The strength of the US dollar pushed the price of the EUR/USD pair to break a strong support, which is the level of 1.1000, down to 1.0993 near its lowest level in more than two months. The poor performance of the Eurozone economy continues to negatively affect the movements of the single European currency. Eurostat revealed that the Eurozone retail sales fell by 1.6% in December, while markets were expecting sales to drop by only 0.5%. Eurostat also lowered its previous estimates for sales growth for Black Friday in November from 1% to 0.8%.

Wednesday's figures come just days after Eurostat reported a slowdown in the last quarter, as economic growth fell from 0.2% to 0.1% on a quarterly basis, while it came at 1% on a yearly basis. This annual growth is less than half the 2.1% growth rate experienced by the United States for the same period.

US economic releases are still mostly positive and support the strength of the dollar. American companies added a total of 291,000 jobs in January in the non-farm sector, a significant increase from December, but much of that strength is likely to reflect unusually warm weather during the month. The ADP report is released before the Ministry of Labor release the jobs report for January on Friday. Many analysts expect this report to show an increase in job opportunities of 150,000 jobs in January, compared to 145,000 in the government report in December. Analysts believe that the unemployment rate will remain at a 50-year low of 3.5%.

On the commercial level. The U.S. trade deficit fell for the first time in six years in 2019, coinciding with US President Donald Trump imposing tariffs on Chinese products. The US Department of Commerce announced that the gap between what the United States sells and what it buys abroad fell 1.7% last year to $616.8 billion. U.S. exports fell 0.1% to $2.5 trillion. But imports declined more, dropping 0.4% to $3.1 trillion. Crude oil imports fell 19.3% to $126.6 billion.

The deficit in commodity trade with China last year narrowed by 17.6% to $345.6 billion. Trump imposed a tariff on China's imports of $360 billion in a trade war that was aimed at hampering Beijing attempts to challenge US technological domination. Ultimately, the world's two largest economies reached a temporary trade deal last month, and Trump backed away from plans to extend the tariff on another $160 billion of Chinese goods.

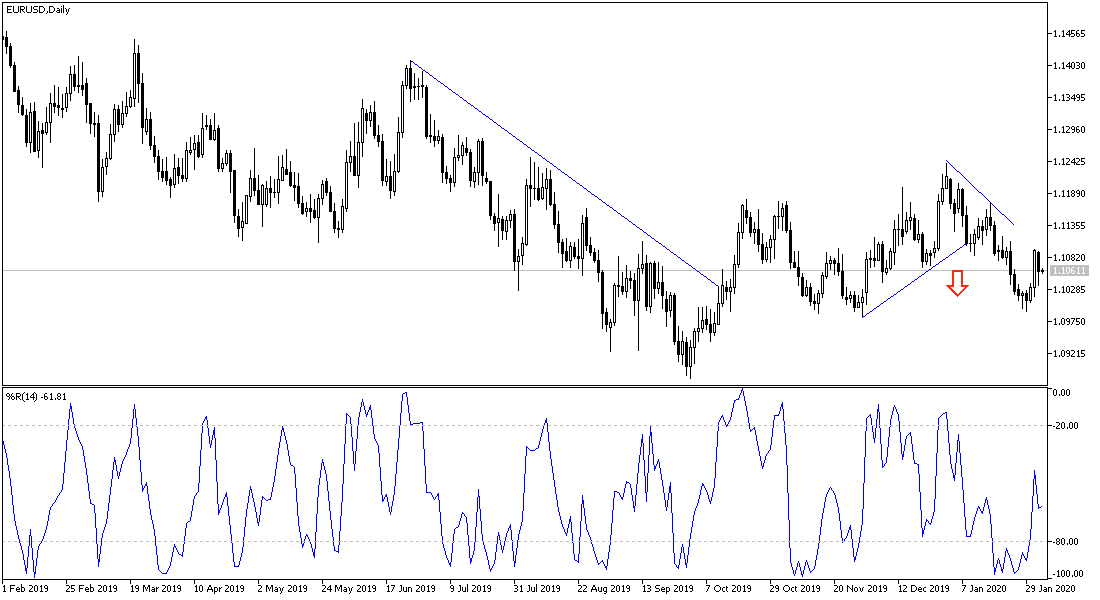

According to the technical analysis of the pair: I still adhere to my technical outlook of the EUR/USD pair, with the continued strength of the downtrend supported recently by the pair retreating below the 1.1000 psychological support, and the bears may target support levels at 1.0955 and 1.0880 in the coming days, especially if the US job numbers came in stronger than expected. The 1.1200 resistance remains a reverse of the current trend.

As for the economic calendar data: German factory orders will be announced, and the testimony of the governor of the European Central Bank, Lagarde, will be monitored. From the United States, Unemployed Claims, Non-Agricultural Productivity and Labor Unit Costs will be announced.