As risk-off sentiment returned on the back of a surge in confirmed Covid-19 cases in China, the Swiss Franc is attracting bids. The sell-off in the EUR/CHF is supported by disappointing economic data out of the Eurozone, led by Germany. While further long-term downside in this currency pair is expected, a short-covering rally is pending. The Swiss National Bank is known for its market manipulation to keep its currency depressed, and likely to step into the Forex market, in an attempt to halt the slide. You can learn more about a short-covering rally here.

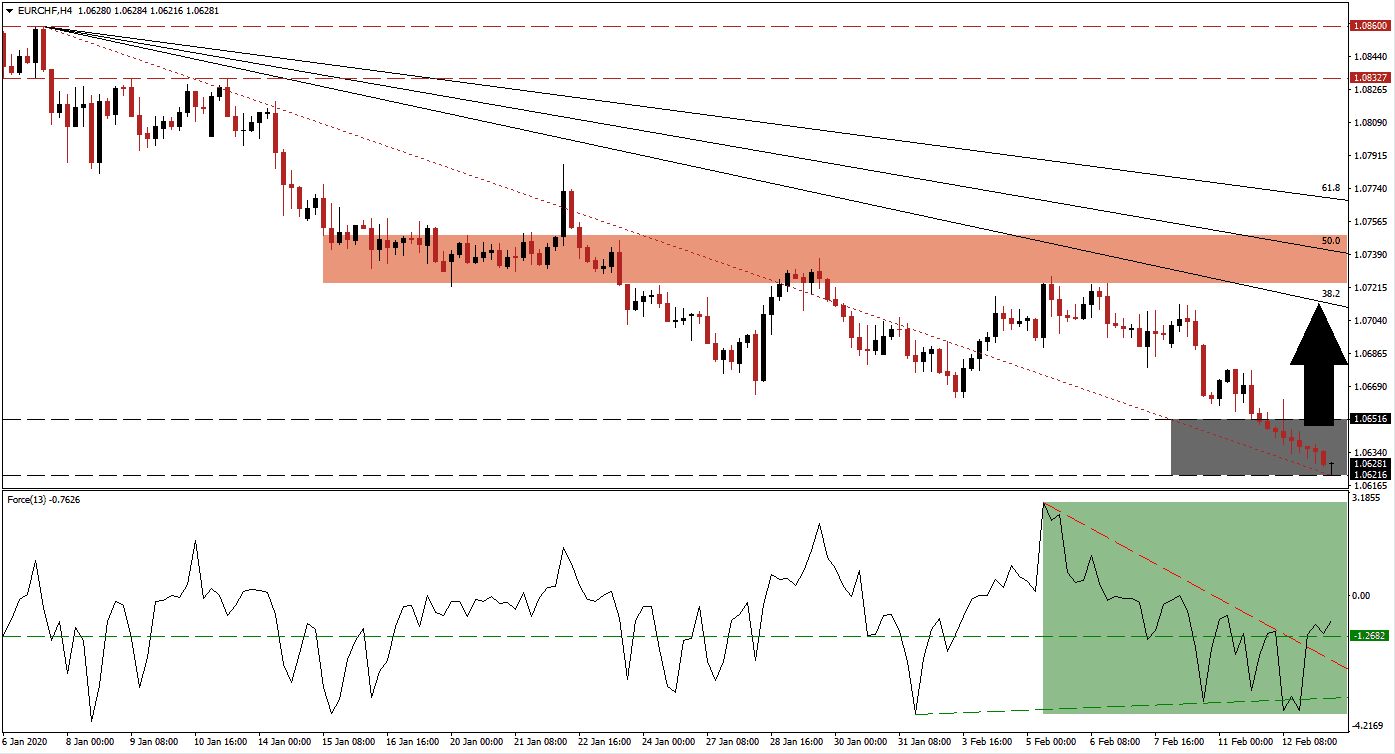

The Force Index, a next-generation technical indicator, suggests that a price spike is imminent, on the back of a solid recovery in bullish momentum. The Force Index quickly reversed from a brief dip below its shallow ascending support level. It led to an accelerated advance, converting its horizontal resistance level into support, as marked by the green rectangle. This technical indicator also eclipsed its descending resistance level from where a push above the 0 center-line is favored to give control of the EUR/CHF to bulls.

Due to the build-up in bullish momentum, this currency pair is well-positioned to push above its support zone located between 1.06216 and 1.06516, as marked by the grey rectangle. A breakout above its intra-day high of 1.06618, the peak of the last spike in the EUR/CHF to the upside, is anticipated to trigger the pending short-covering rally. Volatility is likely to expand as Forex traders weigh the safe-haven demand of the Swiss Franc against SNB market manipulation and weak Eurozone economic data. You can learn more about a breakout here.

A counter-trend recovery will ensure the longevity of the dominant downtrend in the EUR/CHF, established through a series of lower lows and lower highs. The short-term resistance zone awaits this currency pair between 1.07238 and 1.07492, as marked by the red rectangle, but the recovery may fall short of this zone. Forex traders are recommended to monitor the descending 38.2 Fibonacci Retracement Fan Resistance Level, which is expected to enforce the long-term bearish trend.

EUR/CHF Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.06250

Take Profit @ 1.07000

Stop Loss @ 1.06000

Upside Potential: 75 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 3.00

In the event of a collapse in the Force Index below its ascending support level, the EUR/CHF is anticipated to resume its downtrend without a minor recovery. This will positions this currency pair for a more substantial price spike in the future. The next support zone is located between 1.03967 and 1.04399, dating back to July 2015. Caution is advised, as more downside cannot be ruled unless fundamental conditions change.

EUR/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.05700

Take Profit @ 1.04350

Stop Loss @ 1.06200

Downside Potential: 135 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 2.70