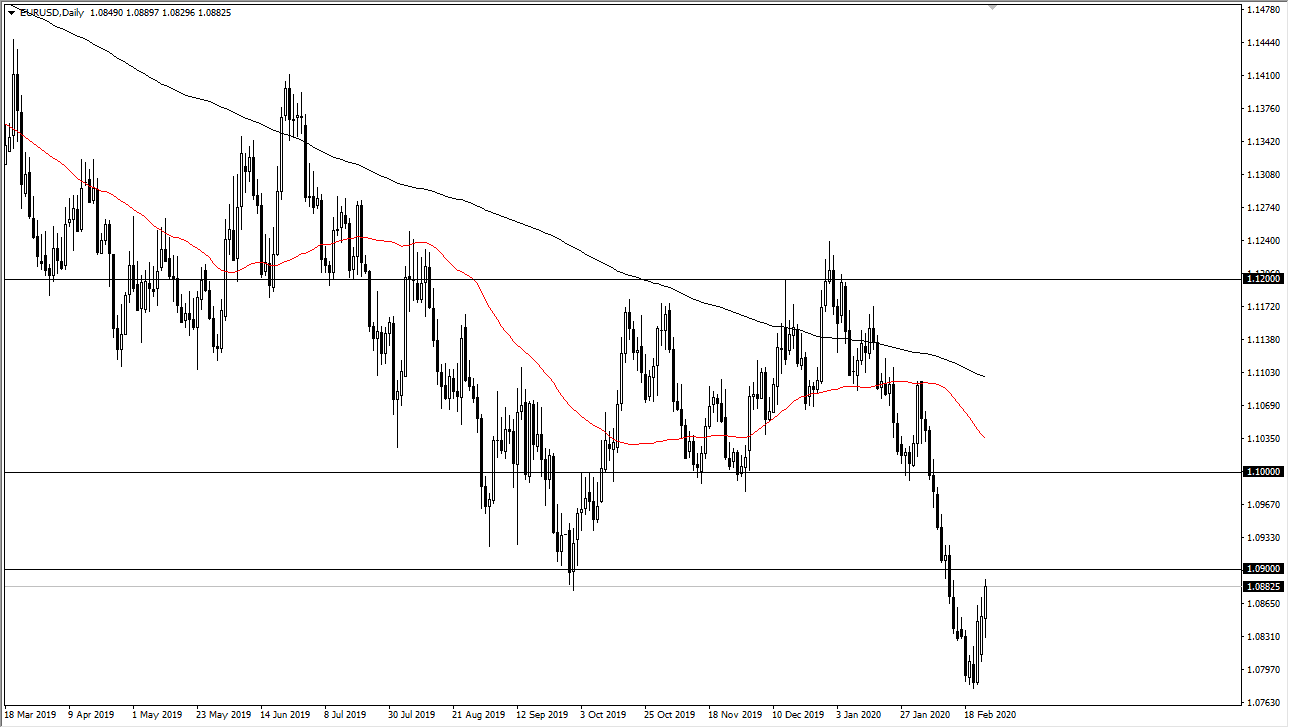

The Euro has rallied quite nicely during the trading session on Tuesday again, but is starting to approach a major resistance barrier in the form of the 1.09 level. The market had been oversold for some time, and as a result it’s very likely that we will continue to see a little bit of a bounce, but I think that it is only a matter of time before the value hunters when it comes to the US dollar come back out. Ultimately, I think that the market will find sellers eventually, but the Federal Reserve suddenly sounds a little less hawkish than believed previously. Essentially, the Federal Reserve has no idea what to do with the situation, but they will be paid attention to.

Even if we break above the 1.09 level, I think that it is only a matter of time before the market goes looking towards the 1.10 level after that, which is massive in its implications. Even if the US does start to soften up a little bit, it is nowhere near as troublesome as the European Union right now, so that is something that should be noted. Furthermore, the market had gotten way oversold, so a bounce of course makes quite a bit of sense. On a longer-term chart, the Euro had filled the gap so a bounce from there makes quite a bit of sense as well.

The market breaking above the 1.10 level would be something that you would have to set up and take notice of, but I think that is a pretty tall order at this point. The Italians suffering at the hands of the coronavirus outbreak certainly is not helping the situation right along with the German economy possibly heading into a recession. The question now is whether or not the US economy will follow right along with it? So far, it does not look like it’s going to happen, but we have to keep that in mind, and we do have to recognize that anything along the lines of an explosive candle above the 1.10 level is something that would dictate that we need to go much higher. I think at this point though, the Euro is simply getting a bit of a relief rally and therefore it should be treated as such. You should be patient enough to sell at higher levels as they offer value. I will be making trading decisions based upon bearish daily candlestick, which of course we have not seen