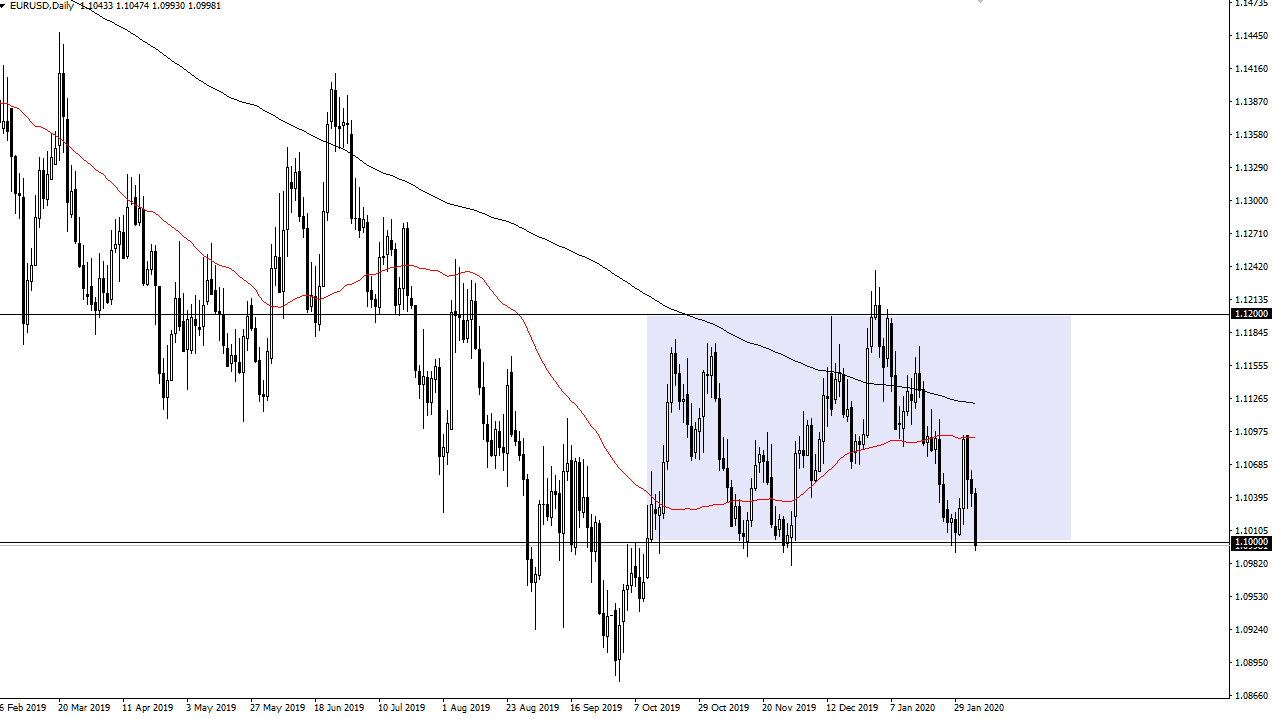

The Euro has tanked during trading on Wednesday, reaching down to the crucial 1.10 level. This is an area that has been supportive several times in the past, but one would have to ask how many more times can hold the market? Much of this move was possibly due to the ADP Non-Farm Employment Change figures coming out at almost twice expected, and then of course the ISM Nine Manufacturing PMI figures coming out better than anticipated. With that being the case, it makes sense that the US dollar get a bit of a boost against other currencies such as the Euro which has struggled in general. As the EU is underperforming the United States, it does make sense that the move happen.

However, it should be noted that this area has been crucial for support more than once, so a simple slice through this area probably is sent going to be easy to do. However, if the market does break down below the 1.0980 level, then it’s likely that it opens up the door to much lower pricing, the first level of course would be the 1.08 handle. With that being the case, I like the idea of waiting to see whether or not we can break down below that level on at least a four hour close before I would short. On the other hand, if the market breaks above the 1.1020 level, then it’s likely that the Euro will bounce a bit. At that juncture I would anticipate seeing the Euro rally towards the 50 day EMA, which is closer to the 1.11 handle above. After that, the market then will go looking towards the 200 day EMA and then eventually the 1.12 level. This assumes that the overall trading range holds.

With the Non-Farm Payroll figures coming out on Friday, it’s very possible that the Thursday session may be a bit quiet, but these are the levels that I am paying attention to so it gives you an idea as to how you can let the market tell you which direction it plans on going next. I am not looking for a huge moves though, that’s not something this pair does very often. I would keep my position size small and be more than willing to take profits as they occur, as it continues to be very choppy in general.