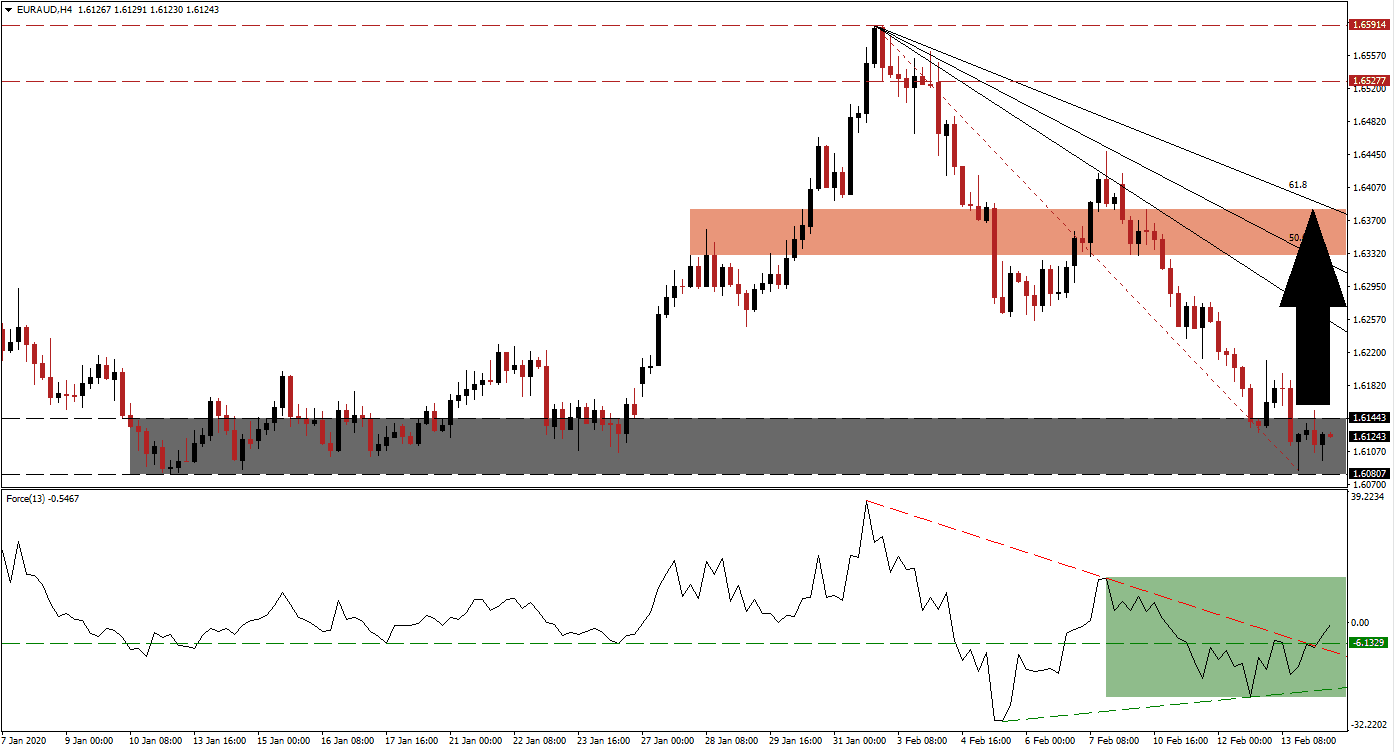

Germany is leading bearish Eurozone economic output, providing evidence monthly that the global economy remains fragile. Adding rising political instability in Europe’s largest economy is fueling bearish sentiment. The European Central Bank is additionally keeping a lid on any potential advance on the currency, hoping to assist the ailing export industry on which it depends. After the EUR/AUD descended into its support zone, bullish momentum started to recover, suggesting a counter-trend advance is imminent.

The Force Index, a next-generation technical indicator, provided the first sign that a recovery is on the horizon. As price action extended its slide, the Force Index drifted higher, allowing for a positive divergence to materialize. The ascending support level served as a platform for this technical indicator to convert its horizontal resistance level into support, as marked by the green rectangle. It also led to a breakout above its descending resistance level, which now acts as a temporary support. A move above the 0 center-line is favored to follow, placing the EUR/AUD under control of bulls.

A breakout in this currency pair above its support zone located between 1.60807 and 1.61443, as marked by the grey rectangle, is anticipated to inspire a short-covering rally. It will elevate the EUR/AUD from extreme oversold conditions, closing the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to monitor the intra-day high of 1.62113, the peak of a previously reversed breakout attempt. A move above this level is favored to attract more net buy orders. You can learn more about a short-covering rally here.

Price action is positioned to extend its pending breakout sequence into its short-term resistance zone located between 1.63306 and 1.63822, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level has entered this zone, reinforcing resistance. It will result in a lower high and keep the long-term downtrend intact. While Covid-19 added temporary stress to an already battered Australian economy, the long-term outlook for the EUR/AUD is increasingly bullish.

EUR/AUD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.61250

Take Profit @ 1.63750

Stop Loss @ 1.60500

Upside Potential: 250 pips

Downside Risk: 75 pips

Risk/Reward Ratio: 3.33

Should the Force Index push below its ascending support level, the EUR/AUD may attempt a breakdown without a short-term reversal. It will position this currency pair for a more massive advance in the future, as a counter-trend advance is required to ensure the longevity of the downtrend. Price action will face its next support zone between 1.58944 and 1.59310.

EUR/AUD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.60100

Take Profit @ 1.59000

Stop Loss @ 1.60500

Downside Potential: 110 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.75