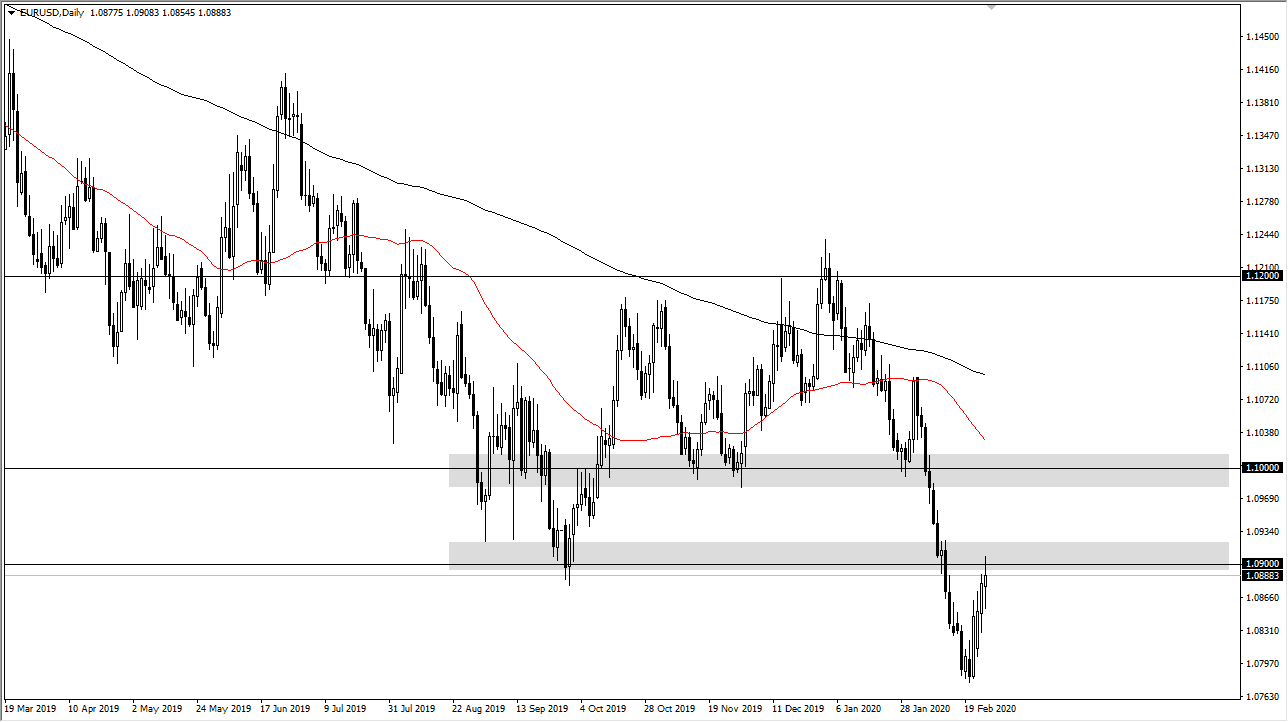

The Euro has been all over the place during the Wednesday session, piercing the 1.09 level one point but then pulling back to form a somewhat neutral candle. The neutral candlestick of course suggesting that the market is starting to run into some trouble here, but at this point if the markets were to break above the top of the candle, I wouldn’t be a buyer there because I believe that the 1.10 level will offer even more resistance. This is a market that continues to be very noisy, and most certainly very negative as the European Union is heading into a recession, all things being equal.

There has been a bit of recovery as of late but considering how sharply the market had broken down it’s not a huge surprise. I believe this point we continue to see a lot of negativity in general, the question now is whether or not the seller shall appear, or if they wait until higher levels? The US dollar continues to be the desired currency and now that Italy is starting to show significant issues when it comes to the coronavirus infection, it makes sense that we will continue to see the US dollar favored.

Furthermore, Nomura raised its rating on the possibility of a recession in Italy during the day, and that doesn’t do the currency any favors. Ultimately, this is probably something the market already knew, but it certainly doesn’t help sentiment overall. The market is likely to continue to test the bottom, but the bounce was overdue. I think at this point it’s not until we get a weekly close above the 1.10 level that you can take the uptrend even remotely serious. The US dollar remains can, and there’s even a shortage of the same US dollars around the world when it comes to various funding markets. At this point, the Euro is bouncing mainly as a relief rally more than anything else. If we do break down below the lows on a move underneath, we should see a drop towards the 1.05 level. Fading rallies continues to work, and a breakdown below the bottom of the very neutral candlestick for the trading session on Wednesday certainly makes a decent sell signal as well. I have no interest in buying the market at this point, but again would change my mind if we got a weekly close above the next resistance barrier.