Yesterday’s ZEW data disappointed, confirming the German economy, and the Eurozone as a whole, are on a weaker footing that market participants priced into their portfolios. Germany is the trading bloc’s export engine and accounts for the majority of its output. With the country in a persistent slowdown, it applies pressure throughout the Eurozone. Political issues are now adding to an uncertain outlook. The EUR/NZD was rejected by its short-term resistance zone, ending the pause of its long-term corrective phase.

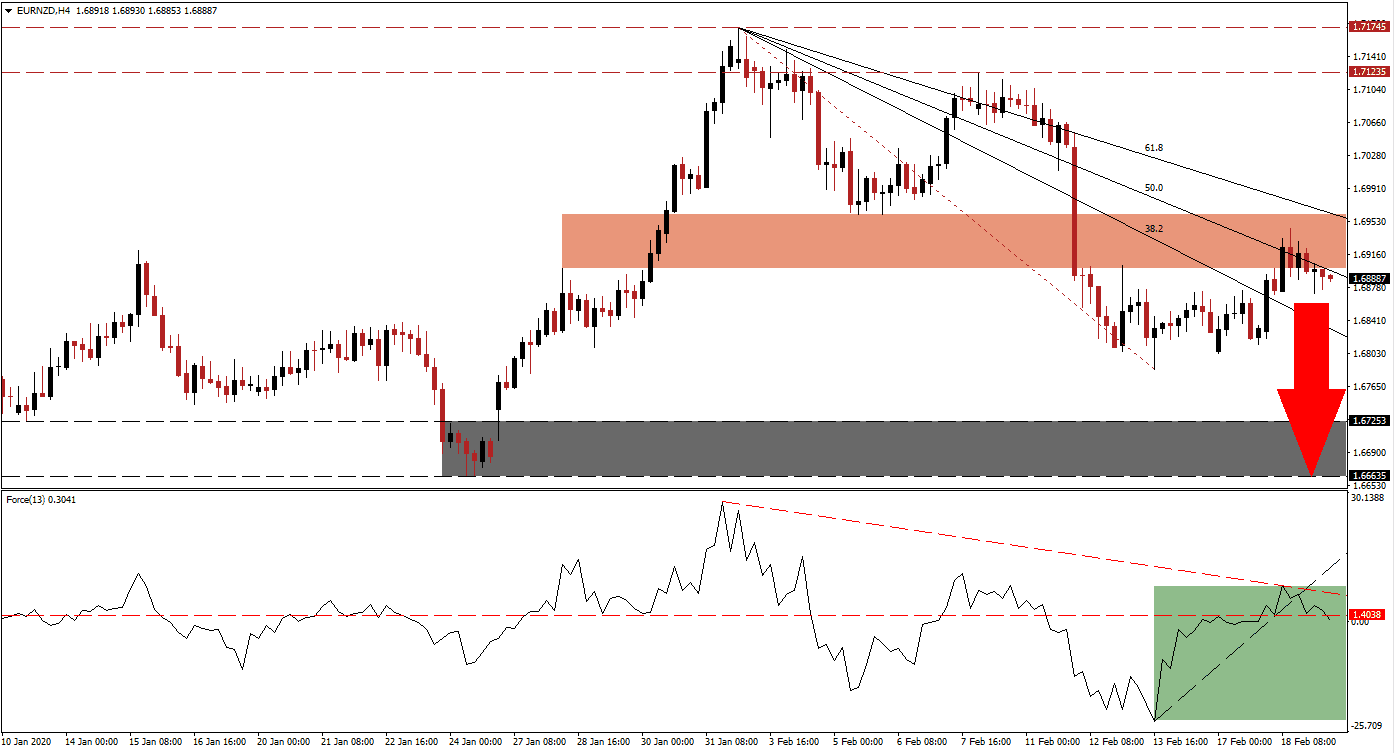

The Force Index, a next-generation technical indicator, shows a dominant bearish pattern with a series of lower highs and lower lows. After the recovery off of a fresh 2020 low, the advance was reversed by its descending resistance level. The Force Index then converted its horizontal support level into resistance, as marked by the green rectangle. This technical indicator is now on track to push below its 0 center-line, placing bears in charge of the EUR/NZD. You can learn more about the Force Index here.

After briefly piercing its redrawn descending 50.0 Fibonacci Retracement Fan Resistance Level, price action was forced into a breakdown below its short-term resistance zone. This zone is located between 1.69003 and 1.69609, as marked by the red rectangle. The Reserve Bank of New Zealand delivered an upbeat economic assessment as it left its key interest rate unchanged. Covid-19 was merely mentioned as a developing risk, which is a misclassification as it has materialized with an unknown impact. Despite this, the outlook for the EUR/NZD remains bearish on the back of Euro weakness.

This currency pair is now likely to be guided to the downside by its Fibonacci Retracement Fan. A breakdown below its intra-day low of 1.67851, the low from where price action recovered to the upside, is favored to result in the addition of net sell-orders. The EUR/NZD is well-positioned to accelerate into its support zone located between 1.66635 and 1.67253, as marked by the grey rectangle. More downside is possible, but a fresh fundamental catalyst required. You can learn more about a breakdown here.

EUR/NZD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.68900

Take Profit @ 1.66650

Stop Loss @ 1.69650

Downside Potential: 225 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 3.00

A spike in the Force Index, closing the gap to its steep ascending support level, which acts as resistance, is anticipated to inspire a breakout attempt in the EUR/NZD. This will include a move above its 61.8 Fibonacci Retracement Fan Resistance Level, clearing the path into its long-term resistance zone. Price action will challenge this zone between 1.71235 and 1.71745, presenting Forex traders a great short-selling opportunity.

EUR/NZD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.70150

Take Profit @ 1.71350

Stop Loss @ 1.69650

Upside Potential: 120 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.40