At the beginning of this week’s transactions, a limited and calm movement is expected for the the EUR/USD pair, as the economic calendar today lacks any important data affecting the performance of the pair that is settling lower below the 1.1000 psychological support, the lowest in four months. The US job numbers came in overall supportive of the US dollar in holding onto gains.

The US Department of Labor announced that employment in the United States jumped by 225,000 jobs in January after a revised increase of 147,000 jobs in December. Economists had expected employment to rise by 160,000, compared to the addition of 145,000 jobs that were originally announced in the previous month. The growth of jobs was reflected more strongly than expected, and the most prominent were in the sectors of construction, health care, transportation and storage. Despite stronger than expected job growth, the unemployment rate rose to 3.6 percent in January from 3.5 percent in December. Economists had expected the unemployment rate to remain unchanged.

Commenting on the results, Paul Ashworth, the chief US economist at Capital Economics said: “Reviews of population controls have cut the workforce by 524,000 and jobs by 507,000, but we knew it was coming when the Bureau of Statistics recently released much lower population estimates for 2019.” He added: “If we set aside those one-time effects, which are not applied to historical data, the workforce increased by 574,000, bypassing an increase of 418,000 in the household labor survey scale.”

Despite the varied results of the important report, the US labor market remains strong by any measure, and is the most important element on which the Federal Reserve relies on adhering to its monetary policy.

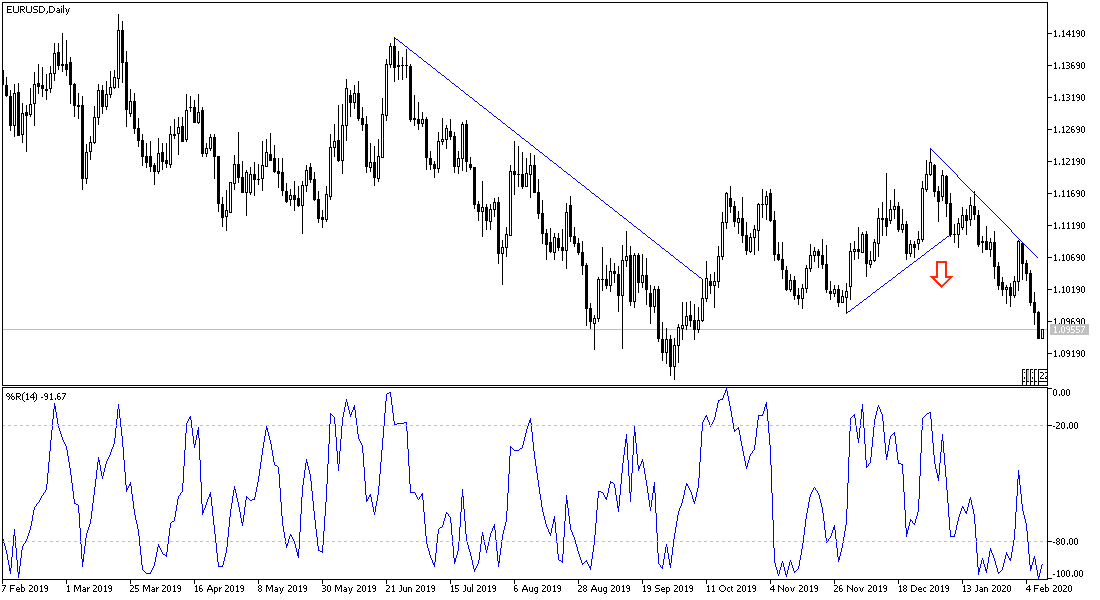

According to the technical analysis of the pair: On the daily chart, the EUR/USD pair remains under downward pressure supported by stability below the 1.1000 psychological support, and still has the opportunity to test stronger support levels, with the closest ones are currently at 1.0920, 1.0880 and 1.0800 respectively, unless the European Central Bank makes a surprise to stimulate the Eurozone economy which is still weak. Without the stability above the 1.1200 resistance again, there will be no control for the bulls over performance. Today's economic calendar contains no important data affecting the pair, whether from the Eurozone or the United States of America.