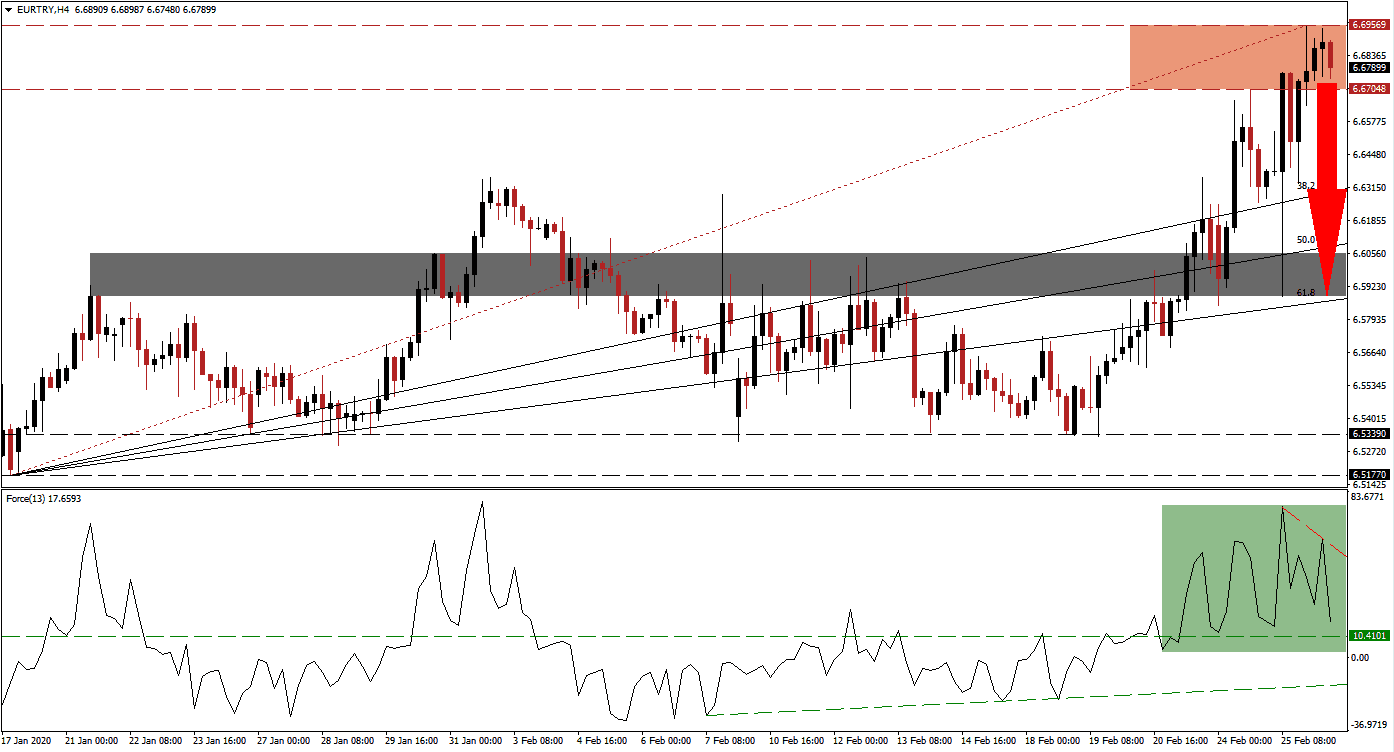

Fourth-quarter GDP data out of Turkey confirmed the economic recovery with a 5.0% expansion, the average growth rate over the past two decades. The annualized increase was reported at 0.6%, slightly above the government forecast of 0.5%. It followed the third-quarter expansion of 0.9% and was fueled by a surge in industrial production. The data sufficed to halt the advance in the EUR/TRY inside of its resistance zone. Price action is now ripe for a violent corrective phase, amid portfolio adjustments to reflect the changing dynamic between the Euro and the Turkish Lira.

The Force Index, a next-generation technical indicator, reversed from its peak, and a negative divergence started to form. Bullish momentum is fading quickly, a move enhanced by its descending resistance level. The Force Index is on track to push below its horizontal support level, as marked by the green rectangle. Bulls are losing control of the EUR/TRY, and this technical indicator is likely to collapse below its ascending support level in negative conditions, allowing bears to regain charge of price action.

After moving into its resistance zone located between 6.67048 and 6.69569, as marked by the red rectangle, the EUR/TRY lost its upside drive. A breakdown is favored to initiate a profit-taking sell-off in this currency pair. Dismal Eurozone economic data, led by disappointments out of Germany, provides a fundamental development, suggesting a weaker Euro moving forward. Price action is anticipated to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level.

A move in the EUR/TRY below its intra-day low of 6.66426, the candlestick marking the end-point of its Fibonacci Retracement Fan sequence, is expected to inspire the addition of new net sell orders. This should provide the necessary downside volume to pressure price action into its short-term support zone located between 6.58844 and 6.60537, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is enforcing the bottom range of this zone. A breakdown will require a new catalyst. You can learn more about a breakdown here.

EUR/TRY Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 6.68000

Take Profit @ 6.59000

Stop Loss @ 6.71000

Downside Potential: 900 pips

Upside Risk: 300 pips

Risk/Reward Ratio: 3.00

In the event of a breakout in the Force Index above its descending resistance level, the EUR/TRY is favored to follow suit. Ongoing economic weakness in the Eurozone, together with a central bank policy to devalue its currency, confirms the long-term bearish outlook. Forex traders are recommended to take advantage of any advance from current levels with new short orders. The next resistance zone is located between 6.76283 and 6.80102.

EUR/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.73500

Take Profit @ 6.80000

Stop Loss @ 6.71000

Upside Potential: 650 pips

Downside Risk: 250 pips

Risk/Reward Ratio: 2.60