A series of disappointing European economic data results, led by Germany, thwart the hopes of Forex traders in improving the performance of the single European currency - the Euro - after falling to its lowest level in three years. The EUR/USD pair extended its losses to the 1.0785 support, violating a new psychological support level. The latest survey by the Leipzins Center for European Economic Research (ZEW) reported that the largest economy in Europe is suffering from the ongoing Corona virus crisis in China, where the virus led to a slowdown in the current situation in addition to future components for the next six months.

That is considered a new blow to the price of the Euro against the USD, which is under constant pressure from a pessimistic group of headwinds that pushed it to the recent losses. Commenting on the index results, the head of the Zew Center stated, “The alarming negative effects of the Corona virus epidemic in China on the global trade have caused a significant drop in the ZEW index of economic sentiment in Germany. Expectations for developing export-intensive sectors in the economy, in particular, have decreased”.

The Zew forecast fell by 18 points to 8.7 in January, while the scale of current conditions fell 6.2 points to -15.7 last month, as financial market analysts responded to the survey by expressing fear about what the anti-Coronavirus measures would do to the world's second largest economy.

The ZEW survey comes just days after German statistics office Destatis showed that the German economy had stopped growing in the last quarter, before markets were exposed to the threat of the Coruna virus.

The ZEW Center Survey asks a total of 300 financial analysts for their opinions on questions related to the market and the economy. Both components of the survey have risen in recent months, indicating that there are less responsive expectations in response to the Brexit agreement in October and the "first phase" trade agreement that was formally signed between the United States and China.

The latest data relates to the first month of 2020 and the opening of a new quarter threatening to be an economic write-off for Europe's largest economy and many other countries around the world. Where the German economy actually faltered with zero growth in the last quarter of 2019 while the French and Italian economies contracted.

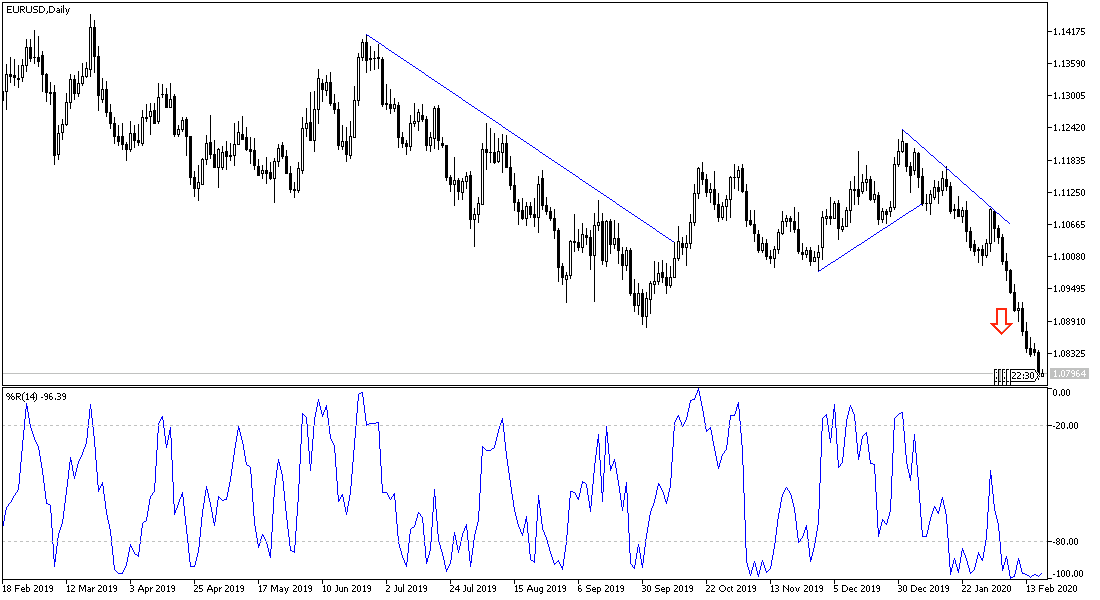

According to the technical analysis of the pair: The gap between the performance of the Eurozone economy and the performance of the American economy has increased, and consequently the losses of the EUR/USD pair have increased to its deepest for three years. All technical indicators collectively indicate that the pair has reached strong oversold areas. However, Europe's poor economic performance overlooks these signals. The pair may remain under downward pressure for a longer period that may extend to the next meeting of the European Central Bank, which may be the last opportunity for the Euro to wait for the life-saving collar from the bank with more stimulus to the bloc economy. The break of the new psychological support at 1.0800 opened the way for expectations towards stronger support levels, the closest of which are 1.0770 and 1.0690, respectively. Amid investor pessimism towards the Euro, the rebound to the upside may be limited and may not exceed 1.0865 and 1.0920 levels at the moment.

As for the economic calendar data today: The Euro zone's current account will be announced. Then to the most important; US producer price index and building permits, ending with the announcement of the Federal Reserve’s minutes for the last meeting.