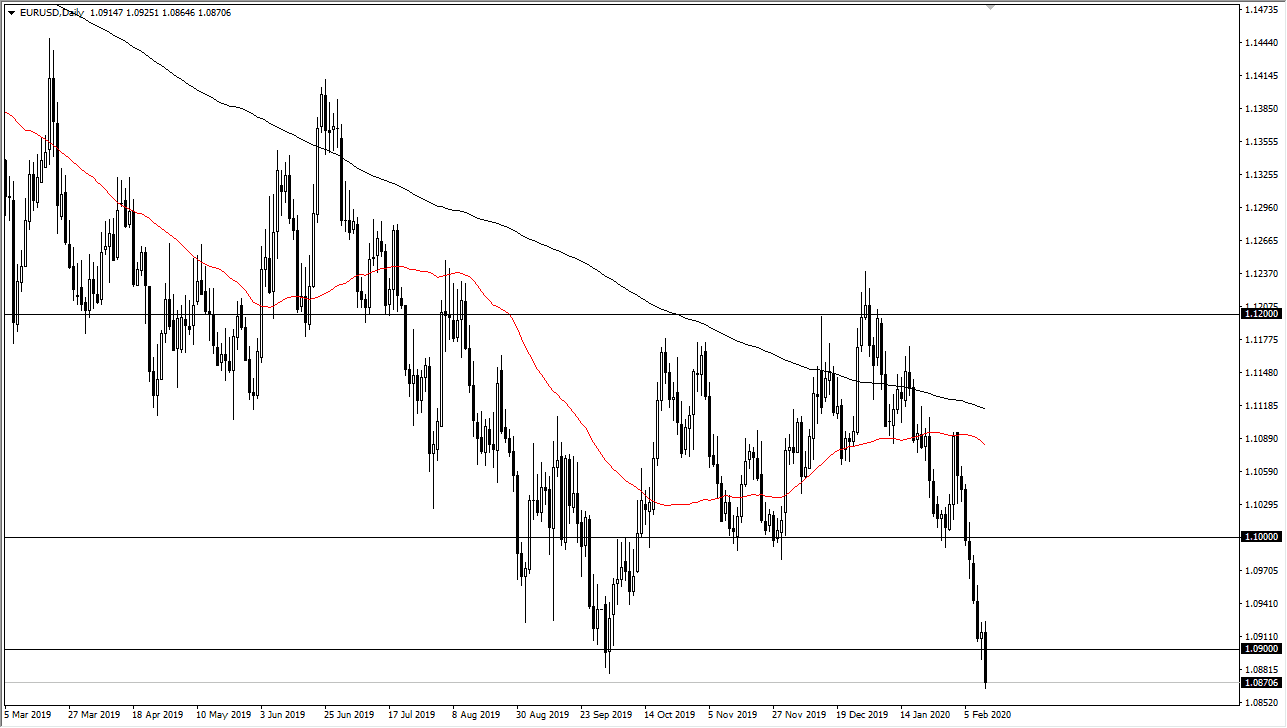

The Euro has broken down a bit to slice through the 1.09 level. This is an area that had been massive support before, so it’s very unlikely to see buyers willing to jump in and pick this market up. We may get a bit of a short covering position, but at this point I suspect that the 1.09 level will offer sellers again. On this move, it’s likely that we could go to the 1.08 level underneath, which is a large, round, psychologically significant figure, but at this point it’s almost impossible to imagine a scenario where the Euro suddenly turns around.

The ECB is jumping into by European bonds again, with a special interest in Greece. As money flows into the bond markets again, this drives yields into negative territory, and that should in fact continue to have this market looking very negative while the US economy is by far stronger than the European Union. Remember, bonds favor the United States as the 10 year is offering somewhere near the 1.75% level, much higher than anything in Europe. That will drive a lot of money into the pair to the downside, as the bond market has a massive influence on currency markets.

Ultimately, I think that rallies are to be sold into, just as a break down below the hammer from the previous session was. There is absolutely no reason where I would be looking to buy this market, so having said that it is likely that there will be more than enough reasons to short this market at the first signs of a bounce. Quite frankly, the Euro cannot get out of its own way and it’s likely that will continue to be the way going forward. Obviously, when you see a massive breakdown like this it’s only a matter of time before you get some type of bounce, but being a little bit patient and looking for signs of exhaustion should continue to lead the way as the US dollar is by far the leader when it comes to the currency markets. With that, I remain very bullish for the greenback, and therefore extraordinarily bearish for this pair.