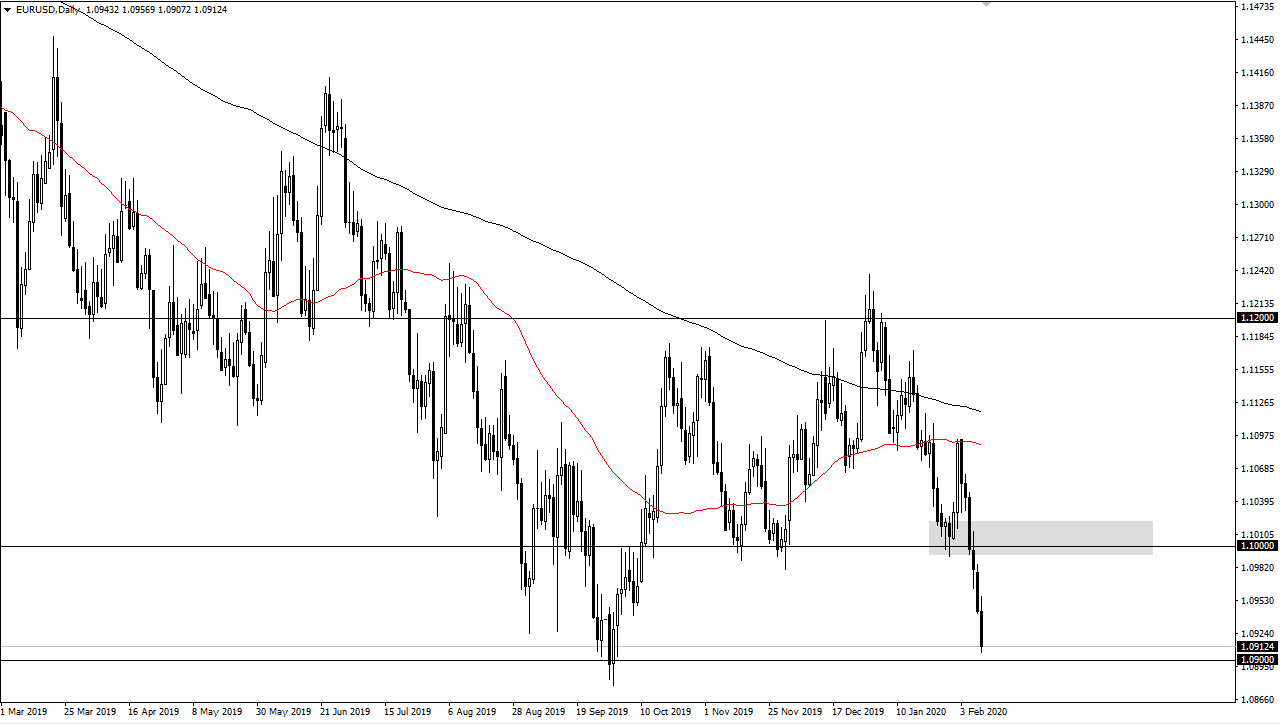

The Euro broke down significantly during the trading session on Monday to kick off the week, as we continue to see a lot of exhaustion in this market and a run towards the US dollar away from the European Union.

EUR/USD

The Euro initially tried to rally during the trading session on Monday, but then broke down significantly as we continue to see a large “risk off” type of move in the market. All things being equal, the 1.09 level should offer a certain amount of support, but if we break down below there it’s likely that the Euro drops down to the 1.08 level, and then possibly the 1.0750 level which was the scene of a major gap that has yet to be filled. At this point, I prefer to sell rallies as they occur, as we may have gotten a bit oversold in the short term. The 1.10 level would attract a lot of attention, as it had previously been so supportive.

The Sentix Investor Confidence numbers came out at 5.2 early in the session, as opposed to 6.1 anticipated by the market. This shows that European investor confidence is dropping, and the fact that it is dropping so rapidly suggests that things are getting worse, not better on the continent. That being said, some type of bounce should occur near the 1.09 level as it will attract a certain amount of attention, but that should be sold into at the first signs of exhaustion. I have absolutely no interest in trying to buy the Euro right now as economic figures out of the European Union continue to slump. Furthermore, it’s akin to “trying to pick the bottom”, which is a great way to lose money.

As long as the US economy continues to show resiliency in strength, it’s difficult to imagine a scenario where you go against the greenback. That would be especially true against the Euro as there has been a complete breakdown in growth when it comes to the European Union and it’s very likely that the ECB will have to do something rather drastic to stimulate the economy. However, if we were to break above the 1.10 level then I think we would probably go looking towards the red 50 day EMA on the daily charts. All things being equal though, I’m looking to sell rallies and not try to get too cute by shorting down at these extraordinarily low levels were trying to buy some type of short-term bounce.