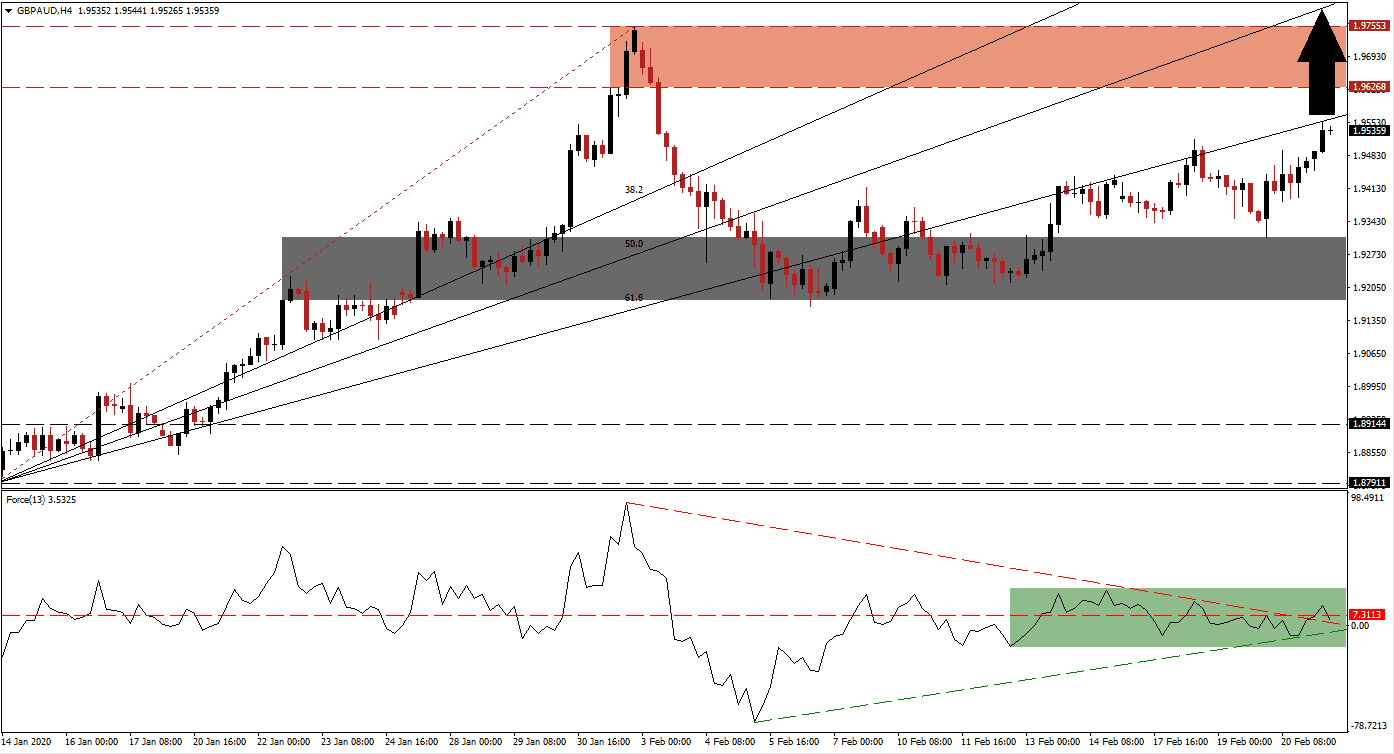

Preliminary Australian PMI data for February disappointed, showing all three sub-components in recessionary territory below the 50.0 level. The economy was already under pressure from the deadly bush fire season before Covid-19 added stress to the supply-chain, commodity, and tourism sectors. UK economic data has constantly surprised to the upside since Prime Minister Johnson won an overwhelming majority in Parliament. The GBP/AUD extended its recovery off of its support zone. A pending breakout above its ascending 61.8 Fibonacci Retracement Fan Resistance Level is likely to extend the rally.

The Force Index, a next-generation technical indicator, shows a sideways trend following the breakout in this currency pair. With the ascending support level exercising upside pressure, a conversion of the horizontal resistance level into support is expected to follow. The Force Index already eclipsed its descending resistance level, as marked by the green rectangle. Bulls are in control of the GBP/AUD with this technical indicator in positive conditions. You can learn more about the Force Index here.

Following the initial breakout in this currency pair above its short-term support zone located between 1.91776 and 1.93090, as marked by the grey rectangle, the 61.8 Fibonacci Retracement Fan Resistance rejected the GBP/AUD. This resulted in a necessary temporary reversal, granting Forex traders a second buying opportunity. It additionally resulted in a higher low, establishing a bullish bias, from where breakout pressures increased. Given the economic headwinds facing Australia, more upside is anticipated.

A conversion of the 61.8 Fibonacci Retracement Fan Resistance into support will provide sufficient upside momentum to push price action into its resistance zone located between 1.96268 and 1.97553, as marked by the red rectangle. The Fibonacci Retracement Fan sequence is then favored to guide the GBP/AUD farther to the upside. This currency pair will challenge its next psychological resistance level at 2.0000 from where the next resistance zone awaits between 2.03519 and 2.05307, dating back to May 2016.

GBP/AUD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.95350

Take Profit @ 2.00000

Stop Loss @ 1.94000

Upside Potential: 465 pips

Downside Risk: 135 pips

Risk/Reward Ratio: 3.44

Should the Force Index contract below its descending resistance level, currently acting as temporary support, the GBP/AUD may reverse its breakout. The downside potential remains limited to its short-term support zone, with the long-term fundamental outlook increasingly bullish. Forex traders are recommended to consider any sell-off as an excellent buying opportunity.

GBP/AUD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.93350

Take Profit @ 1.92150

Stop Loss @ 1.93900

Downside Potential: 120 pips

Upside Risk: 55 pips

Risk/Reward Ratio: 2.18