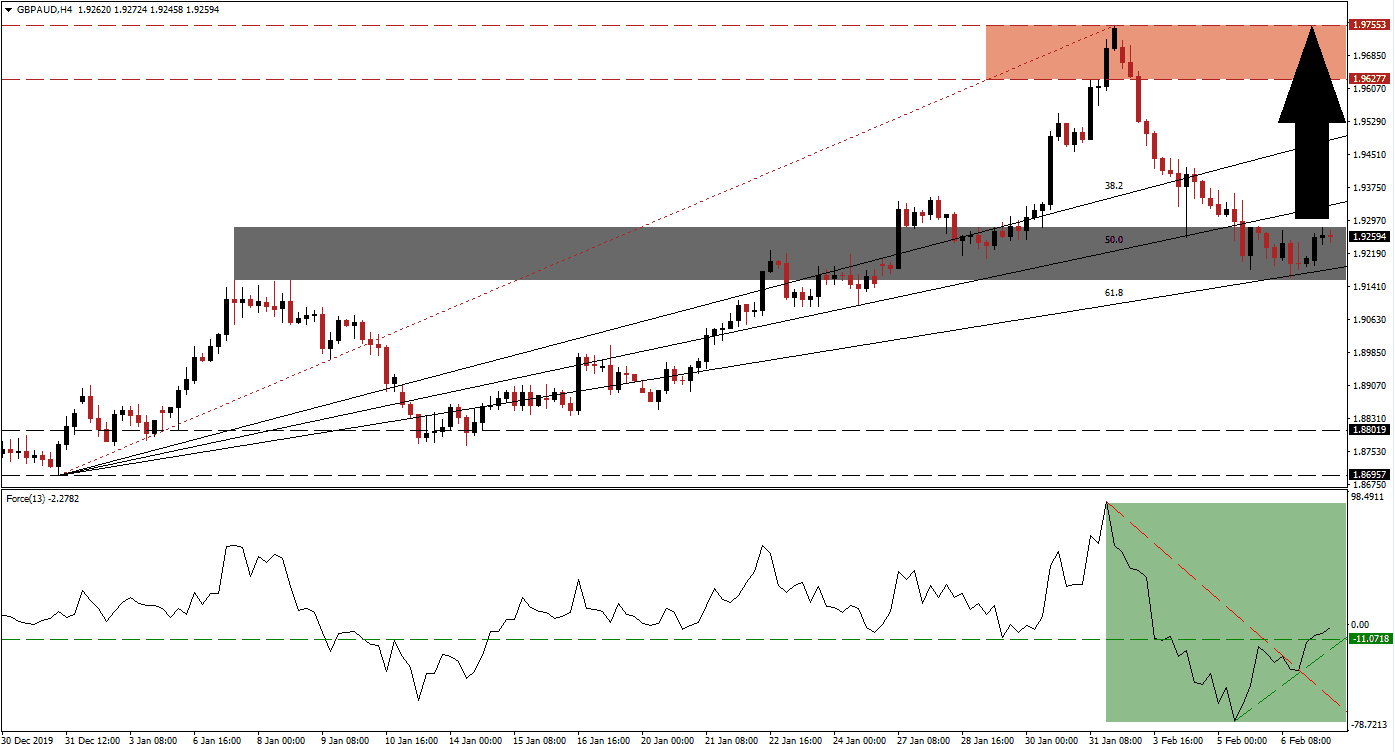

The Force Index, a next-generation technical indicator, shows the rise in bullish momentum after contracting to a lower low. Price action extended its slide as the Force Index recovered, resulting in the formation of a positive divergence. It was followed by a breakout above its descending resistance level, as marked by the green rectangle. This technical indicator then turned its horizontal resistance level into support. A crossover above the 0 center-line is anticipated to place bulls in charge of the GBP/AUD, igniting a recovery. You can learn more about the Force Index here.

With bullish momentum expanding, this currency pair is favored to sustain a breakout above its support zone located between 1.91548 and 1.92813, as marked by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level is currently passing through this zone, adding to upside pressure. A breakout is expected to initiate a short-covering rally, which should convert the 50.0 Fibonacci Retracement Fan Resistance Level into support. This is likely to result in the net addition of new buy orders in the GBP/AUD, further fueling the pending advance.

Forex traders are advised to monitor the intra-day high of 1.94221, the last instance the GBP/AUD traded above its 38.2 Fibonacci Retracement Fan Support Level before it as turned into resistance. A breakout above this mark will clear the path to the upside and into its resistance zone located between 1.96277 and 1.97553, as marked by the red rectangle. Strong PMI data out of the UK added a short-term boost to the British Pound, but an extension of the anticipated breakout requires a new catalyst. You can learn more about a resistance zone here.

GBP/AUD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.92600

Take Profit @ 1.97550

Stop Loss @ 1.91550

Upside Potential: 495 pips

Downside Risk: 105 pips

Risk/Reward Ratio: 4.71

In the event of a breakdown in the Force Index below its ascending support level, the GBP/AUD is likely to follow suit with a breakdown attempt of its own. Due to the bullish fundamental outlook for this currency pair, the downside potential remains limited to its long-term support zone, allowing Forex traders an excellent buying opportunity. This zone is located between 1.86957 and 1.88019.

GBP/AUD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.90600

Take Profit @ 1.88000

Stop Loss @ 1.91550

Downside Potential: 260 pips

Upside Risk: 95 pips

Risk/Reward Ratio: 2.74