The single European currency, the Euro, remains under severe pressure and is losing investor confidence due to the continued disappointing figures for the Eurozone economy led by Germany. This pessimism pushed the EUR/USD pair to collapse to the 1.0782 support, the lowest level in three years, before settling around the 1.0805 level in the beginning of Thursday's trading. The Euro is waiting for a survival ring from the European Central Bank, and the a solution to Corona epidemic, which has put more pressure on the bloc economy, due to the strong link between China and the European economy. Despite the recent Euro losses, analysts at Citibank - the largest foreign currency trader in the world - still see the possibility of further drop in the Euro, as the European currency is still undervalued, and said that they expected the Euro to continue to weaken.

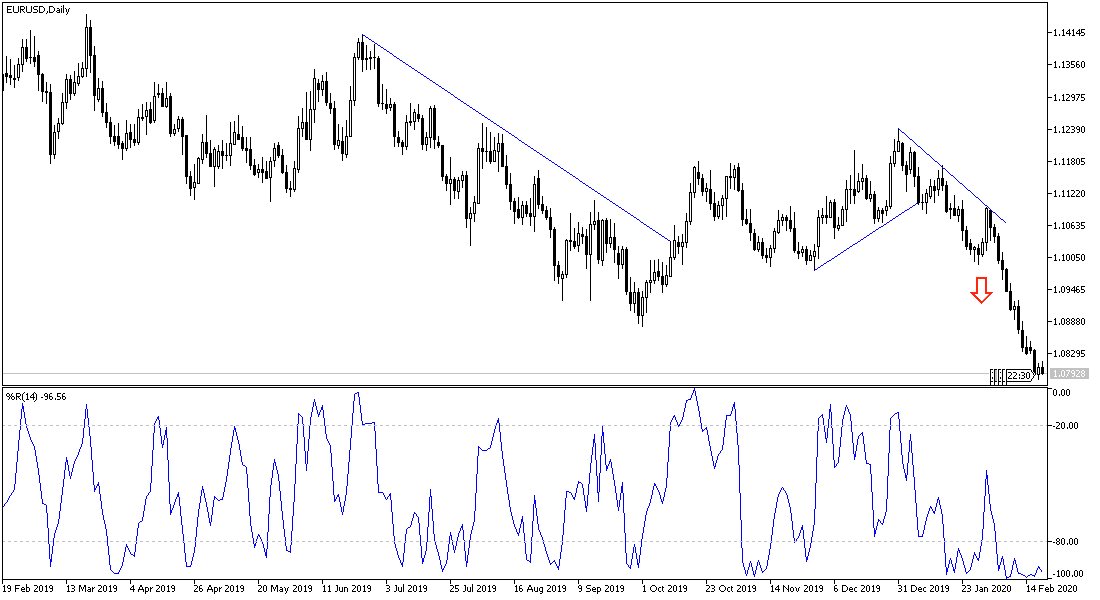

The year 2020 saw a downward journey for Euro against the USD, after the limited gains recorded in the second half of 2019.

The global trade war shook confidence in the Euro a lot. The trade war between the United States and China, which dominated market sentiment in 2019, was also associated with a sharp slowdown in Eurozone industrial activity, which could be an important factor in the Euro's decline. Consequently, the Euro’s ability to recover lies ultimately with the return of growth in the Eurozone economy, and with the conclusion of the Phase 1 trade agreement between the United States and China at the end of 2019, market expectations for a revival of economic activity in the Eurozone increased rapidly. But recent data indicates that this shift is not actually occurring, in part due to an outbreak of the Coruna virus in China.

On the American side, the minutes of the Fed's last meeting showed that most bank officials are optimistic about the US economy and global economies last month, although they have noticed the risk posed by the outbreak in China and say they are ready to keep the interest rate at its current low level in the coming months.

US central bank policy makers noted at their January 28-29th meeting that the risks to the US economy have vanished since their previous meeting in December, and according to the minutes of the meeting, the Trump administration reached a preliminary trade agreement with China, and Congress approved a new trade agreement with Canada and Mexico.

However, "there are still a number of notable negative risks," including the Corona virus, which has "emerged as a new threat to global economic growth prospects."

According to the technical analysis of the pair: the path of the EUR/USD pair on the daily chart is still bearish and stability around and below the 1.0800 psychological support is a culmination of the bears controlling the performance. The trend may remain as is for a longer period in light of the extreme contrast between the US economy and the Eurozone economy as well as the monetary policies. There will be no opportunity for a correction without breaking the 1.1000 psychological resistance, and this will not happen without the return of global confidence in controlling the Corona pandemic and rapid support by the European Central Bank for the Eurozone economy.

For today's economic calendar data: GFK German Consumer Climate and German Producer Price Index will be announced, then the European Central Bank bulletin on monetary policy. From the United States, there are the jobless claims and the Philadelphia Industrial Index data.