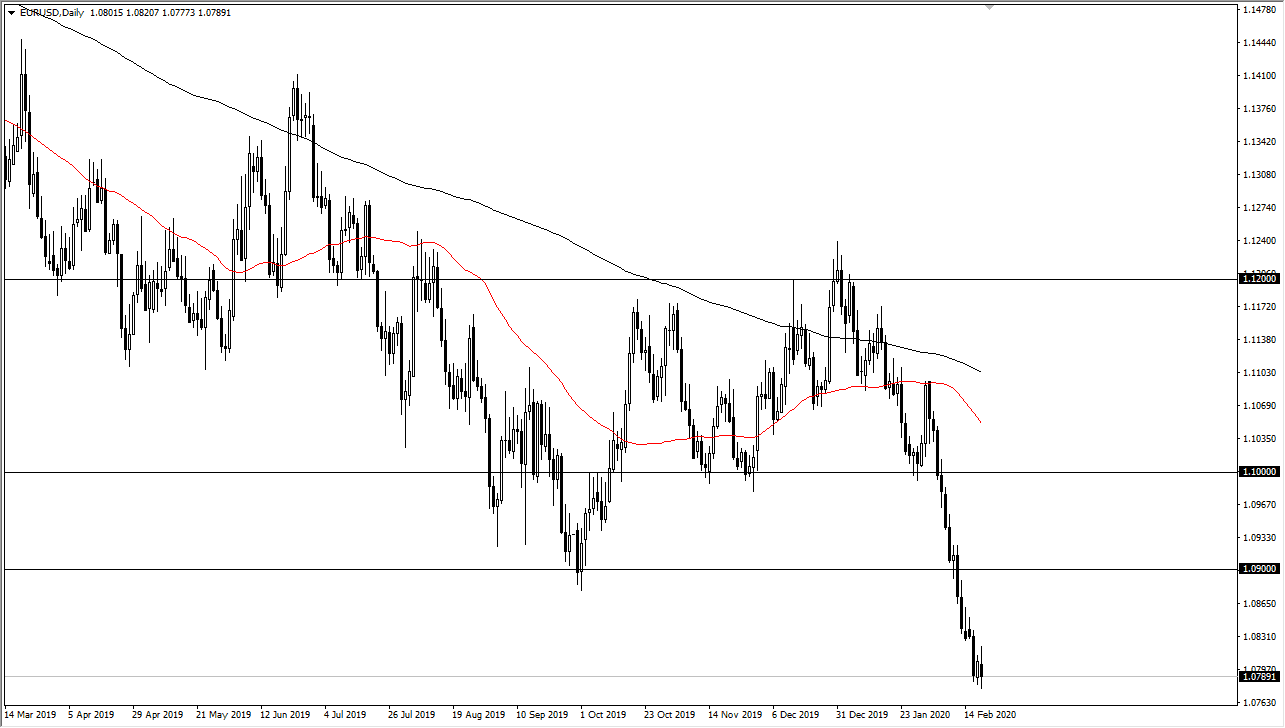

The Euro has gone back and forth during the trading session on Thursday, bouncing around the 1.08 level. At this point, it looks as if the market is going to try to test the bottom of the gap on the weekly charts at the 1.0750 level in order to break this currency pair down. I don’t necessarily think that’s going to be that easy to do, and I think at this point it’s probably easier to simply fade rallies in the Euro as they occur. I would be very interested in shorting at the 1.09 level, assuming that we can even get there.

Essentially, which will be looking for is some type of candlestick like a shooting star on the chart in order to show that the buyers have run out of steam again, because she simply jumping in and shorting at this level, although it could work, could be also described as “chasing the trade.” I can think of no better way to lose money in the markets than to do exactly that. Remember, even in the worst of trends markets eventually get some type of pullback. We are definitely overdue for that in this market.

If we were to break down below the 1.0750 level, then it’s likely that the Euro will go looking towards 1.05 handle after that. Alternately, the 1.09 level should offer resistance but then again so should the 1.10 level. I think you are going to have to be patient, but you are going to have to pay attention to these levels and simply let the market do what it wants to do. This pair typically doesn’t move very much, so you of course will have to be very patient with it, even more so than usual.

All things being equal, I don’t have a scenario in which I want to buy this market unless of course the Federal Reserve suddenly changes its attitude. While there are a lot of traders out there assuming that the Federal Reserve is going to have to cut interest rates, it doesn’t necessarily mean that they are going to, as they have been somewhat reluctant to overtly say anything. On the other side of the Atlantic Ocean you have the European Central Bank looking to loosen monetary policy going forward, as the European economy itself seems to be lying flat on its back and has no real hope of getting out.