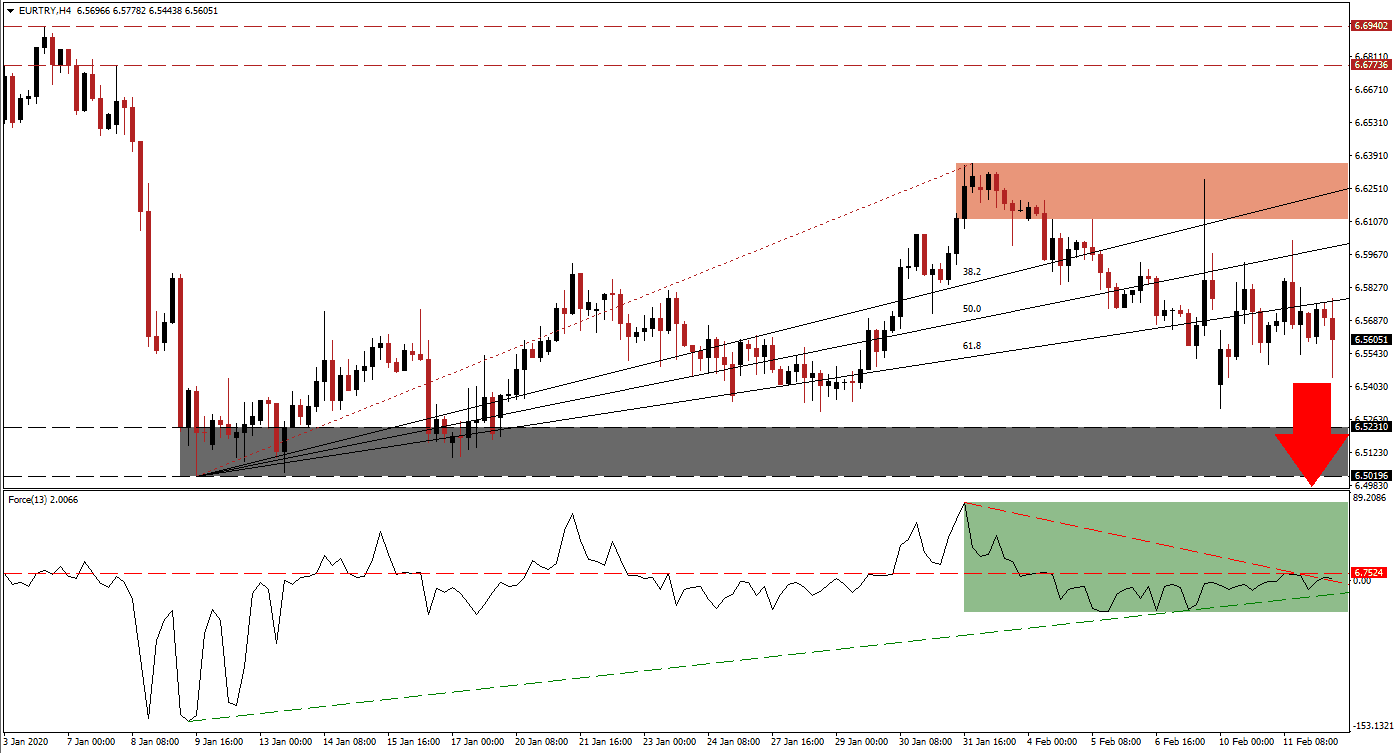

Turkey’s economy is on a firm path to recovery in 2020, but challenges remain. Consumer confidence is depressed, while foreign direct investment (FDI) may not recover until 2021. Turkey has long depended on FDI to finance its growth, but the absence of it may result in sweeping changes moving forward. The EUR/TRY faced a spike in volatility, causing it to momentarily spike into its short-term resistance zone before reversing. A bearish bias emerged, and this currency pair is anticipated to accelerate to the downside.

The Force Index, a next-generation technical indicator, drifted higher throughout the volatility in this currency pair. After the Force Index contracted from a higher high, it converted its horizontal support level into resistance, as marked by the green rectangle. An ascending support level materialized due to a lower high, which assisted the push above its descending resistance level. This technical indicator shows the lack of bullish momentum and a breakdown is anticipated to lead the EUR/TRY to the downside. You can learn more about the Force Index here.

This currency pair is now trading below its shallow re-drawn Fibonacci Retracement Fan sequence after its short-term resistance zone rejected an extension of the advance. This zone is located between 6.61166 and 6.63556, as marked by the red rectangle. The 38.2 Fibonacci Retracement Fan Resistance Level has crossed into this zone, but due to the absence of bullish pressures, the EUR/TRY is favored to move further away from its ascending 61.8 Fibonacci Retracement Fan Resistance Level.

With the Eurozone exposed to persistent weakness out of Germany, including France showing signs of intensifying its slowdown, the Euro is under massive downside pressure. The European Central Bank additionally supports a weaker currency, adding to the bearish fundamental scenario for the EUR/TRY. Price action is positioned to challenge its support zone located between 6.50196 and 6.52310, as marked by the grey rectangle, from where an additional breakdown is likely. The next support zone awaits this currency pair between 6.38701 and 6.41126.

EUR/TRY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 6.56000

Take Profit @ 6.41000

Stop Loss @ 6.61000

Downside Potential: 1,500 pips

Upside Risk: 500 pips

Risk/Reward Ratio: 3.00

A breakout in the Force Index above its horizontal resistance level, off of its descending resistance level, may allow the EUR/TRY to attempt a breakout. The upside potential remains limited to its next long-term resistance zone, located between 6.667736 and 6.69402. This will represent a sound short-selling opportunity for Forex traders to consider, as the fundamental outlook is increasingly bullish on the back of Euro weakness.

EUR/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.64000

Take Profit @ 6.69000

Stop Loss @ 6.62000

Upside Potential: 500 pips

Downside Risk: 200 pips

Risk/Reward Ratio: 2.50