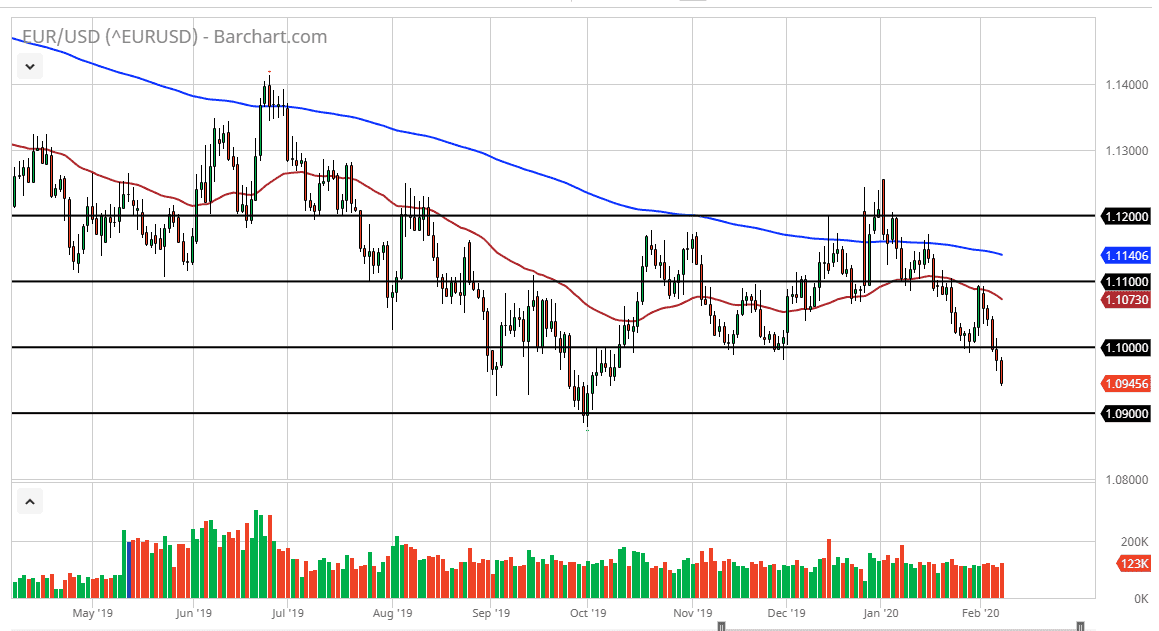

The Euro has had a rough couple of days as we had broken below the 1.0950 level. The jobs number came out the United States reasonably strong, and that suggests that the markets are willing to continue to sell the Euro going forward. The market is closing at the very bottom of the range on Friday, which is always a sign that traders are more than likely going to continue to press the issue. The US dollar is the strongest currency right now I’ll of the major ones that I follow, but more importantly the US economy is as well. Contrast that with the European Union which continues to see lackluster economic figures, and it makes sense that there are plenty of traders out there willing to short this pair.

If the market can break down below the 1.09 level, then it is very likely that we will continue to see sellers push this pair towards the 1.08 level, and then eventually the 1.0750 level. That area features a gap on longer-term weekly chart, which has yet to be filled so it would make sense that if it was to be filled. That being said, it doesn’t necessarily mean that this pair is going to simply melt down. It does tend to be very choppy from time to time and therefore looking for short-term selling opportunities will probably continue to be what we are looking at here. I don’t expect some type of massive selloff, rather I expect this market to continue to grind more than anything else.

If the market recovers and goes above the 1.10 level, then it’s likely that the market goes looking towards the 50 day EMA above which is currently trading at the 1.1073 level. All things being equal, I don’t have any interest in buying this pair, because it is only a matter of time before the market continues to show a proclivity for the US dollar, not only against the Euro, but also against several other currencies as well. Furthermore, the 1.09 level has recently been a major bottom, so it makes sense that we continue to go towards that region. A breakdown below that of course opens up much lower pricing, but right now I am not calling for that to happen although it would not be a surprise considering the way things are going in the major “risk off” sentiment the world seems to have right now.