Japanese trade data released yesterday showed a contraction across the board, confirming the global economy remains under stress. While the data beat expectations, machine orders disappointed, suggesting that more hardship is to follow. Disruptions from Covid-19 are additionally set to depress data, especially in the first half of 2020. The EUR/JPY spiked out of its support zone, on the back of a short-covering rally, and is now vulnerable to a corrective phase on the back of weak Eurozone data.

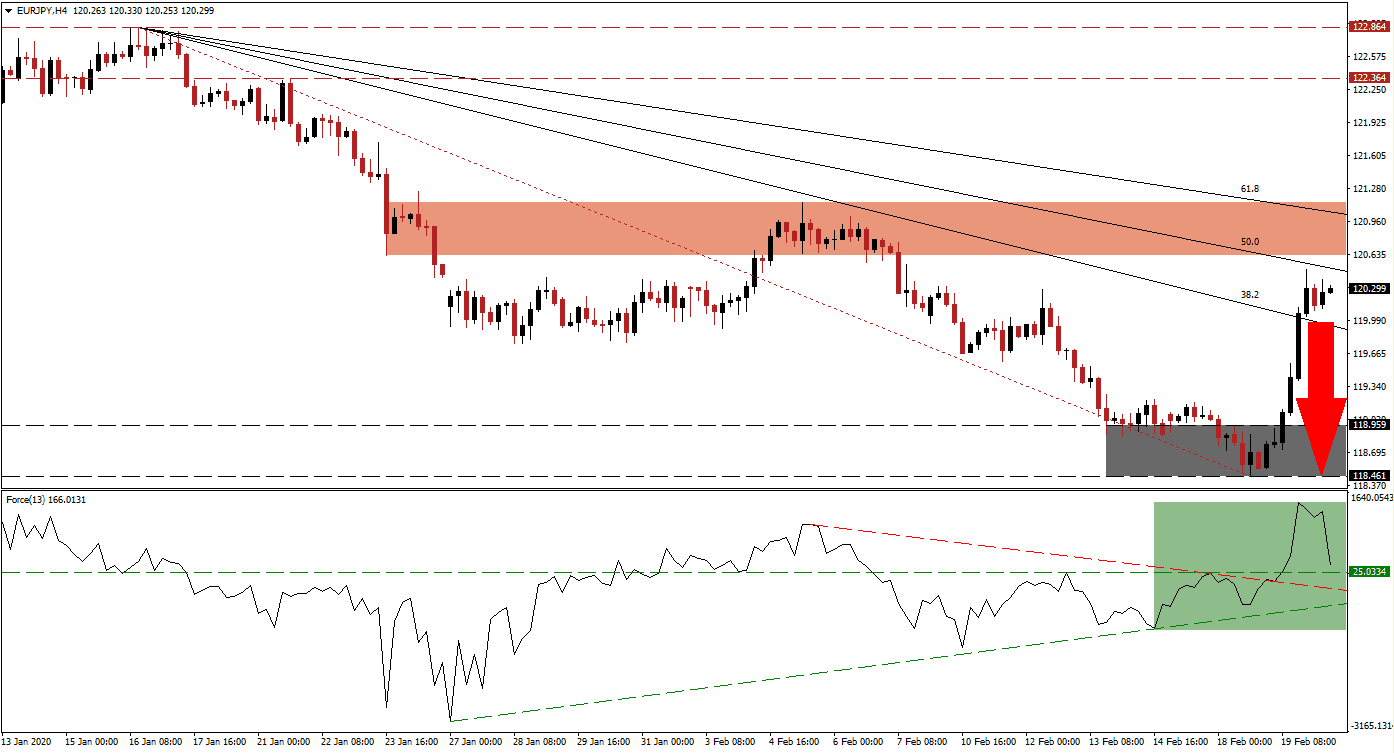

The Force Index, a next-generation technical indicator, confirmed the advance in this currency pair with a surge to a fresh 2020 high. It resulted in a breakout above its descending resistance level, which currently acts as temporary support, as marked by the green rectangle. The reversal is ongoing, expected to convert its horizontal support level into resistance. This technical indicator may extend to the downside, after crossing below the 0 center-line, placing bears in charge of the EUR/JPY. A breakdown below its ascending support level will add bearish momentum. You can learn more about the Force Index here.

Bearish momentum expanded as this currency pair was rejected by its descending 50.0 Fibonacci Retracement Fan Resistance Level. This created a lower high below its short-term resistance zone located between 120.627 and 121.143, as marked by the red rectangle. The 61. Fibonacci Retracement Fan Resistance Level is crossing through this zone, enforcing the long-term downtrend in the EUR/JPY. With German data driving economic disappointments out of the Eurozone, a more massive corrective phase is favored, adding to the safe-haven appeal of the Japanese Yen.

A contraction in the EUR/JPY into its support zone located between 118.461 and 118.959, as marked by the grey rectangle, is anticipated to materialize. Forex traders are recommended to monitor the intra-day low of 119.762. This is the low of a previous sideways trend before price action ascended into its short-term resistance zone, where it was rejected by its 38.2 Fibonacci Retracement Fan Resistance Level. A breakdown below this level is likely to inspire the next wave of net short positions. You can learn more about a support zone here.

EUR/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 120.300

Take Profit @ 118.500

Stop Loss @ 120.800

Downside Potential: 180 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 3.60

Should the Force Index bounce off of its ascending support level, the EUR/JPY is expected to attempt a breakout. While Japanese data has disappointed, Eurozone data followed suit, allowing safe-have demand to become the dominant fundamental driver for this currency pair. Therefore, the upside potential remains limited to its long-term resistance zone located between 122.364 and 122.864.

EUR/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 121.200

Take Profit @ 122.850

Stop Loss @ 120.900

Upside Potential: 65 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.17