The single European currency - Euro - is still unable to stop the pace of losses against most other major currencies, with the continued weakness of the Eurozone economy led by the largest economy in the bloc, Germany. The EUR/USD is in a downtrend since the beginning of the month. The pair was pushed towards the 1.0827 support, the lowest in two and a half years. Official data confirmed that the German economy recorded the weakest growth pace since the aftermath of the sovereign debt crisis last year, and this led to a complete halt to growth in the fourth quarter, the Coronavirus crisis in China threatens further slowdown in the coming months.

German statistics office, Destatis, revealed on Friday that the largest economy in Europe saw only 0.6% growth for 2019, although the annual quarterly growth rate was weaker than that at only 0.3% for the last quarter. This makes 2019 the slowest German economic growth since 2013, the year after the debt crisis that almost caused the Eurozone to collapse.

This was after the German economy halted in the last quarter, as growth fell to 0% from 0.2% previously, leaving GDP unchanged at the end of the year. Surprisingly, the export sector was a major driver of weakness, although the domestic side of the economy has also weakened.

The statistics office also reported a decrease in German exports of goods and services in the last quarter, while imports increased. This may be the reason for the low GDP in “net trade” during this period, although the markets will not know until the second and more detailed estimate is released in the next month. Meanwhile, growth in domestic and government consumption slowed. Commercial investments in machinery and equipment declined, while companies continued to pour money into construction projects and other "fixed assets".

The surprise in Germany increased the risk of Eurostat lowering its first quarterly estimate of Eurozone growth from 0.1% to 0%. The growth of the Italian and French economies decreased in the last quarter, while Spain witnessed strong growth.

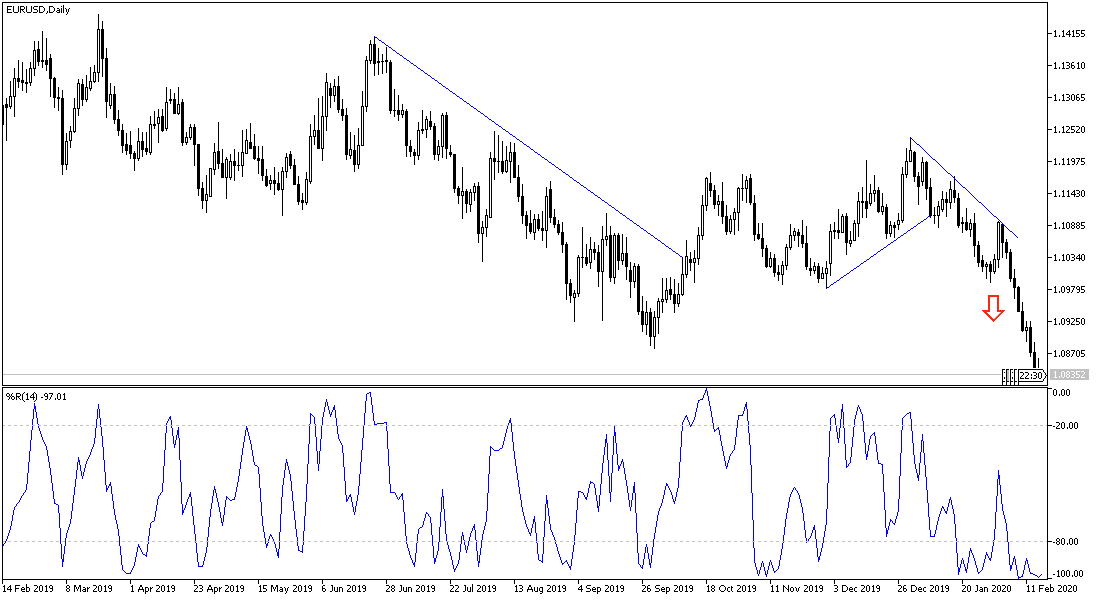

According to the technical analysis of the pair: As expected, the variation of economic performance and monetary policy between the Eurozone and the United States of America will continue to cause constant pressure on the EUR/USD, and with the pair reaching the lowest level in two and a half years, technical indicators reached oversold areas, but the Euro is to correct, as it seems that it will wait for sudden decisions, as markets hope, on the part of the European Central Bank, some expectations indicated the possibility of cutting interest and offering more stimulus plans. The closest support levels for the pair are now 1.0820, 1.0760 and 1.0690, respectively. On the other hand, the 1.1200 psychological resistance remains the key of the upward correction. This will not happen until fears of Corona subside and quick plans are put forward by the European Central Bank to revive the bloc's economy.

We expect quiet moves by the pair in a narrow ranges during today's trading in light of the American holiday and the absence of economic releases from the Eurozone.