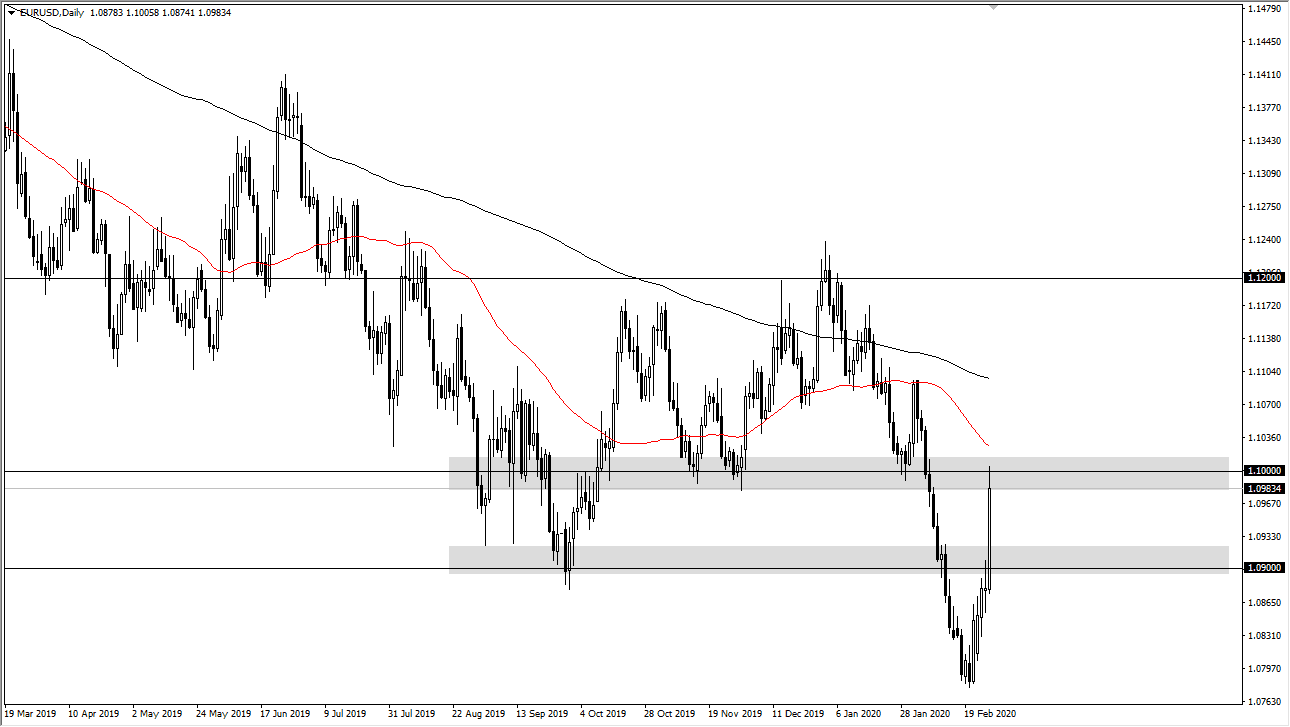

The Euro has rallied rather significantly during the trading session on Thursday but reached into the massive 1.10 level which of course is a large, round, psychologically significant figure. Furthermore, the 50 day EMA looks to be racing towards that area, so at this point I think there are plenty of reasons to believe that we will roll over. The last thing that people will want to do is hang on to risk, and as stock markets have gotten pummeled around the world it’s probably only a matter of time before the outflows stop.

Once that outflow of currency from the United States stocks, it’s very likely that the Euro will suffer as a result. This has been a very strong rally, but in the end, it is just a blip on the radar of the longer term downtrend. The German economy is heading into a recession, and that will continue to weigh upon the Euro itself. Furthermore, cases are breaking out all of the European Union of the coronavirus, and that isn’t helping the situation either. The candlestick for the trading session on Thursday is rather strong, and we are closing towards the top of it so it is a bit difficult to simply short here, but it is likely that we will see plenty of negativity just above.

With that, I’m not going to be overly surprised if the market breaks back down as we had gotten a bit overdone during the last few days. Just as the Euro had been oversold, it now looks to be overbought. I believe that the 50 day EMA will cause a significant amount of resistance, but it’s going to be difficult to simply jump in, but that is typically how trading works. If that’s the case, the first signs of weakness will probably be sold into as there is far too much in the way of negativity in the European Union to think that this can continue for any significant amount of time. Overall, this is a market that is in a downtrend and that is the most important thing to pay attention to. To the downside, it’s very likely that the market will go looking towards the 1.08 level even enough time, but that might be something that takes weeks to get to. Either way, these super spikes can only last so long as they go against the trend.