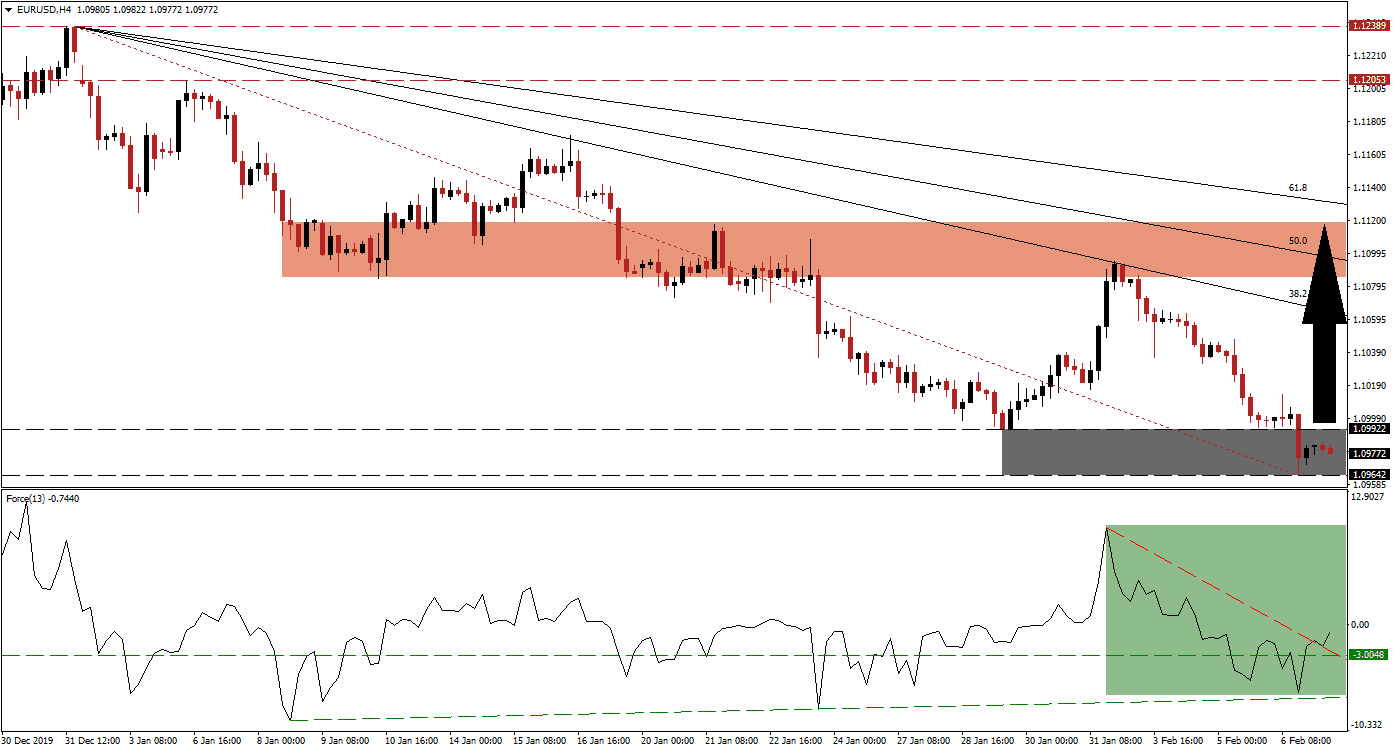

While Eurozone PMI data surprised with upward revisions, disappointing German factory orders and trade data prevented a rally in the Euro. Industrial production added to bearish pressures and offered a reminder that the global economy is weaker than currently priced by financial markets. Despite bearish pressures, the EUR/USD is poised for a counter-trend advance, on the back of a build-up in bullish pressures. A repricing of assets is additionally favored to elevate his currency pair above its support zone.

The Force Index, a next-generation technical indicator, indicates the existence of a positive divergence. After the third higher low, the Force Index converted its horizontal resistance level into support. Bullish momentum sufficed to push it above its descending resistance level, as marked by the green rectangle, turning it into temporary support. This technical indicator is now on track to move into positive conditions, allowing bulls to take control of the EUR/USD. You can learn more about the Force Index here.

Breakout pressures in this currency pair increased after price action moved above its Fibonacci Retracement Fan trendline. This materialized inside of its support zone located between 1.09642 and 1.09922, as marked by the grey rectangle. Given the extreme oversold conditions in the EUR/USD, a short-covering rally is pending. It is anticipated to close the gape to its descending 38.2 Fibonacci Retracement Fan Resistance Level. Volatility is expected to increase after today’s US NFP report with expectations high for a strong reading.

A breakout in the EUR/USD above its intra-day high of 1.10137, the peak of a reversed advance, is likely to invite the next wave of new net-buy positions into this currency pair. While the current correction resulted in a lower low, the pending reversal is positioned to carve out a higher high inside of its resistance zone. This zone is located between 1.10850 and 1.11187, as marked by the red rectangle. A breakout is possible, but a new catalyst will be required.

EUR/USD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.09750

Take Profit @ 1.11150

Stop Loss @ 1.09400

Upside Potential: 140 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 4.00

In case of a push below its ascending support level by the Force Index, the EUR/USD is anticipated to attempt a breakdown. The next support zone awaits this currency pair between 1.08789 and 1.09039. As the Eurozone faces continuous economic issues and rising political divisions, the outlook remains depressed. The US is poised to underperform as well, exposing price action to violent swings moving forward.

EUR/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.09250

Take Profit @ 1.08800

Stop Loss @ 1.09450

Downside Potential: 45 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.25