The Euro has exploded to the upside during the trading session on Friday, as there has been a significant amount of short covering going into the weekend. The Manufacturing PMI figures in the United States came out much weaker than anticipated, so that of course had people sell in the US dollar. Nonetheless, the market had been a bit oversold anyway so it makes quite a bit of sense that there would be a bit of a profit-taking move going into the weekend.

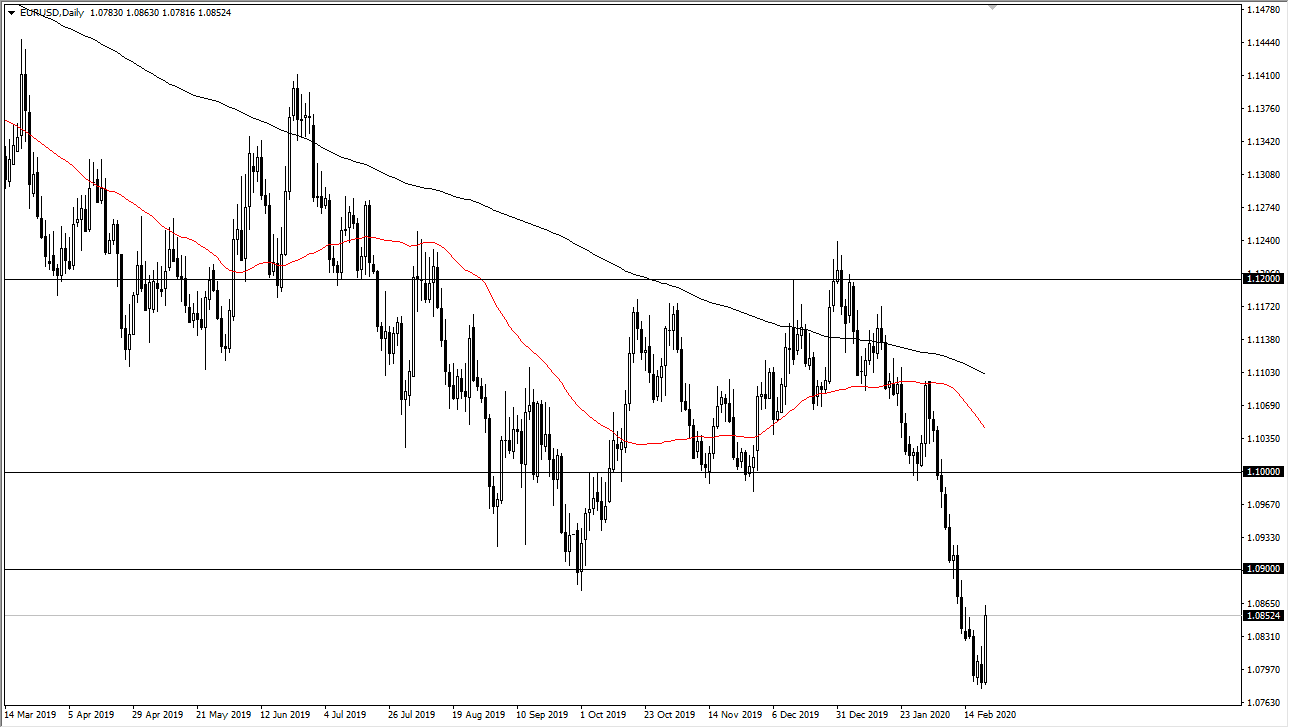

Furthermore, we have no idea what the headlines will bring over the weekend, so a lot of traders will be very comfortable with taking profits and being flat. That being said, I believe that the market is going to try to find some type of resistance above that they can take advantage of. Optimally, the 1.09 level above should be massive resistance, and at the first signs of exhaustion I would be more than willing to sell. Furthermore, the 1.10 level above is also an area that I would be looking to sell.

It is worth noting that the market broke above the highs of the couple of inverted hammers from a week ago, showing signs of resistance being broken, but when you look at the recent move, it makes sense that we would see some type of get back, and at this point I think that the market will eventually take a look at the US dollar as offering a “value” going forward, so therefore I will be looking at the daily candlestick for signs of exhaustion that I can take advantage of. All things being equal, the market should find plenty of support at the lows of the day, but if we break down below there it would also show the market slicing through a larger gap on the higher time frames. If we break down through there, it’s very likely that the market is going to go looking towards 1.05 handle. That being said though, I think it’s probable that the market finds itself a bit overextended so it makes sense that a bit of a break would be needed. Having said that, simple patience and waiting for an opportunity to start selling is the best way to go in this pair. Trying to buy it down here is a bit reckless and difficult as the fundamentals don’t back up the Euro rallying.