Preliminary Eurozone PMI data for February indicated a mild recovery off of depressed levels, hardly sufficient to warrant a stronger Euro. As Germany continues to lead weakness, the French manufacturing sector contracted into recessionary levels. The Covid-19 outbreak in Italy, the Eurozone’s third-largest economy, is clustered in the North, the country’s main industrial hub. It also represents the most massive outbreak in a non-Asian country globally. The EUR/MXN initiated its reversal, after being rejected by its resistance zone.

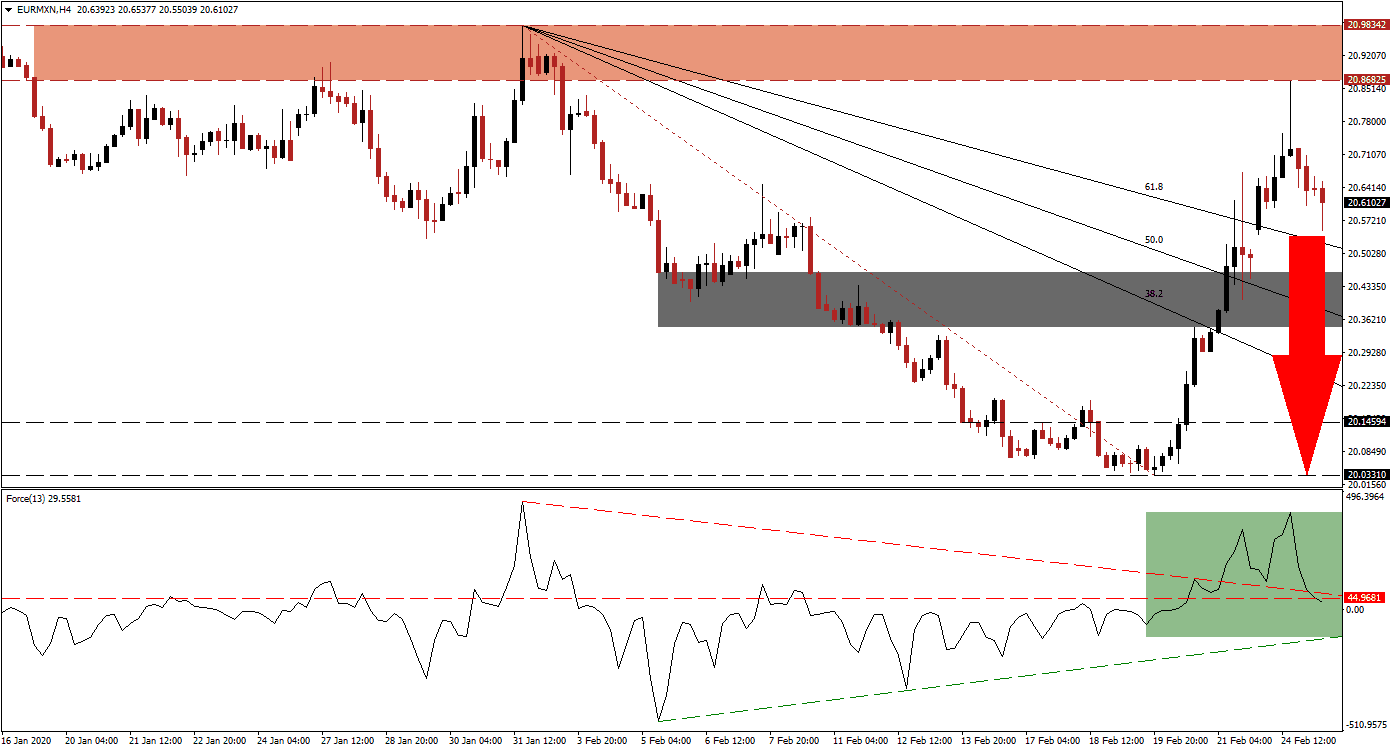

The Force Index, a next-generation technical indicator, advanced to a fresh 2020 high as this currency pair spiked into the bottom range of its resistance zone. A quick reversal took it back below its descending resistance level, which is intersecting its horizontal resistance level, as marked by the green rectangle. The Force Index possesses enough bearish momentum to push into negative territory, granting bears control over the EUR/MXN. This technical indicator is additionally expected to move below its ascending support level, increasing breakdown pressures.

2019 resembled the worst economic performance for Mexico in one decade, but GDP predictions for 2020 remain upbeat. The February CPI rose in February, keeping the Bank of Mexico sidelined. Following the rejection of the EUR/MXN by its long-term resistance zone located between 20.86825 and 20.98342, as marked by the red rectangle, price action is on track to push below its descending 61.8 Fibonacci Retracement Fan Support Level. It will convert it back into resistance, from where more downside is favored.

Due to the build-up in breakdown pressures, this currency pair is positioned to convert its short-term support zone into resistance, assisted by its Fibonacci Retracement Fan sequence, which may guide the EUR/MXN farther to the downside. This zone is located between 20.34569 and 20.46278, as marked by the grey rectangle. It will clear the path for an extension of the breakdown sequence into its long-term support zone, awaiting price action between 20.03310 and 20.14594. You can learn more about a breakdown here.

EUR/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 20.61000

Take Profit @ 20.06000

Stop Loss @ 20.72500

Downside Potential: 5,550 pips

Upside Risk: 1,150 pips

Risk/Reward Ratio: 4.83

A recovery in the Force Index above its descending resistance level could allow the EUR/MXN a chance to pressure for more upside. The upside potential remains limited to its long-term resistance zone, and Forex traders are recommended to consider this as a second short-entry opportunity. Economic data out of the Eurozone remains depressed with more issues on the horizon, while the Mexican economy is entering a recovery phase.

EUR/MXN Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 20.77500

Take Profit @ 20.98250

Stop Loss @ 20.67250

Upside Potential: 2,075 pips

Downside Risk: 1,025 pips

Risk/Reward Ratio: 2.02