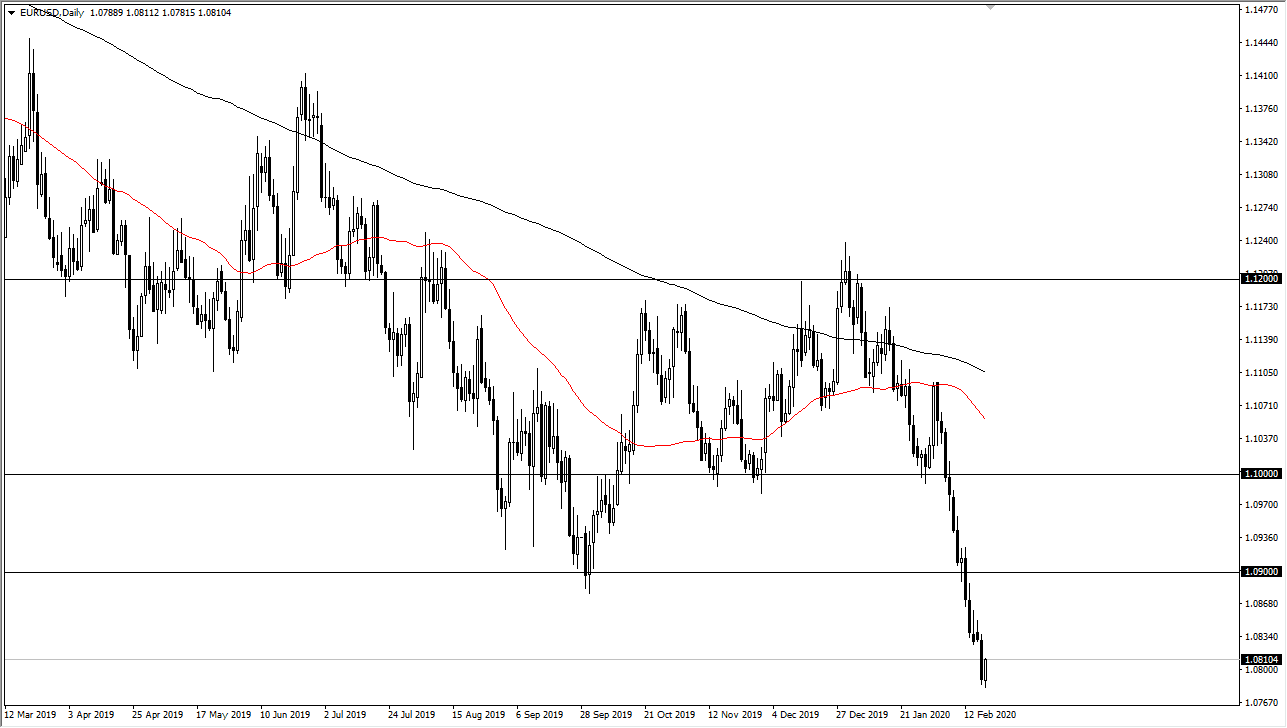

The Euro has rallied a bit during the trading session on Thursday to show signs of life, but quite frankly there are more than enough reason to think that the Euro will continue to fall apart. The Euro has filled the gap on longer-term charts that I had been talking about, so it makes quite a bit of sense that we would continue to see people get involved and perhaps take a little bit of profit at this point nonetheless, I believe that the market is likely to see some type of selling eventually. I would not be a buyer of this area, as there is significant amount of selling pressure above and is simply waiting for an opportunity to take advantage of the trend is what I would be doing.

Ultimately, the 1.09 level could offer quite a bit of resistance, just as the 1.10 level will. I am looking for signs of exhaustion based upon daily closes, in other words, something akin to a shooting star after a rally. We are just now starting to see that bounce as the market has broken above the 1.08 level. That’s a good sign, and certainly a good start, but not enough to wipe out the negativity nor is it enough to suddenly become bullish.

The European Union continues to post anemic economic numbers, while the United States has shown inflationary numbers that are close to target. If the Federal Reserve doesn’t have to cut rates, that will certainly continue to favor the US dollar over the Euro, and quite frankly the ECB is nowhere near getting close to be able to turn things around. If you are patient enough, you should see a nice set up given enough time, but we have to wait in order to profit. Buying down at this low level could work in theory, but it is going to be a nerve-racking exercise in trying to catch a falling knife. I will be on the sidelines when it comes to this pair for the next couple of days, looking to see whether or not I can find some type of value in the US dollar. In other words, selling from higher levels if the Euro becomes a bit overbought. The fundamental analysis of remains a very negative for this pair, and therefore I will let the technicals catch up to the reality.