For two trading sessions in a row, the EUR/USD price is trying to correct higher, but its gains did not exceed the 1.0872 resistance, after the price of the pair fell towards the 1.0777 support, its lowest in three years. Weakening of the pair’s chances of an upward correction, was the increased outbreak of the Corona epidemic in the European Union countries led by Italy, which has the largest number of cases of coronavirus in Europe, where 152 cases and three deaths were recorded. Recently, two regions close to Milan and Venice imposed strict quarantine restrictions, a move that, if repeated, could have a real direct impact on the Eurozone economic activity.

According to the BBC, about 50,000 people cannot enter or leave many cities in Veneto and Lombardy for the next two weeks without special permission. Even outside the region, many companies and schools have suspended their activities, and sporting events including many football matches have been canceled.

The outbreak spread beyond the borders of China, which is still one of the consequences of the epidemic, supporting more investor appetite for the dollar as a safe haven. The unprecedented closure in China, which aims to stop the spread of the disease, inevitably means that world trade will slow sharply in the first half of 2020, which is bad news for economies like Germany that rely on both demand for final goods from China, and the provision of intermediate goods for German industrial production. Coronavirus is thus a problem for the Euro, as the Eurozone is closely related to world trade.

The EUR gained some support from the slight rise in the IFO German business climate index. The index recorded a reading of 96.1, better than expectation of a decline to 95.0 from a reading of 96.0 previously. It appears that the economy has not begun to be affected much by the Chinese Coronavirus, but expectations are that the next releases will see a stronger decline. Last week, the German ZEW index showed a sharp slowdown in expectations with the economic sentiment reading at a reading of 8.7, well below the 21.5 expected by the markets, and a reading of the current conditions component at -15.7, which is much lower than the -10.3 that markets expected.

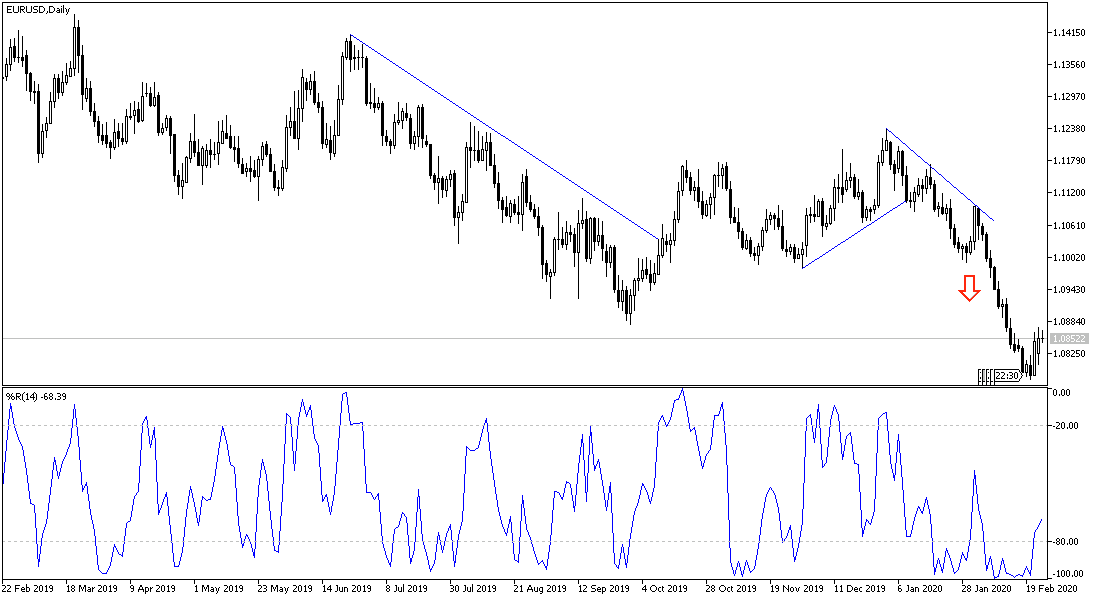

According to the technical analysis of the pair: The EUR/USD upward is still in need of more momentum, and there will be no real reversal of the trend without breaking the 1.1000 psychological resistance. On the downside, any return to move below the 1.0800 support is a confirmation of the bear's continued control over performance, as is the case in the long term. Given the increase in the human and economic losses of the Eurozone from the Corona pandemic, it will pressure any gains for the Euro.

As for the economic calendar data today: The German GDP growth rate will be announced. From the United States, the Consumer Confidence and the Richmond Industrial Index will be announced.