While last week’s PMI data out of the Eurozone indicated a rebound, it came of depressed levels. The focus remains in the manufacturing sector, which remains in recessionary conditions, but service sector data is slowing down, adding to the already fragile growth outlook. Covid-19 is anticipated to have a delayed impact on economic data out of the Eurozone, with the European Central Bank adding to downside pressures. UK economic data continues to provide upside surprises, creating proper conditions for the EUR/GBP to initiate a new breakdown sequence.

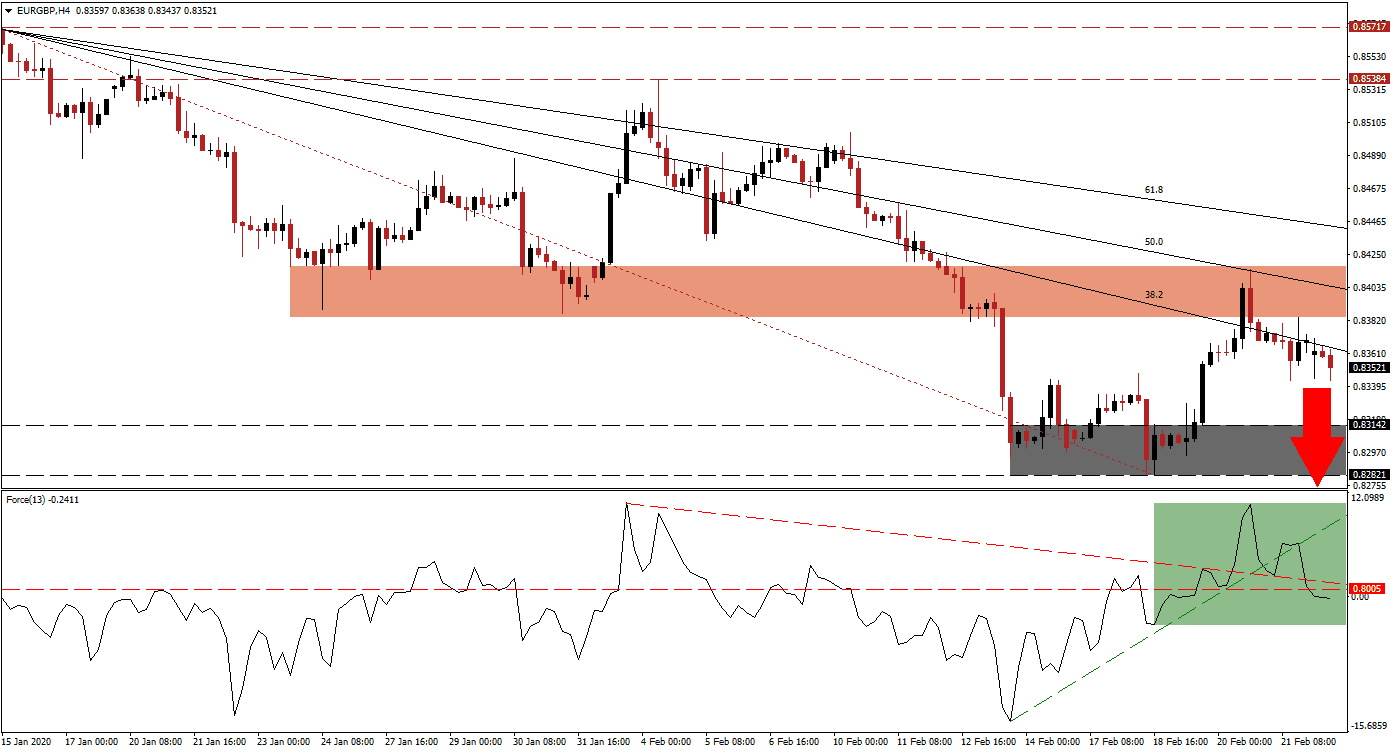

The Force Index, a next-generation technical indicator, reversed from its peak. After a breakdown below its ascending support level, which now acts as resistance, a failed attempt to bounce off of its descending resistance level materialized. The Force Index then extended its slide below its horizontal support level, converting it into resistance, as marked by the green rectangle. This technical indicator also moved into negative territory, granting bears control of the EUR/GBP. You can read more about the Force Index here.

Price action was unable to turn its short-covering rally into a sustained advance. The EUR/GBP was rejected by its descending 50.0 Fibonacci Retracement Fan Resistance Level, passing through its short-term resistance zone. This zone is located between 0.83845 and 0.84170, as marked by the red rectangle. The breakdown quickly moved this currency pair below its 38.2 Fibonacci Retracement Fan Resistance Level from where breakdown pressures are expanding.

A more massive corrective phase is favored, keeping the long-term bearish trend intact. This will be partially fueled by the UK economy outperforming the Eurozone. A breakdown below its support zone located between 0.82821 and 0.83142, as marked by the grey rectangle, is expected. The EUR/GBP will then be cleared to contract into its next support zone, awaiting this currency pair between 0.80924 and 0.81170, dating back to April 2016. You can learn more about a support zone here.

EUR/GBP Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.83550

Take Profit @ 0.80950

Stop Loss @ 0.84250

Downside Potential: 260 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.71

Should the Force Index eclipse its ascending support level, the EUR/GBP is likely to attempt another breakout. The 61.8 Fibonacci Retracement Fan Resistance Level is enforcing the bearish trend. Due to the dominant fundamental developments, the upside of any breakout appears limited to its long-term resistance zone, located between 0.85384 and 0.85717. Forex traders are highly recommended to consider this an excellent short-selling opportunity.

EUR/GBP Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.84500

Take Profit @ 0.85700

Stop Loss @ 0.84000

Upside Potential: 120 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.40