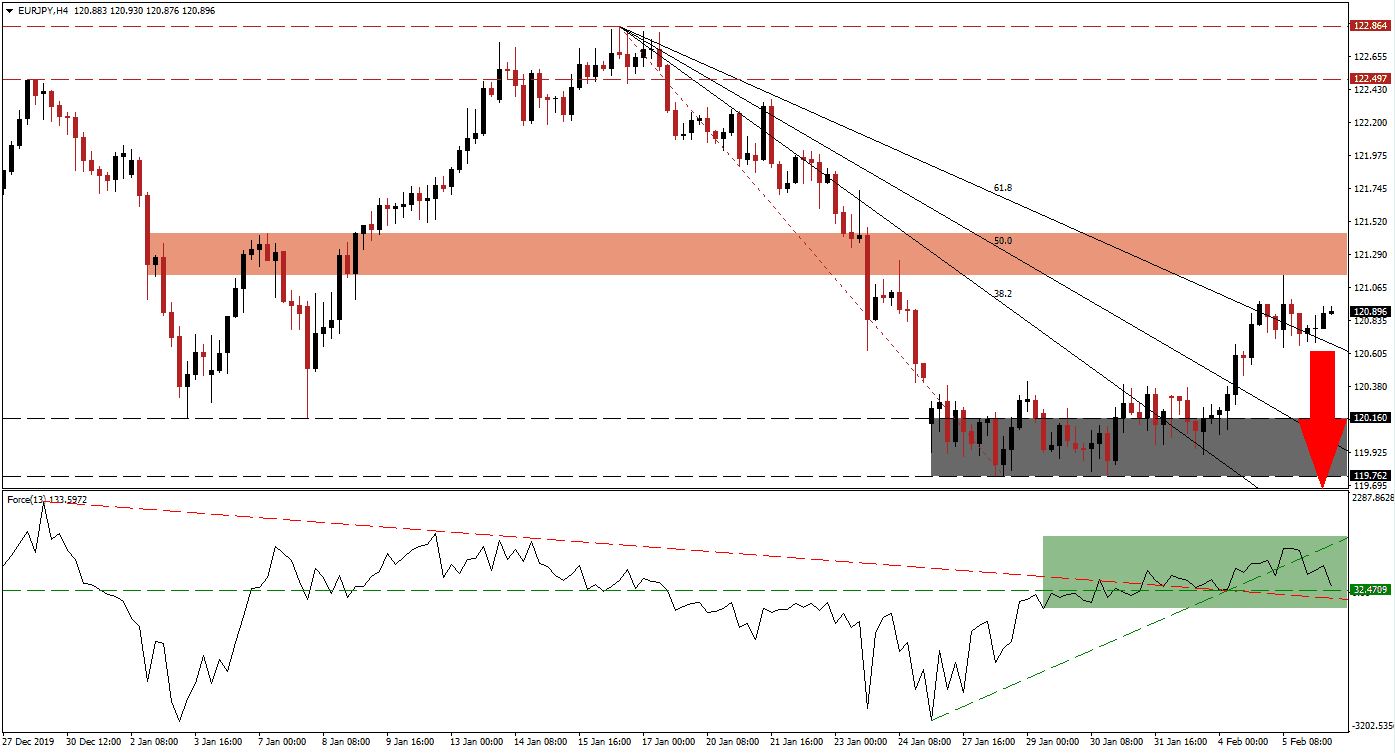

Yesterday’s surprise PMI revisions to the upside out of the Eurozone elevated the Euro, but this is short-term event is close to the end. Bullish momentum started to recede after this currency pair pushed above its descending 61.8 Fibonacci Retracement Fan Resistance Level, converting it temporarily into support. While fears regarding the coronavirus have eased, economic concerns remain elevated, keeping safe-haven demand stable. The EUR/JPY is expected to follow the contraction in momentum with a fresh breakdown sequence.

The Force Index, a next-generation technical indicator, provided an early warning that the breakout in price action is unsustainable after it failed to push to a fresh high. Following the latest breakout in the EUR/JPY, the Force Index contracted below its ascending support level. It is now on track to convert its horizontal support level into resistance, as marked by the green rectangle. A conversion will place this technical indicator in negative conditions below its descending resistance level, with bears taking control of price action.

This currency pair was rejected by its short-term resistance zone located between 121.143 and 121.433, as marked by the red rectangle. The bullish momentum loss is now anticipated to initiate a reversal in the EUR/JPY. Forex traders are advised to monitor the intra-day low of 120.651. It marks the low of the candlestick, which resulted in the breakout above the 61.8 Fibonacci Retracement Fan Resistance Level and formed the bottom range of its resistance zone. A move below this level is favored to attract the next wave of net sell orders.

With the 38.2 Fibonacci Retracement Fan Support Level already below its support zone, and the 50.0 Fibonacci Retracement Fan Support Level passing through it, a more massive correction may unfold. The support zone is located between 119.762 and 120.160, as marked by the grey rectangle. A breakdown in the EUR/JPY will clear the path to the downside until price action can challenge its next support zone awaiting between 118.236 and 118.585. Volatility is likely to increase moving forward. You can learn more about a breakdown here.

EUR/JPY Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 120.900

Take Profit @ 119.750

Stop Loss @ 121.200

Downside Potential: 115 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.83

A breakout in the Force Index above its ascending support level, acting as temporary resistance, may pressure the EUR/JPY into a breakout attempt of its own. With the European Central Bank entrenched in monetary policy to devalue the Euro, amid weak growth prospects, any advance remains limited to its long-term resistance zone located between 122.497 and 122.864. Forex traders are advised to consider this an excellent short-selling opportunity.

EUR/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 121.500

Take Profit @ 122.500

Stop Loss @ 121.100

Upside Potential: 100 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.50