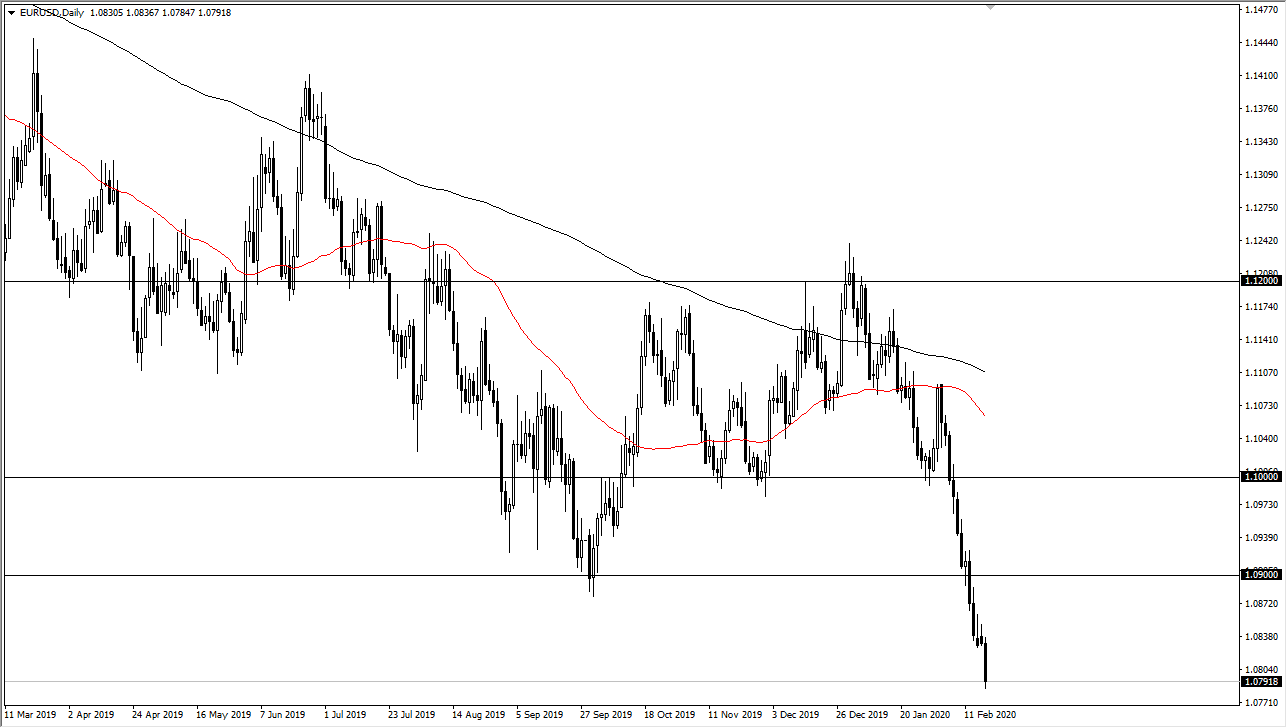

The Euro has broken down significantly during the trading session on Tuesday, slicing through the 1.08 level during the day. Ultimately, if the market was to rally from here, it should offer a nice opportunity to start shorting. After all, the US dollar is one of the favored currencies in the world, as the European Union is falling apart economically while the United States economy continues to go higher.

At this point, the Euro is not a market that you can sell, simply because you would be chasing the trade. I’m not saying that it can’t fall further, I’m just saying the market has fallen so far that you would be chasing the trade here, and you would be risking a serious “rip your face off rally” to cause serious financial damage to your account. The market has been falling apart for a couple of weeks now, and it’s showing no signs of relenting. That being said, the 1.0750 level is a significant area that features a massive gap, one that should offer a bit of support but I think at this point any rally will be sold into. I think that selling the rallies continues to be the best way going forward, as the GDP differential between the two economies is wide enough to drive a truck through.

The Americans continue to outperform the rest of the world while the European Union is hanging on by its fingernails to avoid a recession. Zombie banks in Germany continue to put downward pressure on the EU and therefore it’s likely that we will eventually blow through that gap, although I don’t think it happens anytime soon. I think that rallies are to be looked at with suspicion, especially near the 1.09 level and possibly even the 1.10 level afterwards. You can’t sell it right now because chasing the trade is a good way to lose money. However, if you are patient enough there should be a nice set up down the road in order to start shorting again. Quite frankly, it’s not until the market breaks 1.10 that I think there is any chance for taken a long position. That being said, I will be paying attention to monthly chart for some type of trend change, but we are nowhere near that right now. I believe the troubles for the EU will continue.