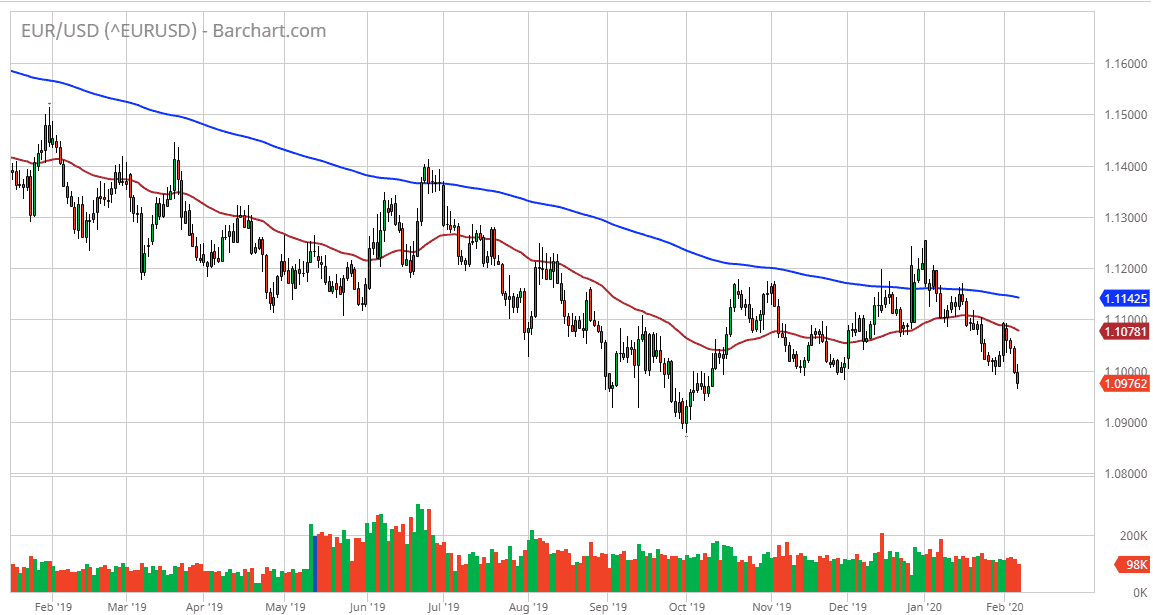

The Euro market has initially tried to rally during the trading session on Thursday, but found the area above the 1.10 level to be a bit too much to hang onto, and it now looks as if we will probably go looking for support closer to the 1.09 level underneath as it is the area that the market bounce from previously, so having said that it’s likely that the buyers will return in that area. With the jobs number coming out during the trading session on Friday we should see a lot of noise, but ultimately this is a market that has broken down ahead of time, perhaps understanding that the US economy is so much stronger than the European Union.

The jobs number should show that the United States continues to add people to the payrolls, and therefore the growth in this economy continues to outpace the rest of the world. Rallies at this point should be selling opportunities as we have seen the 50 day EMA turn things back around. If you have been following me recently, you know that I have been playing the range between the 1.10 level and the 1.12 level, and now that we have broken down through it, we start to look towards the target that I mentioned. The 1.09 level is the initial one, but we could go as low as 1.0750 based upon the fact that there is a gap there from many years ago that has not been filled.

At this point, if the market does break back above the 1.10 level at the end of the day, we will probably go looking towards the 50 day EMA above, but ultimately it is a market that has certainly seen a bit of structural damage done during the trading session on Thursday. The US dollar has rallied against everything, not just the Euro so one would have to think that we will continue to see more of the same, in this choppy yet negative market that has been negative for quite some time. All things being equal, the Euro will continue to suffer at the hands of the greenback.