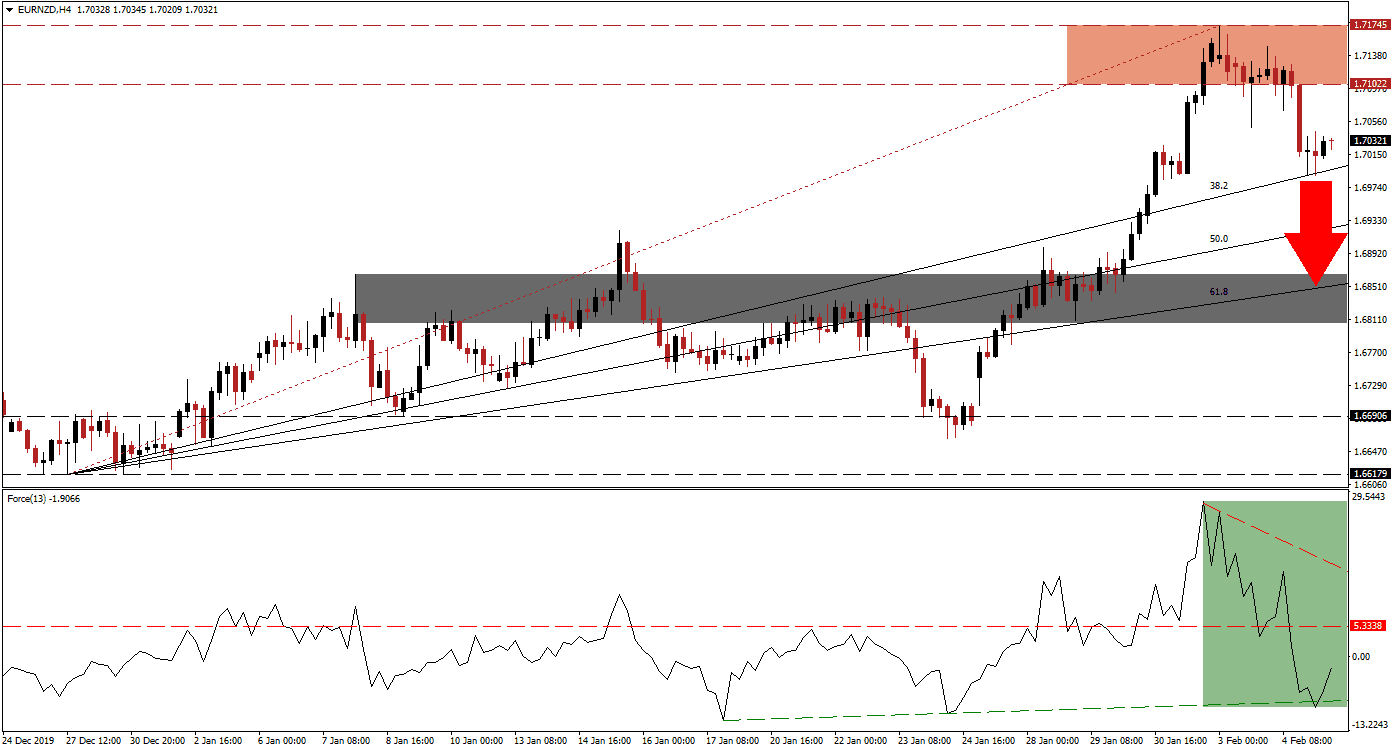

Economic data released out of New Zealand this morning showed a contraction in the unemployment rate mixed with weak hourly earnings for the fourth quarter of 2019. It forced a pause in the EUR/NZD breakdown as it reached its ascending 38.2 Fibonacci Retracement Fan Support Level, but the amount of bearish pressures is favored to reignite the breakdown sequence. Today’s Eurozone PMI data may provide the next fundamental catalyst. You can learn more about a breakdown here.

The Force Index, a next-generation technical indicator, shows the momentum reversal as it collapsed from a higher high. It pushed through its horizontal support level, converting it into resistance. The Force Index then accelerated to the downside, briefly piercing its ascending support level before reversing, as marked by the green rectangle. This technical indicator remains in negative territory, suggesting bears are in control of the EUR/NZD. More downside is expected to keep the corrective phase intact.

After this currency pair pushed below its resistance zone located between 1.71022 and 1.71745, as marked by the red rectangle, it quickly closed the gap to its 38.2 Fibonacci Retracement Fan Support Level. Forex traders are advised to monitor the intra-day low of 1.69887, the current low of the correction. A breakdown will convert the 38.2 Fibonacci Retracement Fan Support Level into resistance and result in the addition of new net short positions in the EUR/NZD.

Price action is positioned to extend its breakdown until it can challenge its short-term support zone located between 1.68061 and 1.68660, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is passing through this zone, posing the next critical challenge for the EUR/NZD. As fears surrounding the disruption to the global economy resulting from the coronavirus are easing, the New Zealand Dollar is receiving an additional fundamental boost. You can learn more about a support zone here.

EUR/NZD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.70300

Take Profit @ 1.68500

Stop Loss @ 1.70900

Downside Potential: 180 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.00

A recovery in the Force Index leading to a breakout above its descending resistance level is likely to encourage a reversal in the EUR/NZD. The upside potential appears limited to the top range of its resistance zone, due to the bullish outlook for the New Zealand economy together with the negative monetary policy of the European Central Bank. Forex traders are recommended to consider any advance as a great opportunity to take short positions.

EUR/NZD Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 1.71150

Take Profit @ 1.71700

Stop Loss @ 1.70900

Upside Potential: 55 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.20