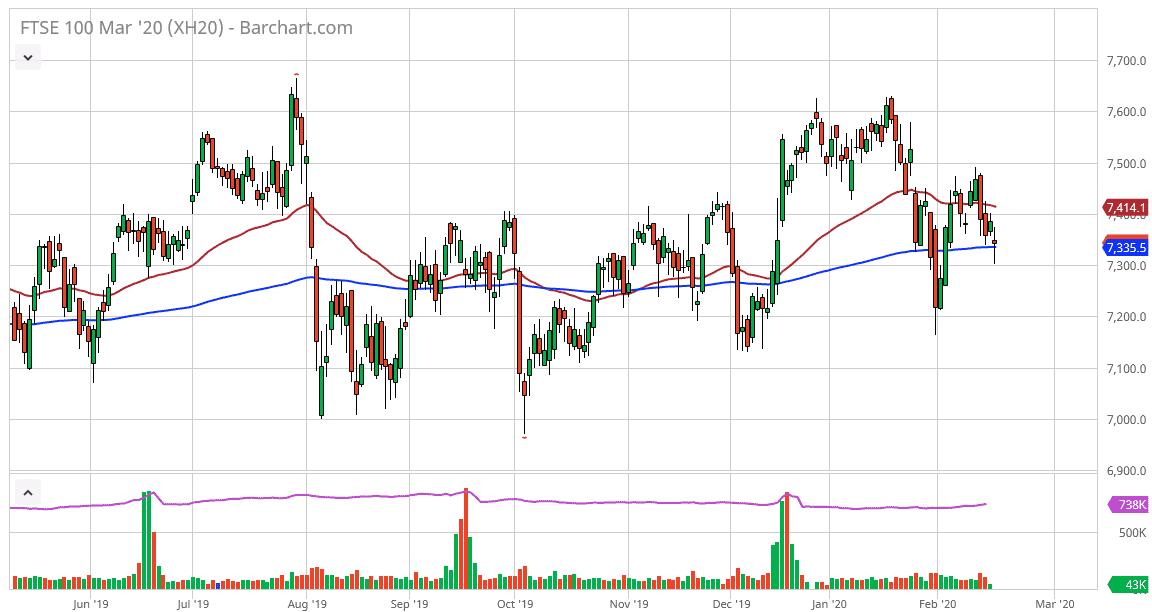

The FTSE 100 has gone back and forth during the trading session on Tuesday, as the market had initially dropped below the 200 day EMA in the futures market to reach down towards the 7300 level. However, the market has bounced significantly from there and closed just above the EMA. The market looks very likely to bounce a bit based upon the strength of the bounce later in the day, and if we can break above the highs during the trading session, then the market is likely to reach towards the 50 day EMA near the 7415 level, and then possibly the 7500 level.

If the market can break above the 7500 level then it’s likely that it goes looking towards the 7600 level again. The British pound strengthened a bit, as the UK government has decided to press forward with its budget, and that might have been part of the reason we saw a recovery over here as well. That being said, the British pound is historically cheap right now, so it’s very likely that we continue to see stocks do okay in London.

I think that short-term pullbacks continue to offer buying opportunities and if you look at the longer-term chart you can see that there is a bit of an uptrend and channel that you can point out, so I do like the idea of buying bounce is anyway. If the market was to break down below the 7200 level, then it would be a very extraordinarily negative sign, perhaps reaching towards the 7000 level given enough time. With that, the British markets would unwind quite drastically. That being said, there are a lot of questions out there when it comes to Great Britain due to the fact that they are leaving the European Union, and therefore people aren’t quite ready to put a lot of money at work.

The negotiations between the EU and the UK look to be very contentious, and that is going to do no favors for the United Kingdom or the European Union for that matter. That being said, I do believe that we see enough support underneath that we are going to see a short-term rally. As far as longer-term trading is concerned, we probably have some work to do before becomes more of a “buy-and-hold” situation. I do prefer the FTSE 100 over most European indices about.