Uncertainty over Brexit and a Corbyn government is a distant memory, after Prime Minister Johnson delivered the best election result since 1986, less than two months ago. This is evident in the services PMI for January, which was released last week. It showed a surge in demand outpacing all of the Eurozone. The EUR/GBP drifted into its short-term resistance zone, but the momentum breakdown is favored to trigger a corrective phase in this currency pair. You can learn more about a breakdown here.

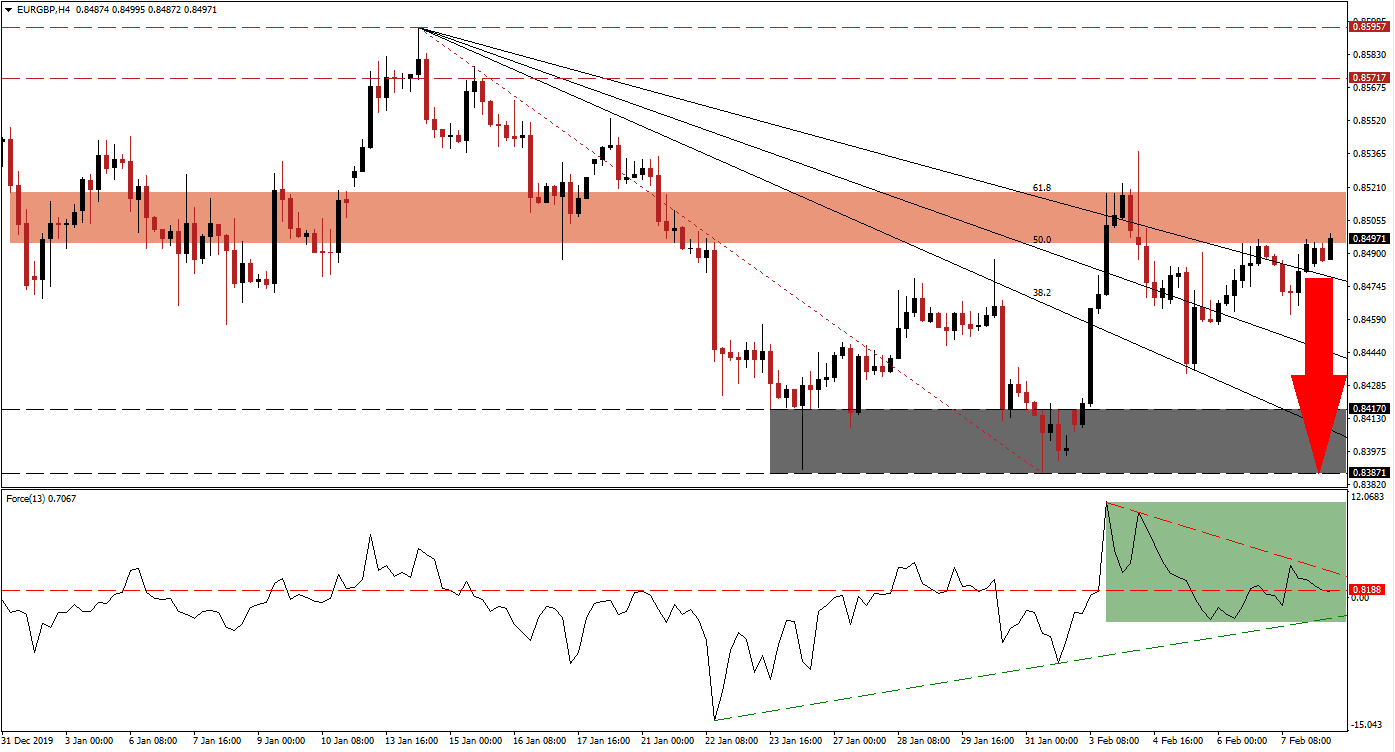

The Force Index, a next-generation technical indicator, started to contract after this currency pair moved into its short-term resistance zone. A temporary breakout resulted in a steeper correction in the Force Index. It resulted in the conversion of its horizontal support level into resistance, as marked by the green rectangle, together with the emergence of a descending resistance level. This technical indicator is now position to cross into negative territory from where a breakdown below its ascending support level is anticipated. Bears will then be in control of price action in the EUR/GBP.

This currency pair was previously rejected by its short-term resistance zone located between 0.84946 and 0.85187, as marked by the red rectangle. The Fibonacci Retracement Fan sequence has moved below this zone. While the EUR/GBP moved above its descending 61.8 Fibonacci Retracement Fan Resistance Level, the bullish momentum breakdown is expected to force a reversal, triggering a profit-taking sell-off. The Euro is under pressure by the European Central Bank, which favors a weaker currency in support of its ailing export sector.

Forex traders are advised to monitor the intra-day low of 0.84616, the low of a previous descend preceding the current push higher. A breakdown is likely to inspire the next wave of sell-orders in the EUR/GBP. This should clear the path into its support zone located between 0.83871 and 0.84170, as marked by the grey rectangle. It will additionally place this currency pair below its 38.2 Fibonacci Retracement Fan Resistance Level, enabling a breakdown extension. You can learn more about a support zone here.

EUR/GBP Technical Trading Set-Up - Profit-taking Scenario

Short Entry @ 0.85000

Take Profit @ 0.83900

Stop Loss @ 0.85300

Downside Potential: 110 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.67

Should the Force Index sustain a breakout above its descending resistance level, the EUR/GBP is anticipated to follow suit. Due to the bullish outlook for the UK economy and its currency, the upside potential is limited to its next long-term resistance zone located between 0.85717 and 0.85957. This will represent a great short-selling opportunity, and forex traders are advised to take advantage of it.

EUR/GBP Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.85500

Take Profit @ 0.85850

Stop Loss @ 0.85350

Upside Potential: 35 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 2.33