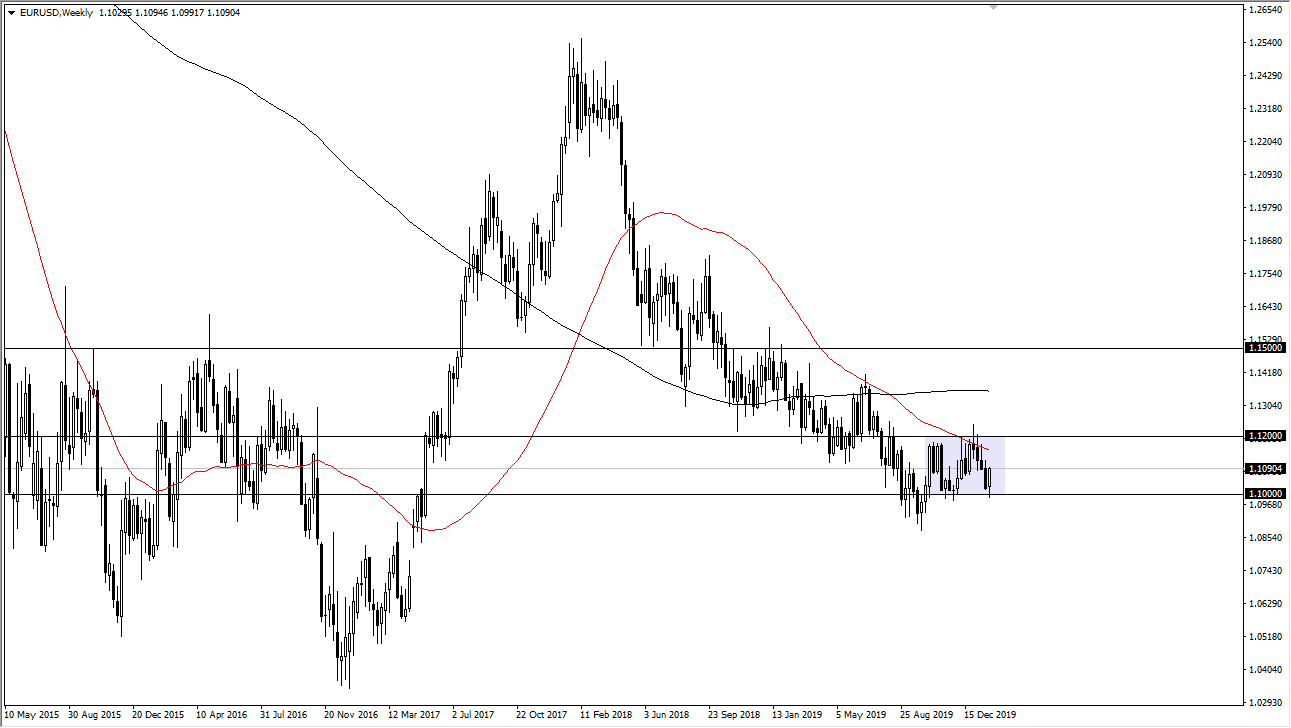

The Euro fell during the month for the most part, reaching down towards the 1.10 level, an area that has been pretty significant support over the last several months. Furthermore, we have fallen for the 1.12 level above which is the massive resistance barrier, and as a result I think that the market continues to bounce back and forth in this area. At this point, it’s very likely that the market continues to go back and forth. The back and forth action in this pair makes quite a bit of sense though, if you take a look at the central bank situation.

In the last couple of weeks, we have seen the Federal Reserve state that it was willing to step in and do what was necessary, talking about potential action down the road. The European Central Bank still looks very soft and therefore likely to continue its asset purchases. In other words, this is a battle between two central banks that are trying to be as open to loosening monetary policy as possible.

At this point, the market does look like it’s ready to go back and forth, so I believe that the month of February will simply be more of the same. However, there are a couple of levels that we could pay attention to in order to get a bit of a hit as to what the next move is, assuming it even comes this month. After all, take a look at the last year or so, it’s not uncommon for the market to go back and forth and go nowhere for three months at a time.

The 1.0950 level underneath being broken could open up the door down to the 1.08 level, and then possibly even the 1.0750 level after that. Otherwise, the market was to break above the 1.1250 level, then it’s likely that we will go looking towards the 200 week EMA which is closer to the 1.14 level. It’s a bit difficult to get overly excited about this market, but it should be apparent that we are at least starting to stabilize in this area. That’s why I think this will be a very quiet month as the world worries about things like the coronavirus and recognize that central banks around the world are likely to be very loose, with these to be especially loud about it. I expect that if you are a short-term trader looking for range bound system opportunities, this is where you need to be.