The strength of the US dollar continued after the completion of the testimony of Federal Reserve Governor Jerome Powell for two days in a row, which stimulated the downtrend of the EUR/USD pair, as the price of the pair collapsed to the 1.0865 support, its lowest level since May 2017. Republicans and Democrats Senates expressed strong support for an Independent Federal Reserve during a hearing with Federal Reserve Chairman Jerome Powell, one day after US President Donald Trump launched another attack on Powell via Twitter. Trump described Fed officials as "bone heads" and argued that the central bank should lower interest rates by greater value. The interest rate is now settling in a historically low range from 1.5% to 1.75%.

Trump has repeatedly criticized the head of the Federal Reserve since announcing his candidacy for Powell in 2017, an outright and repeated criticism that has not happened publicly from former presidents. Powell told both committees that the US economy was generally in good shape, as it managed to overcome headwinds last year due to the trade war between the United States and China and slowing global economic growth. Powell said that the US unemployment rate is approaching its lowest levels in half a century, and companies are increasingly ready to recruit and train insufficiently skilled workers.

On Wednesday, Powell said, "There is no reason not to continue." “Nothing affects this economy as it is not out of control or out of balance.” Powell added that the outbreak in China remains a threat to the US economy, which is closely monitored by the Federal Reserve. Powell said, "We expect some impacts" to occur on the US economy, but added that it was too early to speculate about the impact.

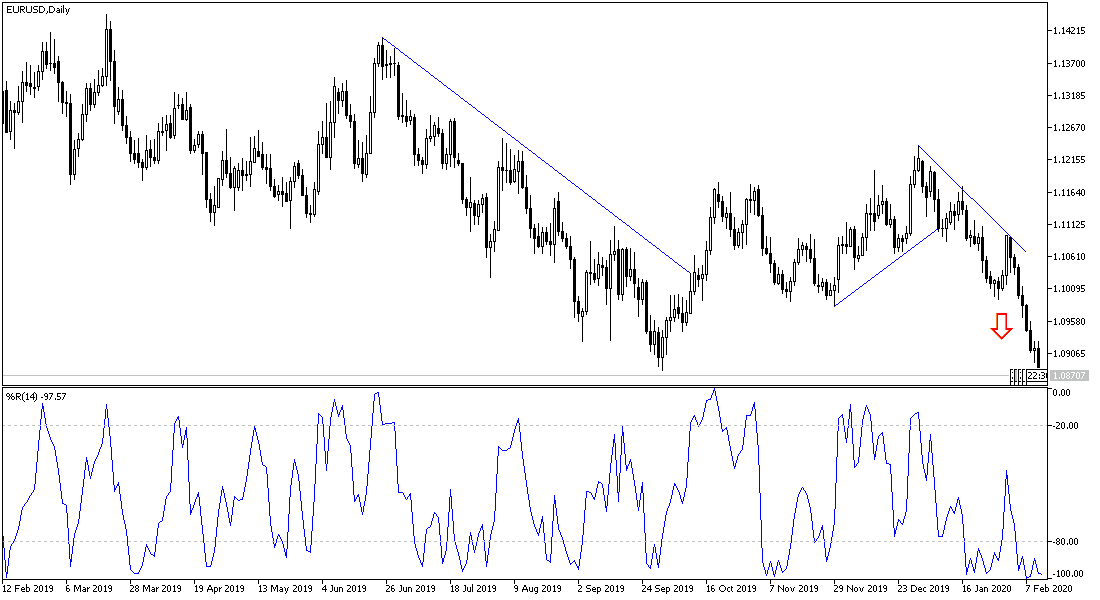

According to the technical analysis of the pair: The EUR/USD downtrend is getting stronger, and the recent collapse has pushed all technical indicators towards oversold areas, and the time is now appropriate to buy and collect bounce gain. The best buying levels currently are 1.0870 and 1.0800. The last performance pushed pair to all the support levels that we expected in the recent technical analyzes. Bulls will not have control over performance without overcoming the 1.1050 resistance. The next US economic issues will have a strong impact on the performance of the pair because it may confirm Powell's confidence in the US economy, or to the contrary, which may stop the progress of the dollar.

As for the economic calendar data today: The German consumer price index data will be released. From the United States, consumer inflation figures from the consumer price index and claims for the unemployed will be announced.