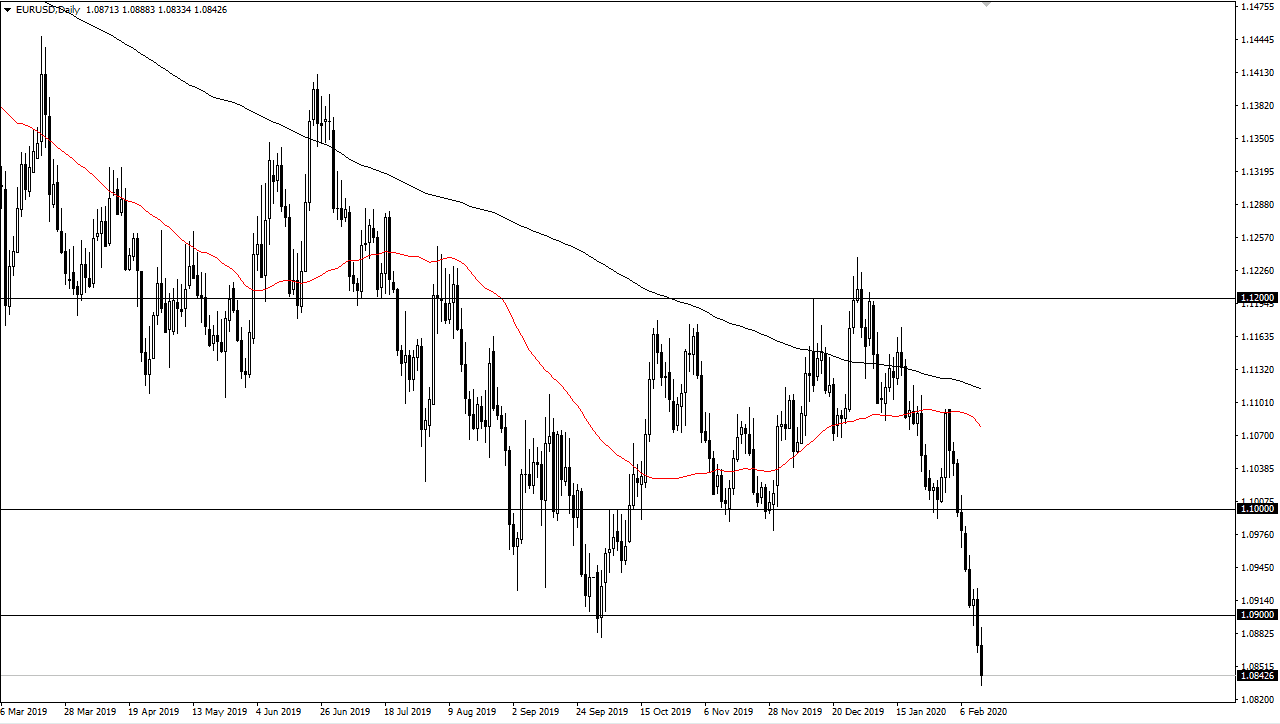

The Euro initially tried to rally during the Thursday session, but then rolled over just below the 1.09 level. Ultimately, this is a market that I think will continue to see a lot of choppiness and negativity, and the Euro should have oversold quite some time ago. I am a bit surprised it has taken so long for this thing to break down, but with the European Union economic figures looking so poor and the US numbers coming out better than expected more often than not, this makes quite a bit of sense. Furthermore, looking at the bond markets, the United States 10 year note offers roughly 1.57%, while German bonds offering negative yields. At this point, it’s a no-brainer to put money in the United States.

After that, a lot of money is flowing into the S&P 500 and other US indices as the US companies seem to be looked at as a bit of a safety play when it comes to the equity markets, especially in relation to places like Europe. The 1.09 level being broken earlier this week was a very negative candlestick, and when I look at the longer-term charts, I believe that we will go looking towards the gap underneath at the 1.00750 level, and at this point that gap looks to be filled rather soon. That being said though, I think that it’s only a matter of time before we get some type of rally that we can sell into, especially near the 1.09 level, and again at the 1.10 level after that.

It is a bit oversold, so I think that rally should be coming sooner rather than later unless of course we get some type of move directly to that gap. The 50 day EMA is rolling over and starting to try to catch up, but it’s can it take quite some time to get there. The candlestick for the session on Thursday truly shows negativity, but at this point I think that short covering will come into play late in the day on Friday, if nothing else just so that people can take profit. Longer-term though, selling those rallies will be the best way going forward as the US dollar should continue to be king going forward. In fact, it’s not until the market breaks above the 1.10 level that I would consider buying it but would still have to reevaluate.